EUR/USD is caught in the crossfire between central bankers from both sides of the Atlantic but also on the upcoming EU Referendum in the UK.

The week began with a big leap – the better polls for Bremain pushed the pair higher with a weekend gap but the picture has been mixed since then. Opinion polls in the UK are balanced and no longer lean for Leave, but to say that the momentum belongs to Remain is certainly an overstatement. It’s a dead heat. Cable reached new yearly highs and retreated over 100 pips. EUR/USD follows.

The second blow came from ECB President Mario Draghi. He appeared in the European Parliament following a meeting regarding talks about a contingency program in case of a vote for Brexit. He said that the Bank is ready and also mentioned more potential stimulus, related and unrelated to the vote. He certainly did not seem encouraged by the recent growth figures in the euro-zone.

Last but not least, the Fed Chair Janet Yellen testified in Washington and also provided a shopping list of warnings: China, the recent jobs report and yes, the danger of Brexit. She did not improve the mood and did not weigh on the US dollar. This kept the pressure on.

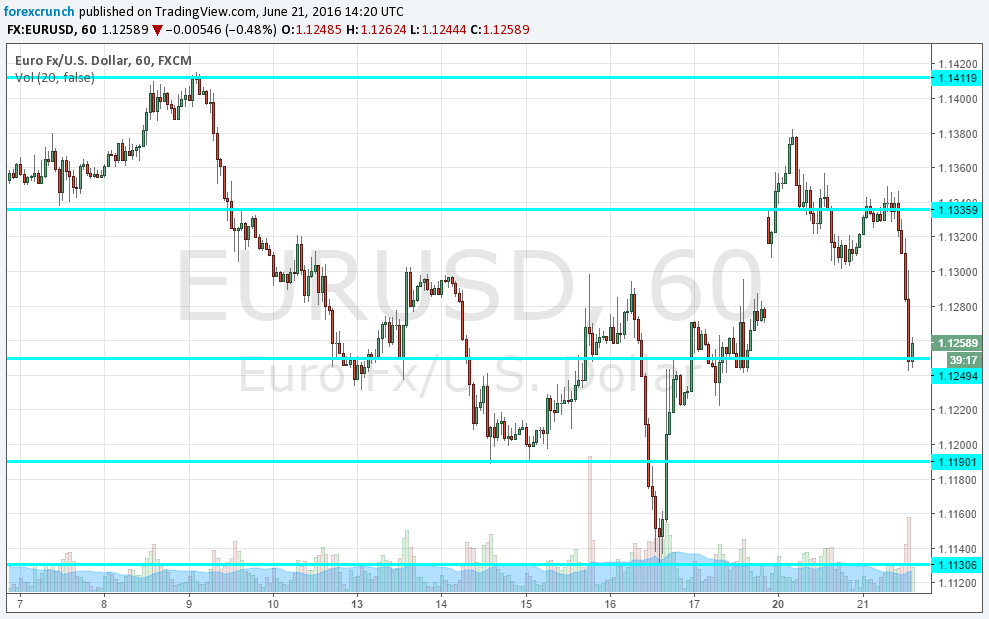

EUR/USD is currently trading around 1.1260. The low so far has been 1.1243, just under support at 1.1243. Further support awaits at 1.1190 and 1.1130. Resistance is at 1.1335 and 1.1410.

More:

Here is the chart: