The euro enjoyed a safe haven currency in 2015 but this status was certainly not sustainable. The team at Bank of America Merrill Lynch see the status as eroding:

Here is their view, courtesy of eFXnews:

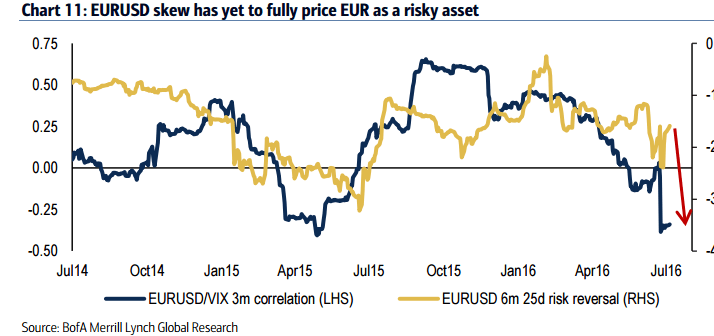

Since the ECB ventured into QE last March, the EUR had begun exhibiting qualities of a ‘perceived safe haven’ currency, strengthening during periods of risk off. One potential cause for this relationship is that ECB QE made the EUR more attractive as a funding currency and crowded positioning made it susceptible to short squeezes during risk off (Risky turn for USD). More recently, this relationship has started to deteriorate and EURUSD has become negatively correlated with the VIX since early May (Chart 11).

One possible explanation for this shift is that Brexit may be gradually sending Euro-centric shock waves to global markets. Our economists see one potential channel as anti-globalization posing downside risks to economic growth, which has caused them to downgrade their global growth forecast.

Another concern is the impact of rising risk premiums on debt maintenance in the periphery, with our European Bank strategists recently highlighting rising Italy NPL ratios as a growing issue.

We see value in owning EURUSD skew as Euro-centric risks are underpriced in our view. EURUSD skew is back to pre-Brexit levels allowing investors to enter sensible zero-cost risk reversals.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.