Inflation is rising in the euro-zone: 1.1% y/y in December 2016. This is slightly above 1% officially expected, but not really surprising given the big jump that had already been reported by Germany. Oil prices are behind the move. Perhaps the bigger surprise comes from core CPI, which finally budges from the 0.8% and edges up to 0.9%.

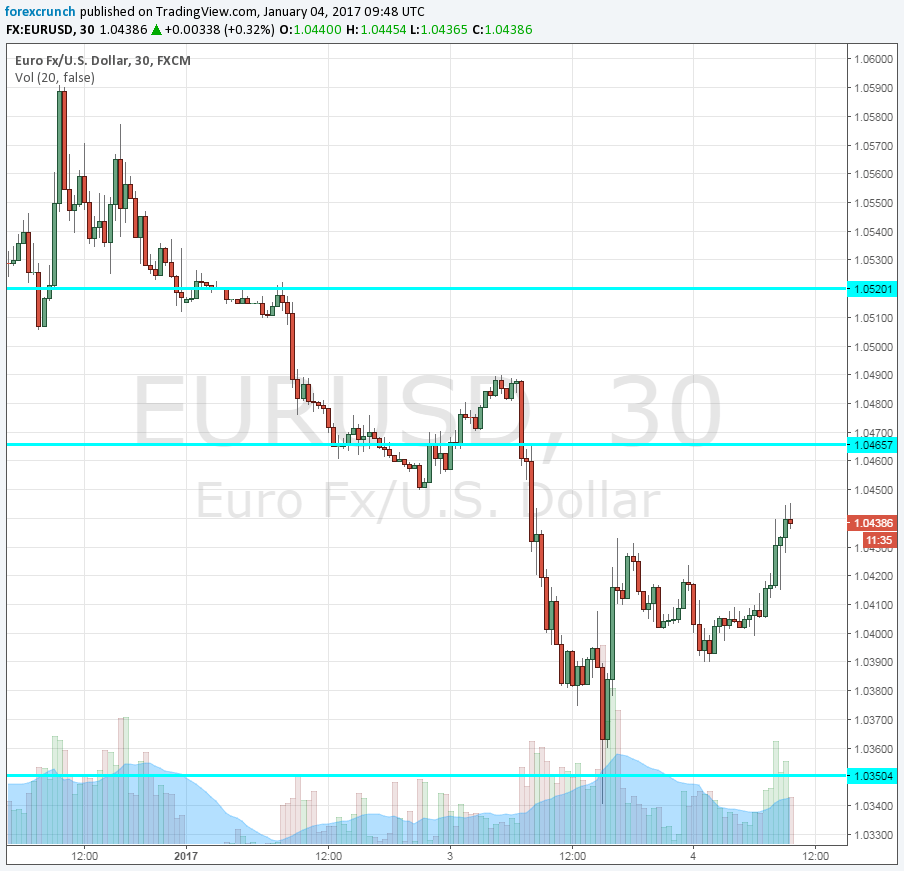

EUR/USD seems to ignore the data – the pair has already risen beforehand. Update: EUR/USD is now sliding. Were markets expecting a stronger outcome?

The initial estimate for inflation in December was officially expected to reach 1%, a big jump from 0.6% reported in November. However, the big leap in German inflation probably meant higher market expectations. Spain’s CPI measure also jumped, but France’s missed estimations. Core inflation was predicted to remain unchanged at 0.8%.

The driver of rising inflation is oil: after long periods of year over year drops in the price of the black oil, things have changed. Oil prices were at their trough back in January 2016 and they are now near 18-month highs.

The ECB had anticipated higher inflation, saying it is likely to jump in early 2017. However, they still decided to extend the QE program through 2017 and remove some bond-buying limits. And, the lack of movement in core inflation is certainly a worry for the Frankfurt-based institution.

EUR/USD managed to recover from the lows ahead of the release: 1.0440 is already 100 pips above the 14-year low recorded yesterday. Nevertheless, we are still under the closing price for 2016.

More: EUR/USD has an open, yet limited opportunity for parity.