EUR/USD continues to trade queitly, with the pair trading close to the 1.3550 line in Tuesday’s European session. In economic news, German Economic Sentiment looked sharp, posting its best reading in over three years. In the US, the markets will be keeping an eye on the Empire State Manufacturing Index. As well, Federal Reserve Chair Bernard Bernanke will speak in Mexico City. Over in Washington, there is hope that an agreement over the debt ceiling crisis could be near, as there are reports of substantial progress in talks between the Republicans and Democrats.

Here is a quick update on the technical situation, indicators, and market sentiment that moves euro/dollar.

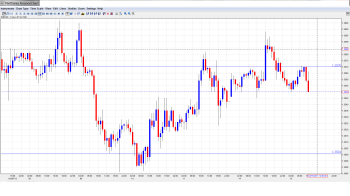

EUR/USD Technical

- In the Asian session, EUR/USD showed very modest movement, dropping to a low of 1.3551 and consolidating at 1.3565. The pair is unchanged in the European session.

- Current range: 1.3500 to 1.3570.

Further levels in both directions:

- Below: 1.3500, 1.3460, 1.3415, 1.3325, 1.3240, 1.3175, 1.31, 1.3050 and 1.3000.

- Above: 1.3570, 1.3650, 1.3710, 1.3800, 1.3870, 1.3940 and 1.40.

- 1.3500 is providing support. 1.3460 follows.

- On the upside, 1.3570 is facing strong pressure. 1.3650 is the next line of resistance.

EUR/USD Fundamentals

- 1:00 Federal Reserve Chairman Bernard Bernanke Speaks.

- 6:00 German Import Prices. Exp. 0.0%, Actual 0.1%.

- 6:45 French CPI. Exp. -0.3%, Actual -0.2%.

- 9:00 German ZEW Economic Sentiment. Exp. 49.2 points. Actual 52.8 points.

- 9:00 Eurozone ZEW Economic Sentiment. Exp. 59.4, Actual 59.1 points.

- All Day – ECOFIN Meetings.

- 12:30 US Empire State Manufacturing Index. Exp. 8.2 points.

- 14:00 FOMC Member William Dudley Speaks.

* All times are GMT.

For more events and lines, see the Euro to dollar forecast.

EUR/USD Sentiment

- Debt ceiling talks continue: The clock is ticking away as the US debt limit will be reached on Thursday if Congress fails to reach an agreement to raise the limit. High-level talks over the weekend failed to break the impasse, but Senate Majority Leader Harry Reid sounded optimistic on Monday, saying that the sides had made “tremendous progress”. The talks are focusing on raising the debt ceiling for several more months until a more comprehensive agreement can be reached. An agreement must be reached by Thursday, or the US treasury will be unable to pay the country’s bills. This could lead to the US defaulting on its debt, which could case chaos in the domestic and international markets.

- International voices weigh in on debt ceiling crisis: The US debt ceiling crisis could affect the world economy, as it could result in the US defaulting on its financial obligations. This has understandably resulted in great concern outside the US. The IMF has warned that the continuing uncertainty emanating out of Washington could lead to a world recession. ECB President Mario Draghi has also weighed in, saying that it was “unthinkable” that Congress would not reach an agreement on the debt ceiling. Major currencies such as the euro and Japanese yen have been very steady throughout the crisis, but that could quickly change if the markets sense that a deal may not be reached prior to Thursday.

- German Economic Sentiment Jumps: There was good news out of Germany,as ZEW German Economic Sentiment continues to improve. The key indicator climbed to 52.8 points in September, its best level since March 2010. Eurozone ZEW Economic Sentiment rose slightly to 59.1 points, but this was short of the estimate of 59.4 points. Still, the markets will not be complaining, as this figure is also a multi-year high.

- QE tapering likely on hold: Overshadowed by the crisis in Washington was last week’s releases of the minutes of the September Fed policy meeting. At that meeting, the Fed surprised the markets by not reducing its bond-purchasing program, which currently runs at $85 billion/mth. The minutes stated that the decision not to begin tapering was a “close call”. This has raised speculation that we could see tapering before the end of the year. However, the monkey wrench in all this is the fiscal uncertainty from shutdown and looming debt crisis. As well, the Fed is heavily dependent on key releases such as Non-Farm Payrolls, which have been suspended to the shutdown. So it’s unlikely that we’ll see any moves to reduce QE prior to December.