After GBP/USD crashed under 1.30 the euro could also follow lower over Brexit. Here is the forecast by Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

The implications of the UK referendum result are hard to nail down, but we expect them to be negative in most scenarios. We would expect Brexit to trigger a chain of non-linear events well into the long-term that are hard to predict and may seem unrelated today, a butterfly effect on steroids. We would also expect markets to start pricing some tail risks that other countries may decide to leave the EU as well. We expect the direct and indirect spillovers from the shock and uncertainty during the long negotiations to push the ECB to ease more, earlier and for longer. Although we expect a broadly positive outlook for EUR/GBP, the outlook for EUR/USD has deteriorated in our view.

As we argued recently, the EUR was not pricing Brexit risks ahead of the referendum. Although the global implications from the Brexit shock could keep the Fed on hold for longer, we expect the negative implications for the Euro area economy to dominate FX markets, supporting a weaker EUR/USD.

Forecasts: bearish.

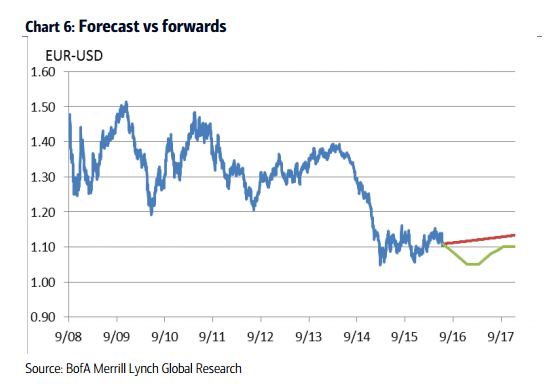

We revised our projections following the UK referendum. We now expect EUR/USD to end 2016 at 1.05, from 1.08 before, appreciating to 1.10 by the end of 2017, from 1.15 before. These projections will still keep the Euro undervalued, but not substantially, compared with our equilibrium EUR/USD estimate of 1.16. In our view, a much weaker Euro would affect the Fed’s policy reaction function, as the US data remains mixed, recently losing momentum.

Risks: US data.

The risks to our EUR/USD projections are balanced. We would expect more downside if more EU countries start calling for a membership referendum, raising concerns about tail risk scenarios of an EU breakup. In contrast to what some other analysts have argued, we do not believe that a closer union would address such risks. Quite the opposite, more integration could backfire and lead to more calls for exit. The positive risks to our EUR projections primarily have to do with the US data, if the last NFP print proves to be the beginning of a new trend, pointing towards recession risks in the US.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.