No change in the BOE’s policy – rates are left unchanged. Perhaps more importantly, the BOE raised its inflation and growth forecasts. They not only removed the hint about another rate cut later this year but also said rates could go “either way’ – a rate hike is not off the cards.

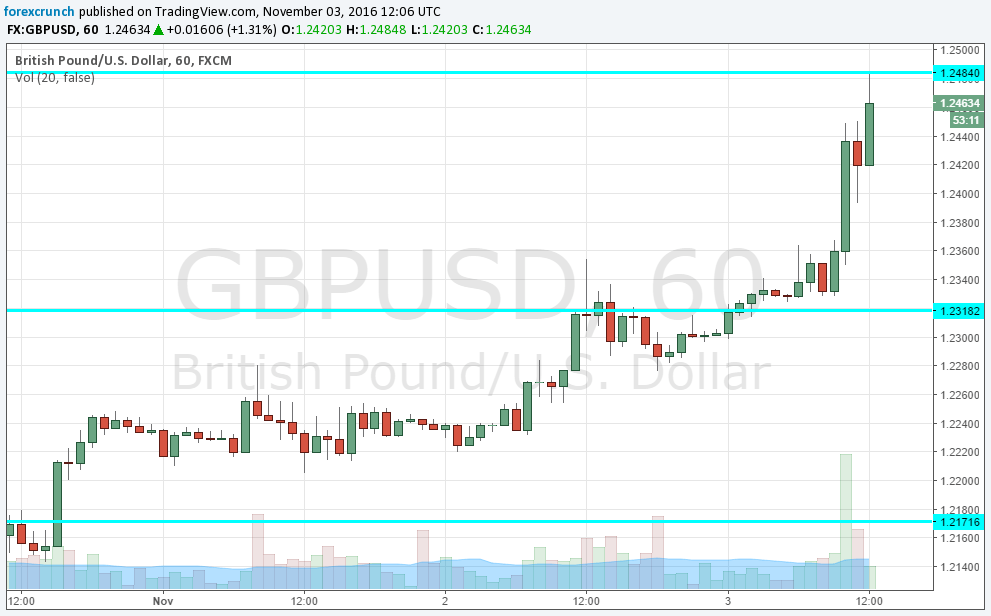

GBP/USD is reaching new highs above 1.2470. It seems that Carney wants to see a stronger pound. This is one of the best days for sterling longs, basically across the board.

BOE QIR

The BOE updated the forecasts: the CPI forecast of 2.72% in a years time vs 2.0% in Aug based on market interest rates and modal projection, 2016 GDP +2.2% vs 2.0% in their August Inflation Report. They do add a dovish warning: forecasts show stronger short-term growth outlook but weaker recovery in

They do add a dovish warning: forecasts show stronger short-term growth outlook but weaker recovery in medium term and overall lower output.

BOE Background

The Bank of England was expected to leave all its policy measured unchanged in its “Super Thursday” gathering which consists of the rate decision, the meeting minutes and the Quarterly Inflation Report.

GBP/USD was trading at much higher ground, thanks to the court ruling: only parliament can approve Brexit. There will be an appeal, though.

Follow our live coverage, with Valeria Bednarik and Mauricio Carrillo:

More: BOE Preview Keeping the powder dry in response to GBP weakness [Video]