The Euro showed some bounce after yesterday’s drop (April 16th), as Euro dollar climbed back above the 1.31 level. The Spanish government is due to auction up to EUR3 billion of government bonds later Tuesday, but there are serious concerns that the government will not be able to meet its deficit reduction targets. The key releases today are German ZEW Economic Sentiment, which came in well above the market forecast, and US Building Permits.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

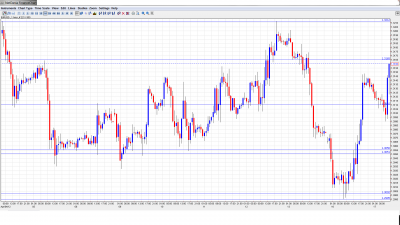

- Asian session: EUR/USD dropped just under 1.31, touching a low of 1.3098, and consolidating at 1.3099. The pair is up in the European session, trading at 1.3156.

- Current range: 1.2995 to 1.3150.

- Further levels in both directions: Below: 1.2945, 1.2873, 1.2760, 1.2660 and 1.2623.

- Above: 1.30, 1.3050, 1.3110, 1.3165, 1.3212, 1.33, 1.3360, 1.3437, 1.3486 and 1.3550.

- 1.3212 has strengthened as the upper border for the pair once again.

- 1.31 is providing support as the pair strengthens.

Euro/Dollar climbing into mid-1.31 range – click on the graph to enlarge.

EUR/USD Fundamentals

- 9:00 German ZEW Economic Sentiment. Exp. 19.7. Actual 23.4.

-

9:00 Eurozone ZEW Economic Sentiment. Exp. +10.7. Actual 13.1.

- 9:00 Euro-zone CPI. Exp. +2.6%. Actual 2.7%.

- 9:00 Euro-zone Core CPI. Exp. +1.5%. Actual 1.6%.

- 12:30 ECB President Draghi Speaks.

- 12:30 US Building Permits. Exp. +0.71M. See how to trade this event with USD/JPY.

- 12:30 US Housing Starts. Exp. +0.71M.

- 13:15 US Capacity Utilization Rate. Exp. +78.6%.

- 13:15 US Industrial Production. Exp. +0.4%.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Chinese Growth Sputtering?: After posting a weak growth rate last week, China’s economic indicators continue to be a source of concern for the markets. The latest disappointing release is Foreign Direct Investment, which dropped by 2.9% in March. Compared with a rise of some 26% last May, investors appear to be souring on opportunities in China. The markets can only hope that the decision by the Chinese central bank to widen the trading range of the yuan, the Chinese currency, will help jumpstart growth in the Asian giant.

- ECB to help Spain?: Europe’s fourth largest economy is still struggling to find a way to cut its deficit while enabling some growth. In the meantime, Spain and Italy are exchanging not-so-nice comments. The ECB stepped up its rhetoric against the high yields and hinted that it might intervene using its SMP program. This hasn’t been used so far. Spanish banks borrowed over 300 billion euros from the ECB in March, much higher than in February. The danger of a credit crunch is still here.

- US Economy Sending out Mixed Signals: Analyst and traders must be scratching their heads at the mixed bag coming out of the US. Retail Sales hit 0.8%, better than the market forecast. However, the NY Manufacturing Index plummeted, way below the market prediction, as it posted a five month low. Weekly jobless claims rose to 380K and triggered worries. This is the first release after the disappointing Non-Farm Payrolls released on Friday, that showed only a small gain of 120K. Is the economy cooling down again, or is it only temporary? Here are 5 reasons why this may be temporary. Last week’s release of US consumer sentiment was lower than the market forecast, as consumers are still somewhat skeptical of the economic recovery. Consumer confidence, and in turn, consumer spending, are critical for improved growth in the US economy.

- British Pound headed for 1.60?: With all the focus on EUR/USD over the past few days, let’s not forget about the British pound, which has absolutely shined in 2012. The pound is once again closing in on the psychologically significant 1.60 level, despite a sluggish economy and weak consumer confidence in the UK. Will we see the pound climb over this level this week? Given the continuing rise of GBP/USD, the likelihood of additional QE looks less likely.