EUR/USD is off the lows and has found a new range ahead of the all-important decision by the Federal Reserve. The euro is moving by external factors, influenced by the British EU Referendum more than anything else.

The euro enjoyed some back wind from the pound: while the polls are still leaning for Leave, the pound enjoyed a good jobs report. The first surprise came from the actual reaction to the report: sterling took a break from the Brexit debate. The second surprise came from the fact that the euro got carried away.

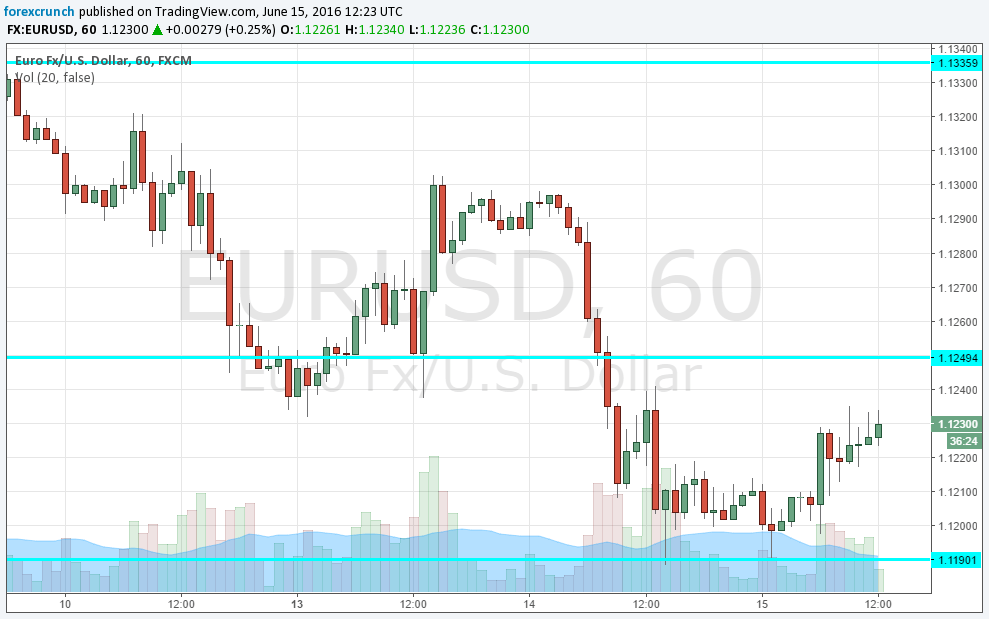

EUR/USD moving by different flutes

And the third surprise came from the report itself: it showed a drop of the unemployment rate to 5% in the UK, around half of that in Europe. Also wages look better in the UK.

In the US, the PPI came out better than expected at 0.4% instead of 0.3%. Also core PPI beat expectations with +0.3% instead of +0.1%. To complete the winning streak, the Empire State Manufacturing Index scored 6 points instead of -3.4 predicted. This improves the mood just a bit, but should have an impact on the Fed, so it’s a “risk on” move for markets, which is bad for the dollar.

Confused? Markets are busier and wilder in recent days, but basically it’s either risk on or risk off. With a pro-Remain EU Referendum poll, the pound rises, the euro follows and on the other hand we have a drop of the USD and the JPY. When things lean for Leave as we’ve seen recently, the situation turns in favor of the greenback and the yen and against the euro and the dollar.

EUR/USD is trading in range: it found support at 1.1190, just under the round level of 1.12 and resistance is at the more veteran 1.1250 level.

More: Brexit or Bremain – all the updates