The decision of the European Central Bank hardly moved the euro until Draghi uttered his words about a lack of urgency. And now the common currency gets another boost, and not only from the NFP.

According to reports, the ECB discussed the option of raising rates even before bond-buying ends. The Federal Reserve initially tapered QE from early 2014 before ending the program altogether in October 2014 and raised rates for the first time only in December.

The ECB, which follows the Fed in so many policy decisions, was thought to follow suit also in this case: an extremely gradual removal of the stimulus. An initial rate hike was seen as coming only in 2019. This would have consisted of an initial upgrade of the deeply negative deposit rate, which stands at -0.40%.

However, the report suggests that this is not the sole option. Draghi and co. could act on rates before they stop buying bonds. The specter of a rate hike is certainly bullish.

Is this for real? Sure, a discussion may have probably occurred. Everybody can talk about anything. Nevertheless, it seems quite unlikely that they will raise rates while buying bonds. In addition, the European economies have a long way to go despite the recent improvements.

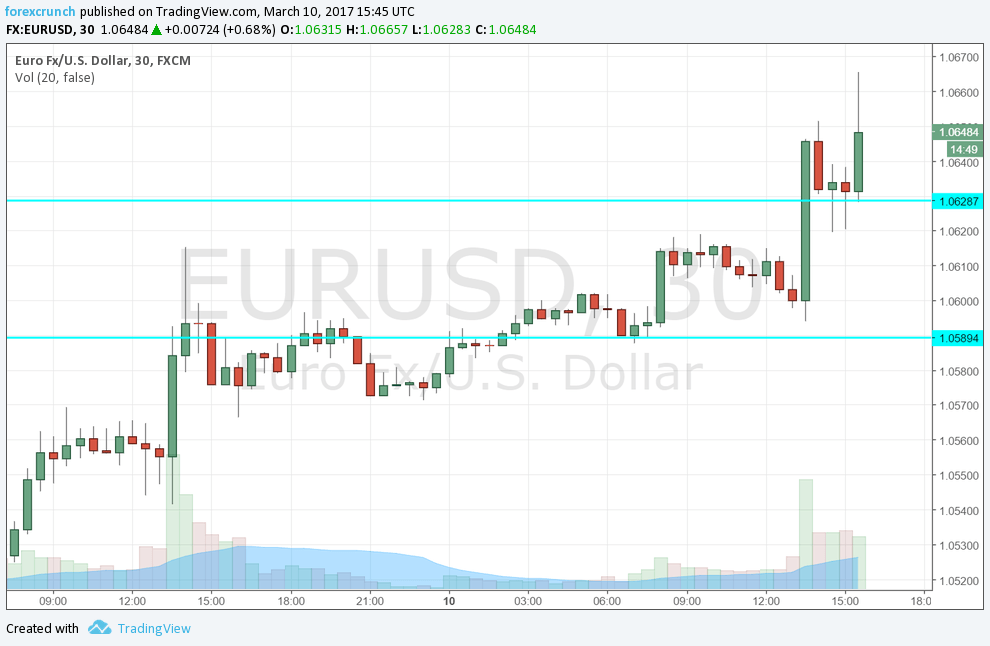

EUR/USD had already risen on the US jobs report. The solid report showed a gain of 235K jobs and wage growth of 2.8% y/y. However, the combination of a monthly gain of only 0.2% (below 0.3% predicted) as well as a “sell the fact” reaction caused a sell-off of the greenback. A Fed rate hike next week is priced in.

Euro/dollar was battling the resistance level of 1.0630 and reaches new highs at 1.0664.

More: ECB’s hawkish twist – what’s next for EUR? – 3 opinions