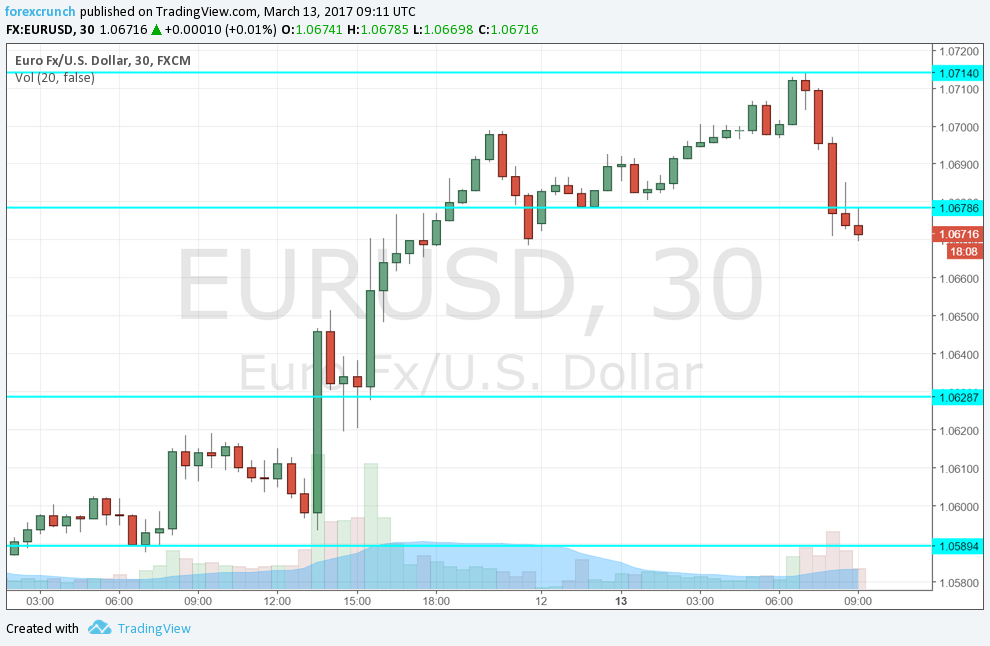

EUR/USD is trading at 1.0670 after reaching resistance at 1.0710. The attempt to break higher was rejected. While euro/dollar remains on high ground, some of the momentum is lost.

Why? The moves to the upside were propelled by the European Central Bank. First came the press conference by Mario Draghi. He explained that the Bank removed the “using all available instruments” clause from the statement because there is no longer a sense of urgency. The clarification send the euro a bit higher.

And on the following day, another bullish report came out of Frankfurt. The report claimed that the ECB discussed the option of raising interest rates before ending the bond-buying scheme. This was a big surprise: the Fed first tapered down its own QE program, then waited for over a year before initiating the rate-rise cycle. Nevertheless, the euro enjoyed a strong close to the week.

ECB cools things down

The winds blow in a different direction in the new week. First, Jan Smets, the Belgian member of the ECB, says that they did not signal any upcoming change in policy in last week’s rate decision. Not even a small step.

He further detailed that the ECB sees inflation as low and it hasn’t improved since December. He basically poured cold water on the elevated expectations.

Secondly, ECB President Mario Draghi is set to take the stage later today. According to assessments, he is also due to curb the enthusiasm of markets.

Will EUR/USD fall from here? Or is it just a correction?

More: ECB’s hawkish twist – what’s next for EUR? – 3 opinions