- US economic releases pointed to a still resilient economy.

- Investors raised their bets on a June Fed hike.

- There was a lot of worry regarding the fate of the US debt ceiling issue.

The EUR/USD weekly outlook is bearish as the dollar will likely keep rising without an agreement on the US debt ceiling issue.

Ups and downs of EUR/USD

In the past week, EUR/USD was mostly at the mercy of the dollar as there were no key economic releases from the Eurozone. On the other hand, the dollar had a very busy week filled with economic releases.

–Are you interested to learn more about ETF brokers? Check our detailed guide-

The US released data on services PMI, GDP, initial jobless claims, and core the PCE price index. Most of these economic releases pointed to a still resilient economy. This prompted investors to raise bets on a June Fed hike. Consequently, the dollar had a strong week.

Additionally, the dollar benefitted from its safe-haven status amid ongoing US debt ceiling talks. There was a lot of worry regarding the fate of the US debt ceiling issue. Despite multiple meetings, stakeholders could not finalize an agreement to raise the debt limit. The US government could default on its debt obligations in less than a week. This would be catastrophic and would likely lead to a recession.

Next week’s key events for EUR/USD

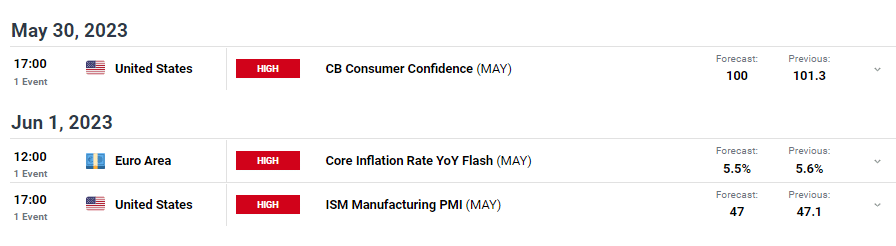

Investors will pay attention to three major news releases next week. These include the CB consumer confidence and the ISM manufacturing PMI from the US. There will also be an inflation report from the Eurozone.

The US ISM manufacturing PMI will show the activity level in the manufacturing sector. Investors will also focus on the Eurozone inflation report as it will inform investors of the ECB’s next policy move.

EUR/USD weekly technical outlook: Bears aim for the 1.0650 support level.

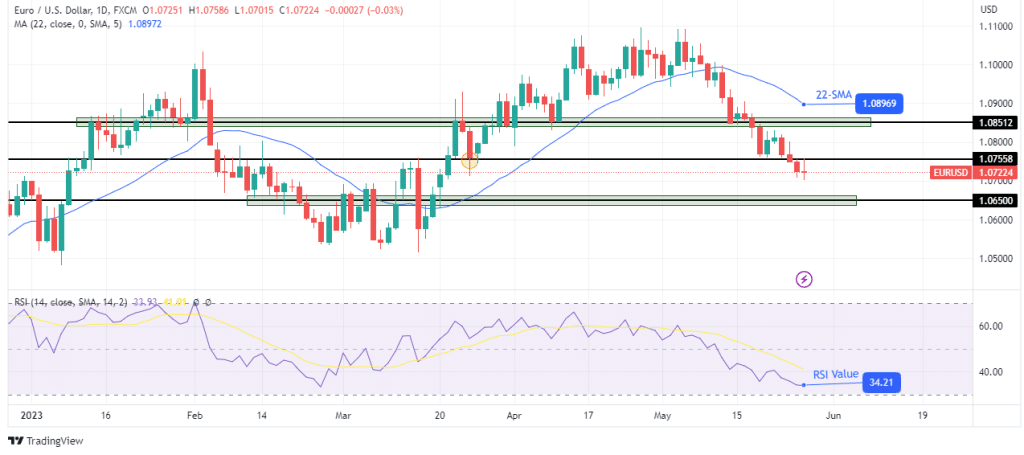

The bias for EUR/USD on the daily chart is bearish because the price trades far below the 22-SMA, a sign bears are in control. Additionally, the RSI trades closer to the oversold region, suggesting strong bearish momentum.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

Bears have made a series of strong candles that have broken through support levels, including 1.0851 and 1.0755. Currently, the price is heading for the next support level at 1.0650. However, we might see a retracement in the coming week after such a move. Still, the bearish bias will remain strong with the price below the 22-SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.