EUR/USD was on the back foot but managed to recover and end the week on a higher note. GDP and inflation figures stand out. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Both French and German industrial output disappointed with falls of 1.1% in June, but it didn’t break the euro. German and French inflation figures for July confirmed the initial read. In the US, the JOLTs report extended the dollar recovery but weak inflation figures already dampened the picture.

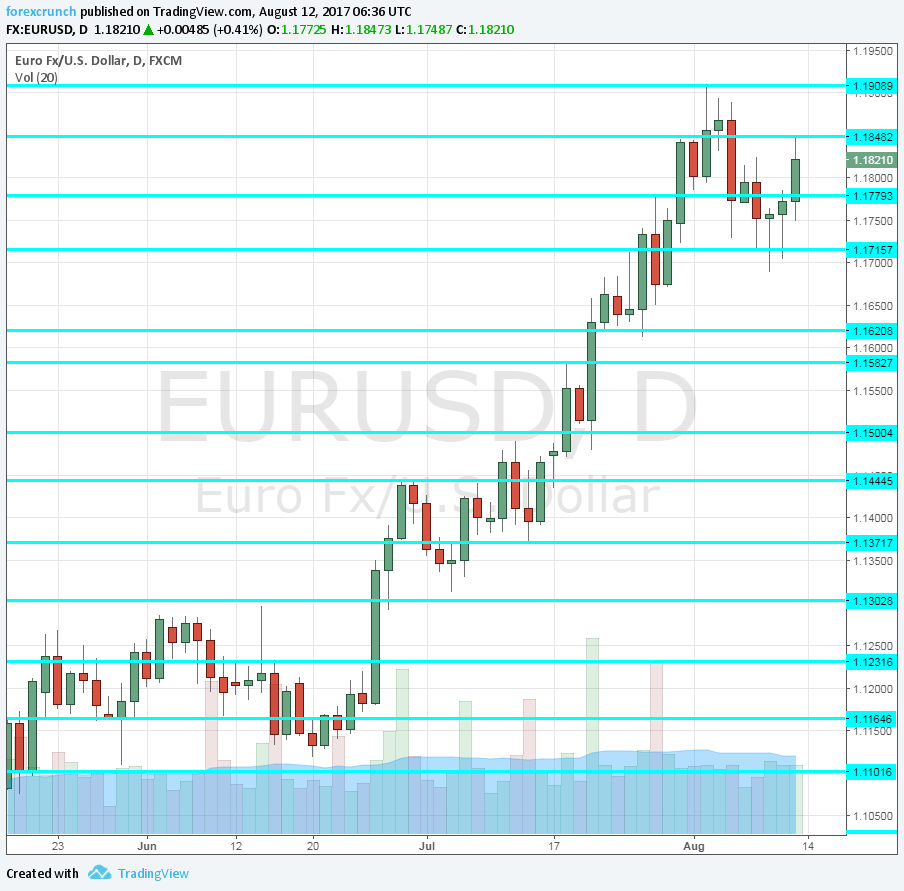

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Industrial Production: Monday, 9:00. While this indicator is published after the main countries had already published their data, the all-European figures still carry weight. Output expanded by a healthy 1.3% in May. A drop of 0.5% is expected m/m while output is expected to continue rising on yearly basis: 2%.

- German GDP: Tuesday, 6:00. Germany is Europe’s largest economy and its growth rate has the most significant impact on overall growth. Back in Q1, the economy grew by 0.6% q/q, the same as the overall euro-zone growth rate. A similar figure is expected now: 0.7% with 1.9% y/y.

- Italian GDP: Wednesday, 8:00. Italy is the euro-zone’s third-largest economy and its growth rate lags behind. A mere 0.2% was seen in Q1 2017. Perhaps this growth rate will climb in Q2. The Italian figure feeds into the all-European numbers. A growth rate of 0.4% is on the cards.

- Flash GDP: Wednesday, 9:00. This is actually the second read of GDP. The first read did not include German output and stood at 0.6%, for the second quarter in a row. The second release is expected to confirm it, but these expectations will change once the data from Germany comes out. A growth rate of 0.6% is expected.

- Final CPI: Thursday, 9:00. The first read of inflation showed a year over year price rise of 1.3%, as expected. More importantly, core CPI surprised to the upside, standing at 1.2%. These two figures will likely be confirmed in the final read for July.

- ECB Meeting Minutes: Thursday, 11:30. These are minutes from the July meeting, where ECB President Mario Draghi told us that they will make decisions in the autumn. Back then, Draghi tried to sound dovish but markets were following the lead from the data and the euro extended its gains. In that press conference, Draghi said they have not discussed QE tapering just yet. The minutes could reveal if they were tiptoeing around the topic and how they see the economy at large. The previous meeting minutes triggered volatility in the euro.

- German PPI: Friday, 6:00. Producer prices are quite volatile, but they eventually feed into consumer prices. This forward-looking measure of inflation surprised to the upside in June, remaining flat. Another “no change” figure is on the cards m/m while producer prices are expected to continue advancing y/y at 2.2%.

- Current Account: Friday, 8:00. Similar to the current account, the euro-zone enjoys a wide surplus in the overall balance, thanks to German exports. A 30.1 billion surplus was seen in May. A similar figure is expected in June.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started the week by trading in the ranges discussed last week.

Technical lines from top to bottom:

We start from the higher ground this time. 1.2565 capped the pair back in late 2014. It is followed by 1.2240, another line from that time and 1.2170, quite close by.

1.2040 was the low point in 2012 and close to the round number of 1.20. It is followed by 1.1876, the trough in 2010, also seen in early August 2017.

1.1712 was the swing high in August 2015, the highest point after the ECB announced QE. 1.1620 was a swing high in May 2016.

1.1580 was a stepping stone for the pair on the way up in July 2017. It is followed by the round number of 1.15.

1.1445 is the June 2017 peak and immediate resistance. 1.1390 is the post-breakout low and works as support.

1.13 is the top line seen in November before the collapse. 1.1230 capped the pair in June.

I am bullish on EUR/USD

Economic data and politics remain in favor of the euro and against the dollar. The picture remains unchanged in the US: the jobs report looks good but inflation remains weak. On the other hand, the ECB is getting closer to QE tapering as inflation is gradually rising.

Our latest podcast is titled As good as it gets? – US economy edition

Follow us on Sticher or iTunes

Safe trading!