EUR/USD crashed quite sharply following the one two punch from Draghi and the NFP, closing at 1.0846. This may not be the end.

Brian Martin & Dylan Eades of ANZ foresee the next levels down the road, and explain with a chart:

Here is their view, courtesy of eFXnews:

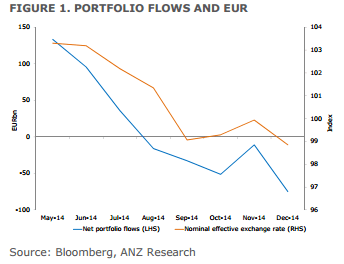

“Price action has confirmed that the euro is being driven by actual and expected portfolio rebalancing effects and that the market is ignoring the improving growth and inflation outlook.

For now though, the FX markets are ignoring the improved growth outlook. Instead negative interest rates and the expectations of persistent difference in the policy path with the US are weighing on EUR/USD. The February NFP release was materially stronger than expected. NFPs rose by 295k and the unemployment rate fell to 5.5% from 5.7%. Whilst earnings growth remains soft at 2.0% y/y, expectations are now firmly focused on a removal of the reference to “patience” at the March FOMC meeting. That would confirm that the FOMC has moved away from date dependency in its forward guidance to data dependency.

If, as we expect, the activity data firms again in coming months, then the FOMC remains on course to begin normalising interest rates soon, probably at the June meeting. In the interim, the USD can continue to take the strain for monetary tightening.

Further downside risks seem probable and the break of 1.10 points to a test of 1.05, or possibly parity.”

Brian Martin & Dylan Eades – ANZ

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.