The Jackson Hole Symposium has already ended, but the echoes from that event continue rocking markets. For the US dollar, it is a boon. The extended gains show that the very late rally on Friday was not only a result of thin liquidity on a Friday in August.

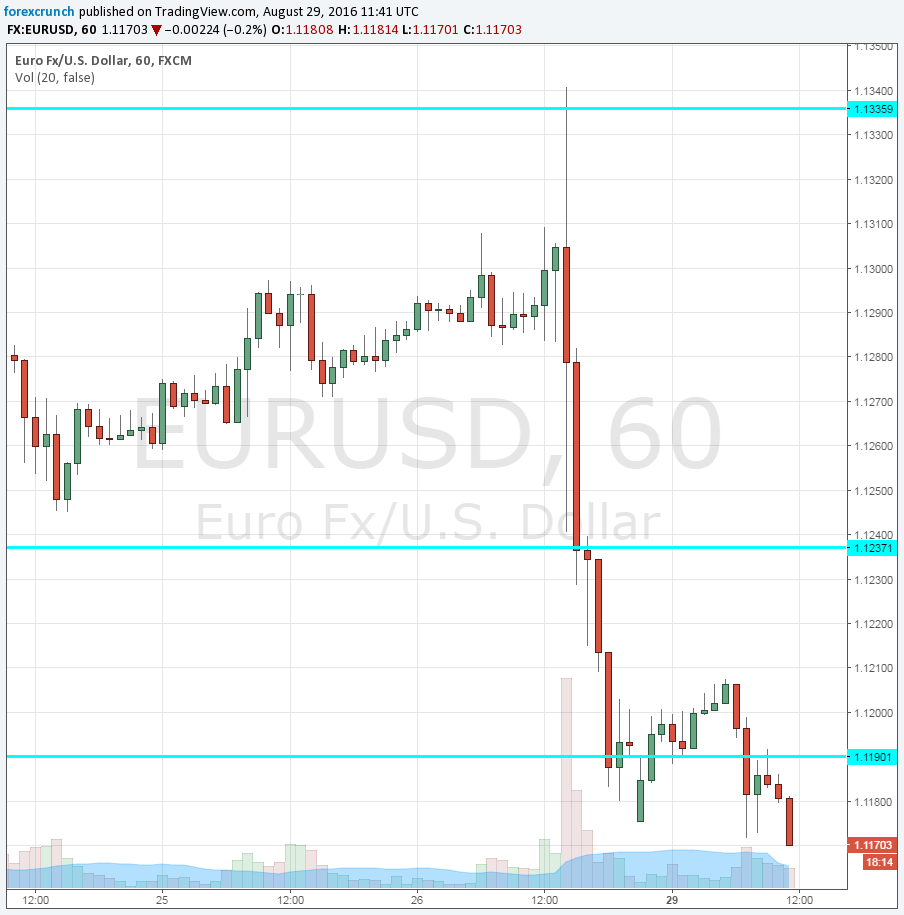

For EUR/USD, we are back under the 1.1190 level which capped the pair during long weeks following the EU Referendum in the UK back on June 23rd. The pair currently trades at 1.1170. Further support awaits at 1.1130, which is weak support, and 1.1060 provides more serious support below. Resistance awaits at 1.1230 and 1.1335.

What happened at Jackson Hole?

The annual symposium hled by the Kansas City Fed drew attention but expectations were low. However, when newswires broke with the headlines that “the case for a rate hike has strengthened”, Yellen’s words sent the dollar higher. Things took a turn when the full text was digested. As usual, the Fed Chair wrapped her words with lots of caveats: the pace will be gradual and everything is data dependent. There was no “smoking gun” for a hike in September.

So, we quickly saw the dollar re-weakening. The next punch came from Vice-Chair Stanley Fischer. He “clarified” that Yellen’s statement is “consistent” with a hike in September. That already sent the dollar much higher. And we are seeing the results also now.

It is important to remember that Fischer is a hawk and also his words do not consist of a promise to raise rates. Nevertheless, the strength of the greenback extends.

Will the US dollar continue gaining?

A lot depends on the Non-Farm Payrolls report on Friday.

Markets remain rightfully cautious about a rate hike in September. The Fed’s forecast have been optimistic on too many occasions, and it found any excuse not to make a move. So, caution is also warranted this week. Only a blockbuster report can convince markets that a rate hike is coming on September 22nd. Apart from the Fed’s natural dovishness, the presidential elections are coming up, and Yellen would not like to draw attention from either camp.

More: EUR/USD at crossroads – what’s next?

Here is the EUR/USD chart: