Standard Life, Aviva and M&G already announced withdrawal freezes. Who’s next? We talked about how the construction sector led the recovery and now it is taking away.

These funds allow investing in properties in a liquid manner. However, when there is a run to the exits, it can turn into a stampede as these funds need to sell not only stocks of developers but actual properties. Selling buildings under pressure can cause even more losses to investors as these could be at fire-sale prices. On the other hand, announcements that withdrawals are impossible also weigh on the atmosphere.

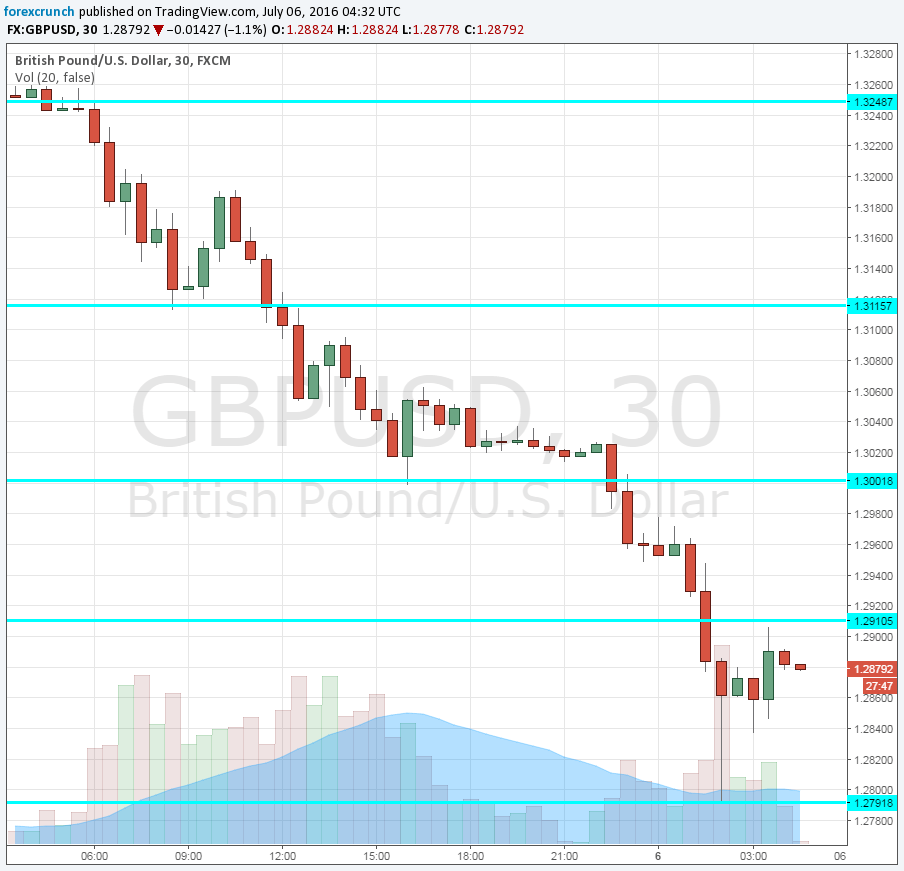

GBP/USD < 1.30 levels

After an initial bounce exactly at 1.30 there was no mercy for cable in the Asian session. Alongside a slide in stocks, GBP/USD collapsed all the way to 1.2891 before stabilizing at 1.2880.

After the big crash, the pair bounced back 1.2910, a line which could serve as temporary support with 1.2790 serving as support. However, once European traders jump in, we could see different levels.

Below 1.2790, we are further in levels last seen in the mid-1980s, making round numbers more important than lines seen so many years ago. On the topside, 1.30 now serves as resistance followed by the previous post-Brexit low of 1.3110.

More: Brexit – all the updates in one place

Here is the chart: