EUR/USD has moved higher and a miss on German PMIs has not deterred it. However, it may have reached a fork in the road. Here are two opinions.

Here is their view, courtesy of eFXnews:

EUR/USD: Large Triangle Still In Place: Make Or Break Levels – Goldman Sachs

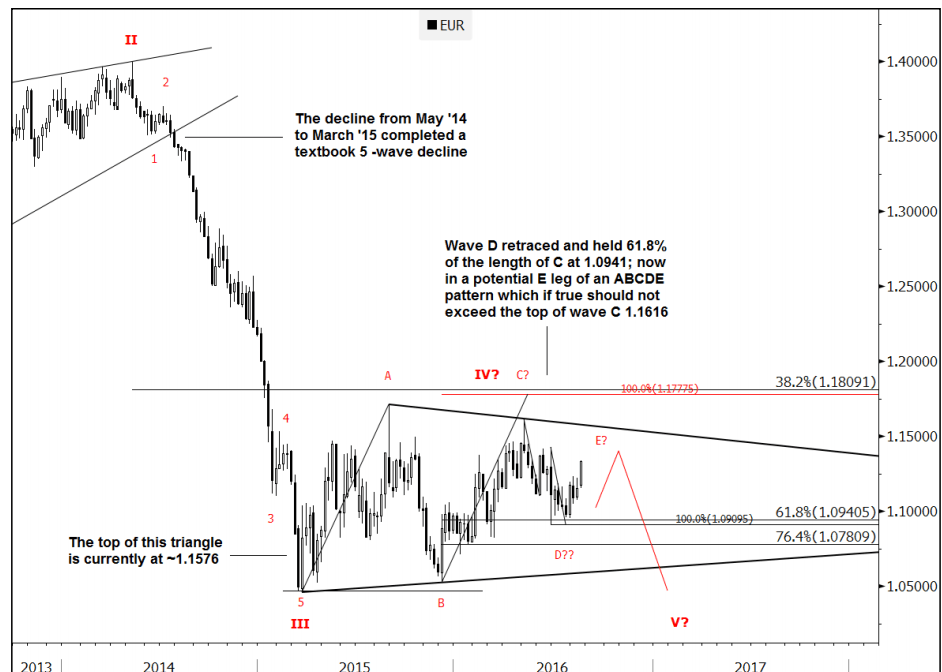

The base case scenario remains for EURUSD to continue its long-term trend eventually. As has been discussed in the past, the currency has formed a triangle like consolidation since the Mar. ’15 low. This is now getting closer to looking like a complete ABCDE.

Once complete, the market should, in theory, resume its underlying trend (i.e. commence wave V). This would mean eventually breaking through the base of the triangle (1.0588) and back down towards the Mar. ’15 level (1.0458), if not significantly lower.

All of this is contingent on 1) the market holding below triangle resistance which is currently at 1.1576 and 2) wave E ending somewhere beneath the top of wave C which is up at 1.1616.

In other words, any break beyond 1.1576-1.1616 will seriously call into question the nature of this setup. Doing so would imply potential to have already put in a meaningful base.

View: Cautious above 1.1398-1.1427 (highs from June). Any move past 1.1576-1.1616 warns that a more significant low could already be in place.

EUR/USD and AUD/USD Vols Are The Most Attractive Macro-Hedges – BofA Merrill

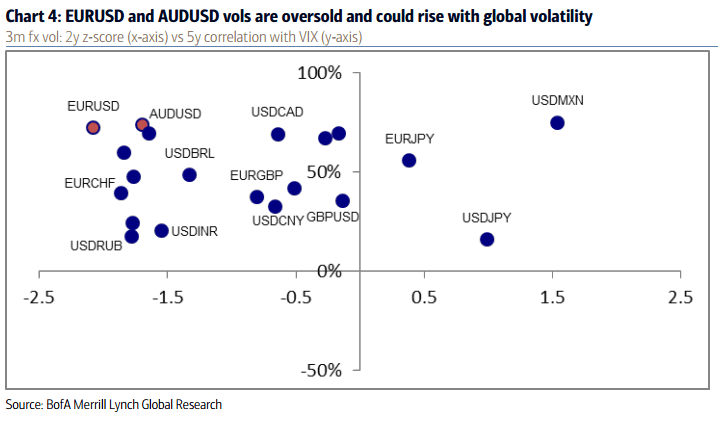

FX vols are currently oversold, with volatilities 1 to 2 standard deviations below average, as investors have put central bank policy divergence on hold for the foreseeable future. Furthermore, the anticipation of fiscal stimulus has also decreased the risk premium across markets. Both beliefs are overly complacent and make the market more vulnerable to shocks, in our view.

Our economics team still expects a Fed hike later this year if economic data remain strong, while our European team has been calling for further ECB action in the fall. On this fiscal front, major economies could be limited in their scope for fiscal expansion and markets may be disappointed as a result.

In the known-unknown risk scenarios that we considered (the Fed, US election, Italian banks), we expect EURUSD and AUDUSD vols to outperform as macro hedges. Both currencies have exhibited 75% correlation to the VIX and screen as the cheapest on a relative basis, notably below their 2y average (Chart 4).

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.