- Manufacturing PMIs: Monday: 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German one at 8:55, and final euro-zone number at 9:00. These final PMI readings are expected to confirm in the initial releases from late January. Spain’s manufacturing sector has been in contraction mode for the past six months, and the trend is expected to continue, with an estimate of 46.8 pts. In Italy, the manufacturing sector has been in decline for over a year and the forecast for the upcoming release is 46.9 pts. The German indicator is expected at 45.3 and the eurozone PMI is projected to fall to 47.8 pts, indicative of contraction. France is in slightly better shape, as the PMI is expected at 51.0, pointing to mild expansion.

- Spanish Unemployment Change: Tuesday, 8:00. After a sharp decline of 34.6 thousand in December, investors are bracing for a gain of 44.2 thousand in unemployment rolls in January.

- Services PMIs: Wednesday: 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German one at 8:55, and final euro-zone number at 9:00. Services PMIs continue to outshine the manufacturing PMIs, as the initial PMI for the major eurozone economies were all above the 50-level. The initial German PMI came in at 54.2 and the all-Eurozone indicator at 52.2 points. The final PMI readings are expected to confirm the initial readings from January.

- Retail Sales: Wednesday, 10:00. Eurozone retail sales rebounded in November, with a strong gain of 1.0%, marking a 5-month high. However, the indicator is projected to decline by 0.5% in December.

- German Factory Orders: Thursday, 7:00. Factory orders have been in a slump, with four declines in the past five months. Analysts expect better news in December, with an estimate of 0.6%.

- German Industrial Production: Friday, 7:00. The indicator bounced back in November with a gain 1.1%, after back-to-back declines. A decline is expected in December, with a forecast of -0.2%.

- German Trade Balance: Friday, 7:00. Germany continually posts trade surpluses. The surplus narrowed in November to EUR 18.3 billion, down from 20.6 billion a month earlier. The downtrend is expected to continue in December, with a forecast of EUR 16.4 billion.

- French Industrial Production: Friday, 7:45. The second-largest economy in the eurozone posted a gain of 0.3% in November, marking a third straight gain. Investors are braced for a decline of 0.3% in December.

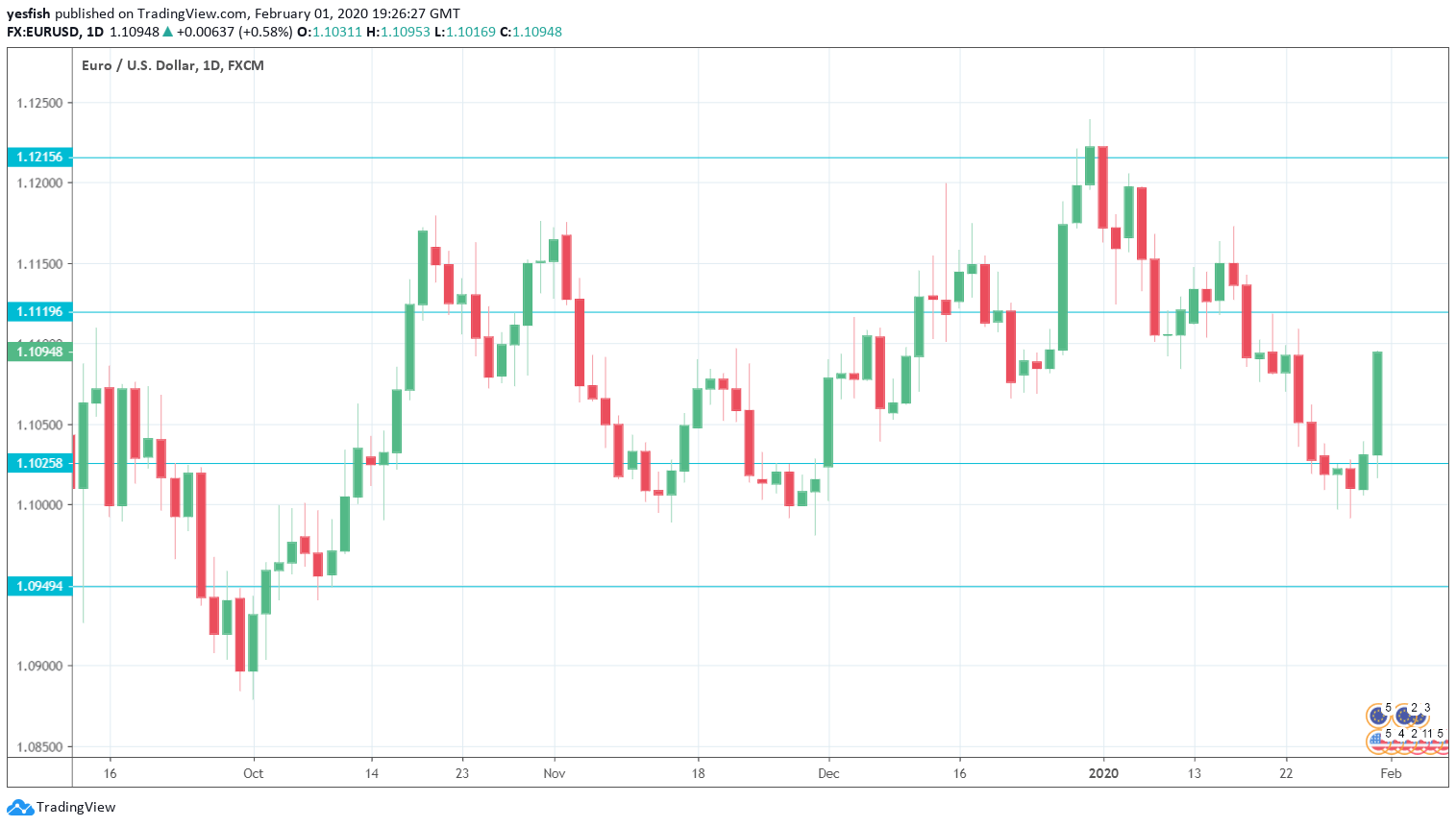

EUR/USD Technical analysis

EUR/USD posted considerable gains at the end of the week, coming close to the 1.11 level.

Technical lines from top to bottom:

1.1390 has held firm in resistance since June.

1.1290 was last tested in early July. 1.1215 is next.

1.1119 is under pressure in resistance following gains by EUR/USD last week.

1.1025 (mentioned last week) is providing support. 1.0925 is next.

1.0829 has held in support since April 2017.

1.0690 is the final support level for now.

.

I remain bearish on EUR/USD

The eurozone economy has been churning out lukewarm data, and the departure of the U.K. from the EU will not make the euro more attractive to investors. If the euro slips close to the 1.10 line, we could see speculators try to push it below this key level.

Follow us on Sticher or iTunes

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!