The disappointing US Non-Farm Payrolls provided the trigger for a big breakout in EUR/USD.

The pair is now at its highest level for the year. The last time it trade so high was back in November 2011. What’s next?

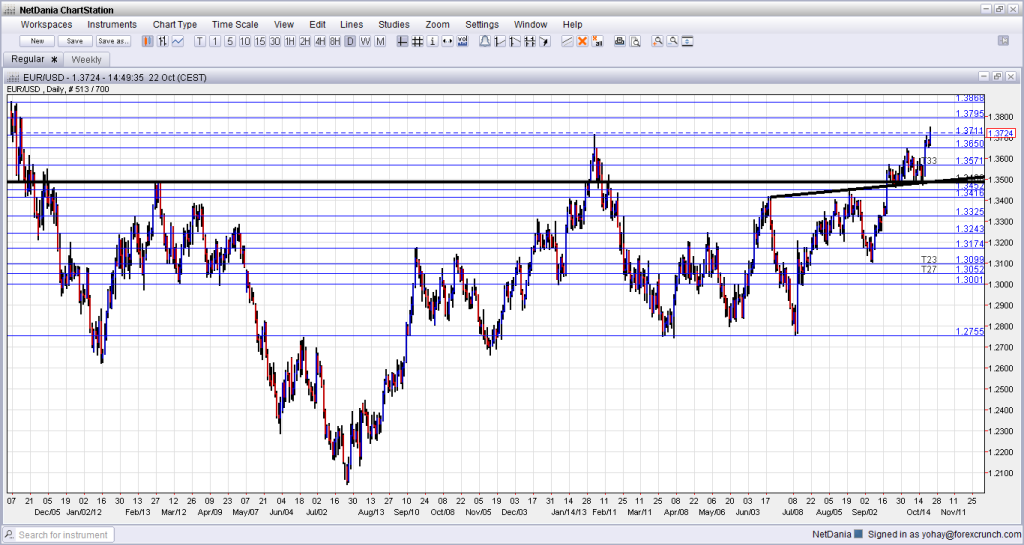

Here is how it looks on the daily chart. The breakout is clear to see and it looks very convincing:

The new high at the time of writing is 1.3748. The pair broke above the February (and previous 2013 high) of 1.3711 and remains above this line. If the breakout holds, the next line is 1.38, which is a round number and also worked as temporary resistance. This is a weak line.

Above, the 1.3870 line is already much more important, after capping the pair several times in the past. 1.3940 is the next line. It provided support back in 2011 and serves as the last backstop before the round 1.40 number.

If EUR/USD reaches 1.40, the ECB might begin complaining about it quite loudly. Technical resistance isn’t at the round number but rather 20 pips above it, looking at history.

The most important line on the upside is 1.42, which was a swing high back in 2011.

On the downside, we find 1.3650 below 1.3710. For more levels and events, see the EUR/USD forecast.

While the data is somewhat stale, the miss isn’t so big and the drop in the unemployment rate came without a drop in the participation rate, the euro capitalized on the move.

And speaking about capitalization, the ECB is set to publissh a blueprint for bank capitalization requirements: the bigger banks will be required to hold an 8% capital buffer. Estimates were between 8% to 10%. Opting for the low side is positive for the euro.

Further reading: EUR/USD Targeting Further Upside

More analysis: Why QE Tapering isn’t likely until April 2014 – the Tapril?