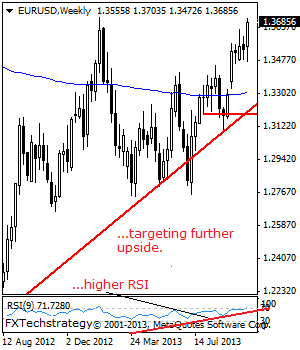

EUR/USD: With EUR resuming its medium term uptrend, further upside offensive is likely in the days ahead. This suggests further upside is expected towards 1.3710 level.

Further out, resistance resides at the 1.3800 level followed by the 1.3850 level and possibly higher towards the 1.3900 level. Its weekly RSI is bullish and pointing higher supporting this view.

Conversely, support stands at the 1.3645 level with a break of here threatening further downside towards the 1.3500 level. A cut through here will aim at the 1.3451 level. A reversal of roles is likely to occur here and turn it higher. All in all, EUR remains biased to the upside.