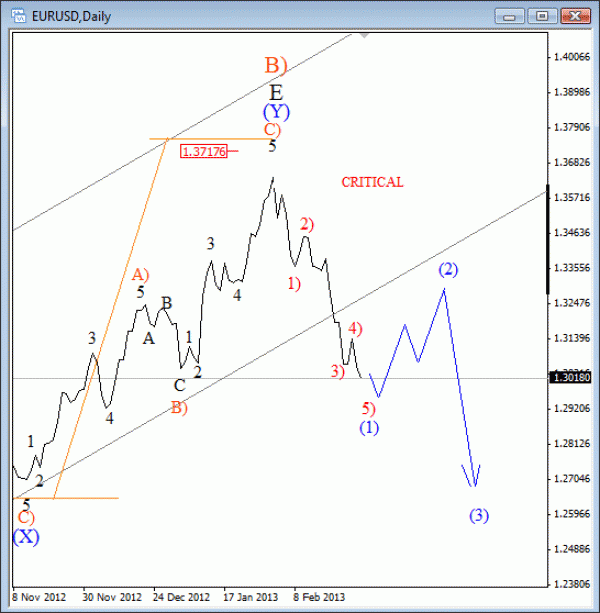

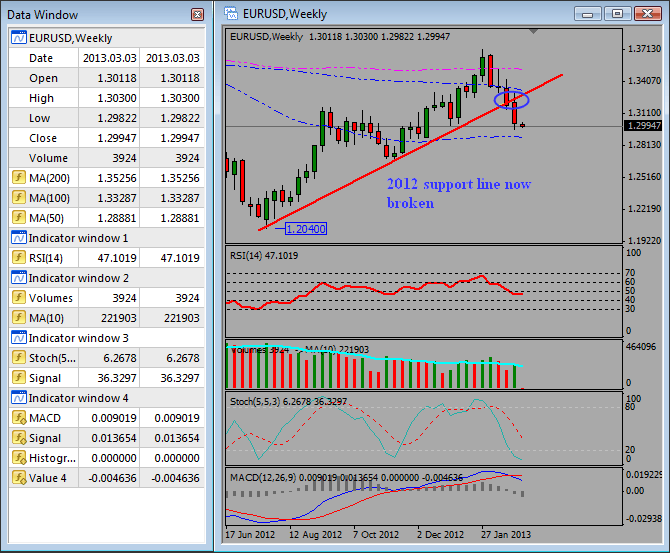

Recently we were tracking a possible corrective decline from 1.3700 on EURUSD because of the overlapping structure. However, a sharp and extended fall through the 2012 support line with a weekly and monthly close price beneath it forced us to rework the count.

In fact, we decided to check the line chart, where a fall is pretty clean and directional. A move can be counted impulsively and that is a bearish sign for the pair, but we expect a three wave bounce back to 1.3300 in March, before downtrend extends.

EURUSD daily- line chart

EURUSD monthly

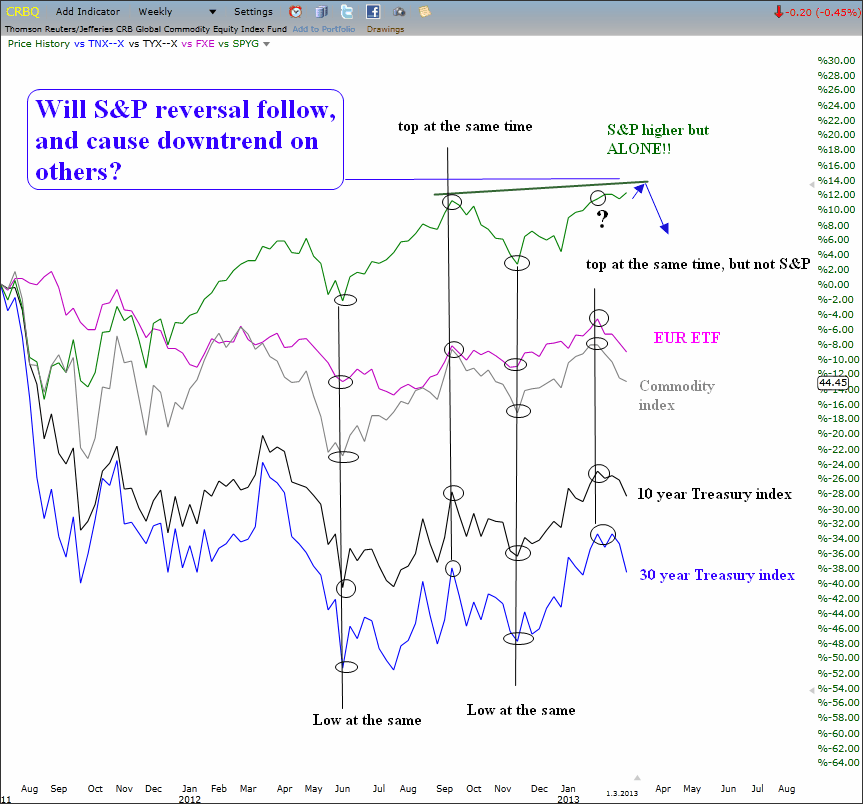

The reason why we also turned bearish on EURUSD is the overlay chart below which shows that most of other correlated markets turned lower, but not S&P which is still bullish, yet it remains alone. This could be a sign and S&P is approaching its top.

If this proves correct and if S&P will turn lower from 1560-1600, then the USD will probably accelerate sharply. The greenback is already showing strength without any help from S&P.

Market Correlations

Get more charts and forecasts with free access through 7-Day Trial Offer.

You can also follow us on twitter @ewforecast