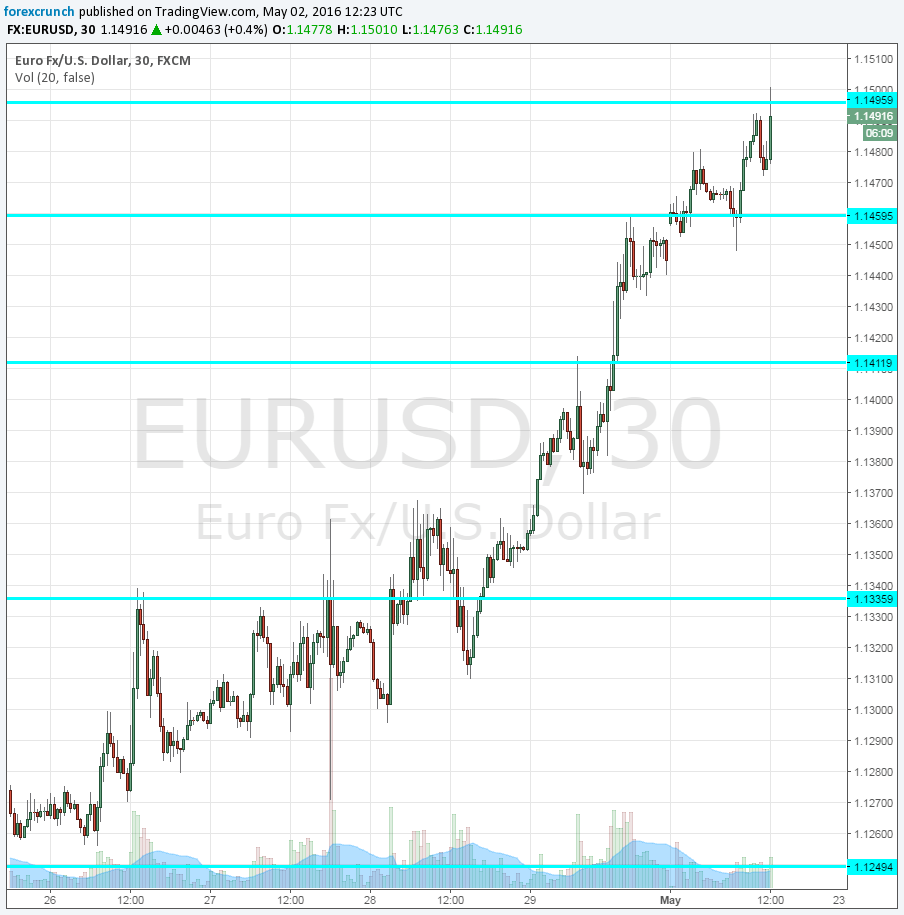

EUR/USD struggled during several sessions with the 1.1460. After a move higher which was suspected as a false break (or fakeout), the pair did settle above this all-important line and under the very round 1.15 level. Am attempt to move higher looked like stop-hunting: the pair reached 1.1501 and dropped quite quickly.

However, this might be a first test of waters, with a second move that could already be successful.

What’s behind the move? The weakness of the US dollar and not any kind of euro strength. The US dollar resumed its falls after the Fed refrained from hike hints. The optimism about the global economy was not translated into any kind of decision to raise rates anytime soon. The poor GDP read didn’t help either.

In the euro-zone, growth looks better, but it comes on top of deepening deflation. However, also the ECB is reluctant to act, especially in light of ongoing criticism about its action.

Here is how recent moves look on the EUR/USD chart.

Support awaits at 1.1460, which formerly worked as resistance. It is followed by 1.1410 and 1.1335, the previous limit of the range. If the break above 1.15 is confirmed, there may be weak resistance at 1.1650, but real resistance awaits only at the high of 1.1712, which was the swing high in August 2015.

More: EUR/USD: What Can Break The Range? Where To Target? – ANZ