Euro-zone inflation remains depressed, but this isn’t a huge surprise after Germany’s numbers. It seems that this kind of disappointment was already priced in. Prices rose 0.2% y/y and core inflation remains at 0.9%.

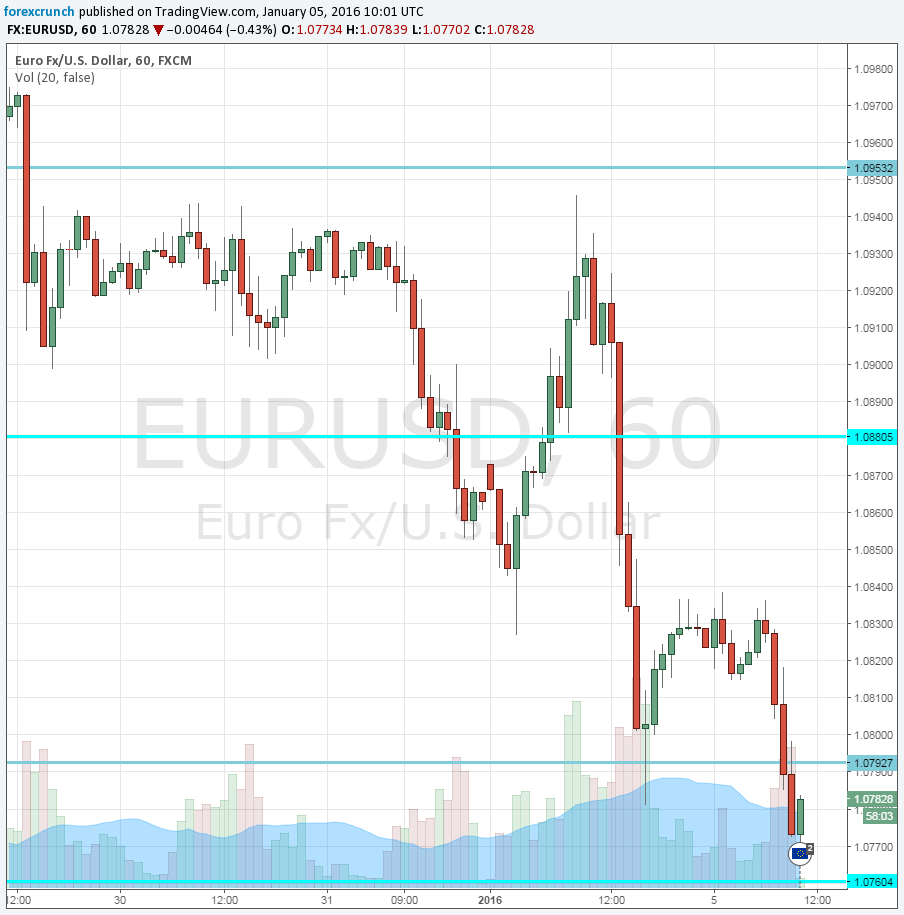

EUR/USD wobbles on low ground, trading around 1.0780. Update: the pair is now extending its falls below 1.0770.

At the same time, Italy released its own data which also showed weaker than expected inflation.

Officially, inflation in the euro-zone was expected to rise from 0.2% in November to 0.4% in the preliminary read for December. However, yesterday’s disappointing German figures mean that real expectations were lower. Core inflation was predicted to remain around 0.9% seen beforehand.

EUR/USD was falling towards the publication, alongside most currencies and not enjoying the safe haven status it used to enjoy. EUR/USD broke below the post-Draghi-disappointment lows of 1.0790 and traded around 1.0777 just before the data came out.

This shows the vulnerability of the common currency. Only the yen remains a safe haven at the moment.

Earlier, German and Spanish employment figures looked OK, but the ECB has a “single needle in the compass” – only inflation seems to matter. Mario Draghi and his colleagues convene on January 21st to make their first decision of 2016.