EUR/USD is trading at lower ground. After some dollar weakness and hopes for a positive outcome in the French elections, the tables have turned.

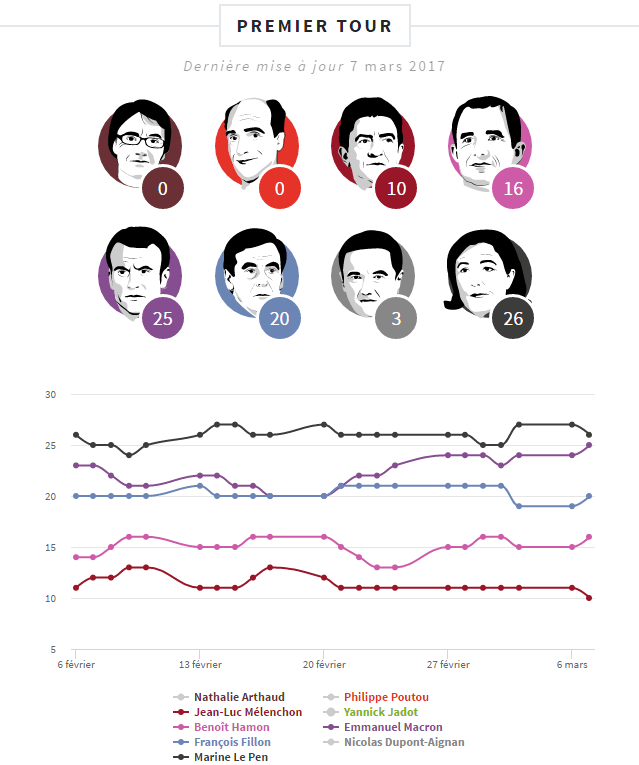

However, will the euro rise now? A fresh opinion poll from France shows Marine Le Pen losing ground to centrist Emmanuel Macron. It is now 26% against 25%, closer than 27% to 24% yesterday.

If Macron beats Le Pen in the first round, it will increase his chances to win in the second round. The fresh poll shows 60% against 40% for the second day in a row.

Here is how it looks. But there are other reasons for a weaker USD.

Source: OpinionWay.

Françios Fillon, which is behind with 20% in the first round and out of the second round according to this poll, would have better chances to beat Le Pen in a theoretical second round: 58% instead of 56% yesterday. This is all good news.

The US dollar is resuming its strength. This is partly due to a fresh bout of buying related to the upcoming rate hike on March 15th. In addition, there is a bit of a “risk-off” atmosphere. This does not help the greenback against the yen, but it is helpful against the euro and the pound.

Regarding the French elections, we had a significant development yesterday. Former PM Alain Juppe announced he would not replace the struggling candidate from his center-right Les Republicans party Françios Fillon. Some market participants had hoped that the experienced centrist would re-enter the race after failing in the primaries and would sweep support into the Elysee Palace.

However, the ongoing running of Fillon does help another centrist, Emmanual Macron. The former socialist has better chances to get into the second round, by finishing second after extreme-right candidate Marine Le-Pen. However, yesterday’s Opinionway poll showed that he hasn’t extended the gain against her in a theoretical run-off. It has actually squeezed to 60% against 40%.

Is a 20 point lead safe enough? Markets are extra cautious after Brexit and Trump, even though the polls were within the margin of error in those 2016 shocks.

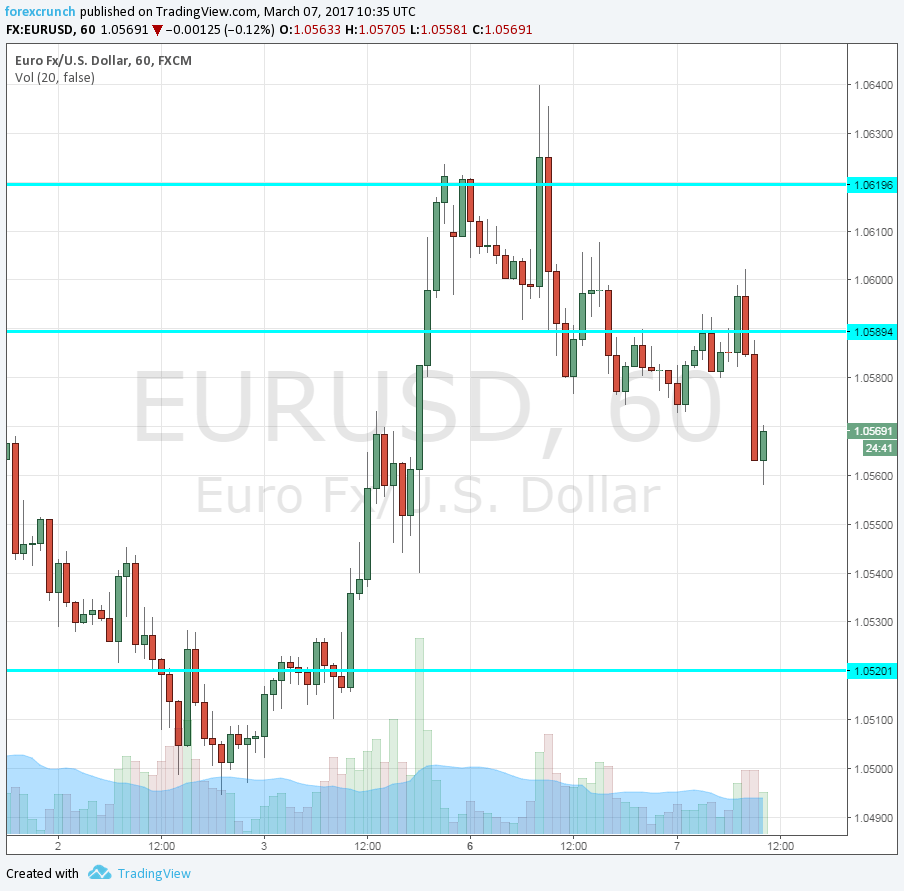

EUR/USD struggling

Euro/dollar has reached a low of 1.0558. This is 80 pips off the highs seen yesterday, but still well above last week’s low of 1.0490.

The euro faces another big event this week: the ECB meeting. Here is the full ECB Preview.