The Federal Reserve sees a slightly more optimistic picture, especially regarding the global economy. However, there is no rate hike expected in June. They only mention international developments as part of the considerations but not as a risk. The view about inflation and employment is relatively positive and mostly unchanged from the previous decisions. As in the March statement, we learned that there was one dissenter, Esther George.

USD made a surge and then went back to normal. All in all, the Fed did rock markets in the initial reaction but things calmed down quite swiftly. We will probably see a second reaction in Tokyo and later on in the European open. but perhaps the BOJ will have the upper hand in moving markets.

Here is a passage from the statement:

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Federal Reserve was expected to leave policy unchanged in its April meeting, which did not consist of a press conference nor new forecasts. The focus was on the tone: is the Fed less worried about the global economy? Should it worry about the US economy? And will it finally bury the chance of a rate hike in June? The Fed probably knows the GDP data before we do, and if to judge by the durable goods orders (and despite trade data), it doesn’t look that great. Regarding hikes, what about the Fed’s credibility? Inflation expectations have improved but real inflation is only muddling along. At least the stock market is looking better.

The dollar was softer against the euro, steady against the yen and slightly stronger ahead of all the rest ahead of the Fed.

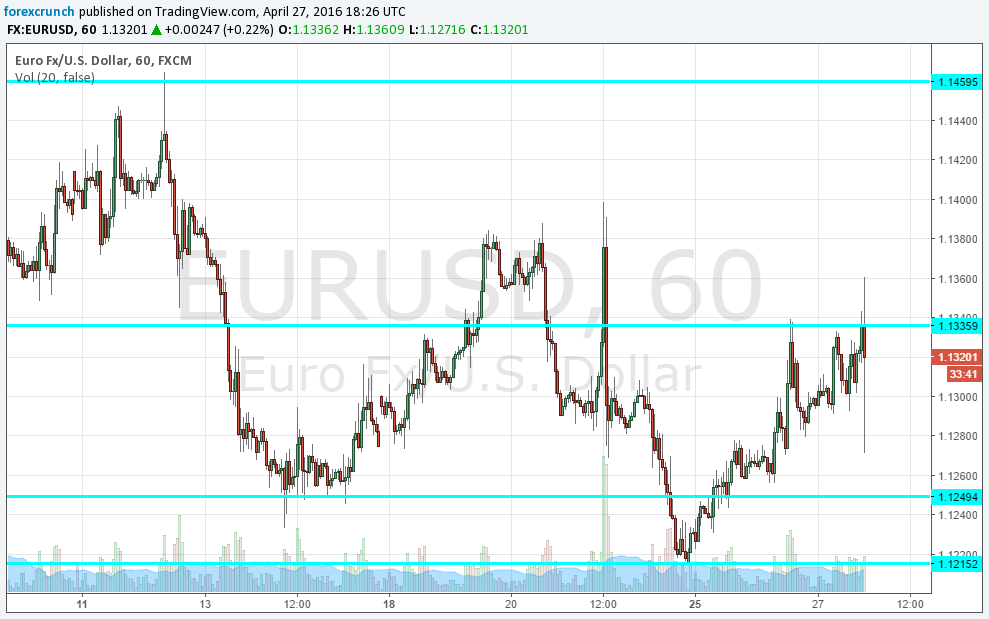

EUR/USD reaction:

Live Coverage

\

Currencies

- EUR/USD traded around 1.1320, capped by the 1.1335 level. Is it a buy on dips or a sell on rallies?

- GBP/USD was around 1.4550, fading some of the rally, especially after unconvincing GDP in the UK.

- USD/JPY traded around 111.32 ahead of the closely watched BOJ decision.

- USD/CAD was around 1.2640, off the lows but looking OK despite a rise in oil inventories.

- AUD/USD struggled under 0.76 on very poor inflation data.

- NZD/USD retreated to 0.6840, above support at 0.6820 ahead of the RBNZ.

Background

In its March meeting, the Fed surprised with a dovish tone and the US dollar suffered. After a few slightly more hawkish tone from a few FOMC members, the greenback recovered only to be hit by a very worried tone by Fed Chair Janet Yellen.

Nevertheless, despite her talk about “caution especially warranted, expectations for a rate hike in June have slightly improved in recent days and the dollar benefited, especially against the yen. It is important to remember that the Bank of Japan and the Reserve Bank of New Zealand will both make their decisions in the upcoming hours.