The dollar probably needed excuses to continue its rises and certainly received them with a beat in both the ISM Manufacturing PMI and the construction spending measure. The dollar is currently king, and this is seen across the board.

EUR/USD, which had already ignored good German news, is plunging to new lows. 1.0340 is the new low at the time of writing, falling below the 1.0352 level seen after the FED decision.

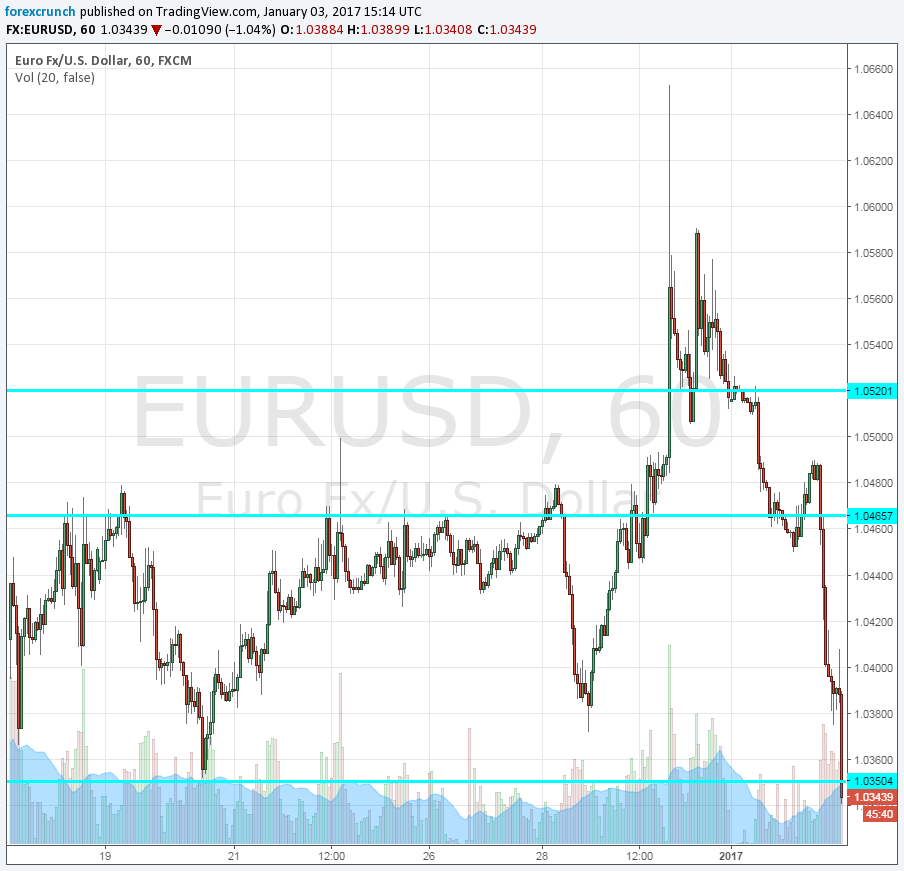

Here is how it looks on the hourly chart. Note that the line was breached. As with many cases of EUR/USD, this could prove to be a fake one. But, the USD strength is real and perhaps we will see a real, momentous break after an initial cautious dip.

1.0340 was actually a level seen back in 2003, and it is very close to 1.0350, needless to say. If the break is confirmed, the next line of support is only 1.0150, a high seen back in 2002, 15 years ago.Resistance awaits at 1.0460.

More: Limited window to EUR/USD in January – this might be in the works.