EUR/USD was hit hard by dovish Draghi and fell back to lower ground. Fresh PMIs, as well as other events, await the euro. Will it continue lower? Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The ECB decided to reduce the amount of monthly bond buys to 60 billion from April 2017 but also chose to extend the program towards the end of the year and to loosen a few limits. Coupled with a dovish tone about the path of inflation, EUR/USD eventually plunged. Earlier, Italian voters rejected the constitutional changes proposed by Renzi, in another blow to mainstream politics. But here, the euro recovered quickly. In the US, the ISM Non-Manufacturing PMI beat expectations, as markets shift their attention to the FED.

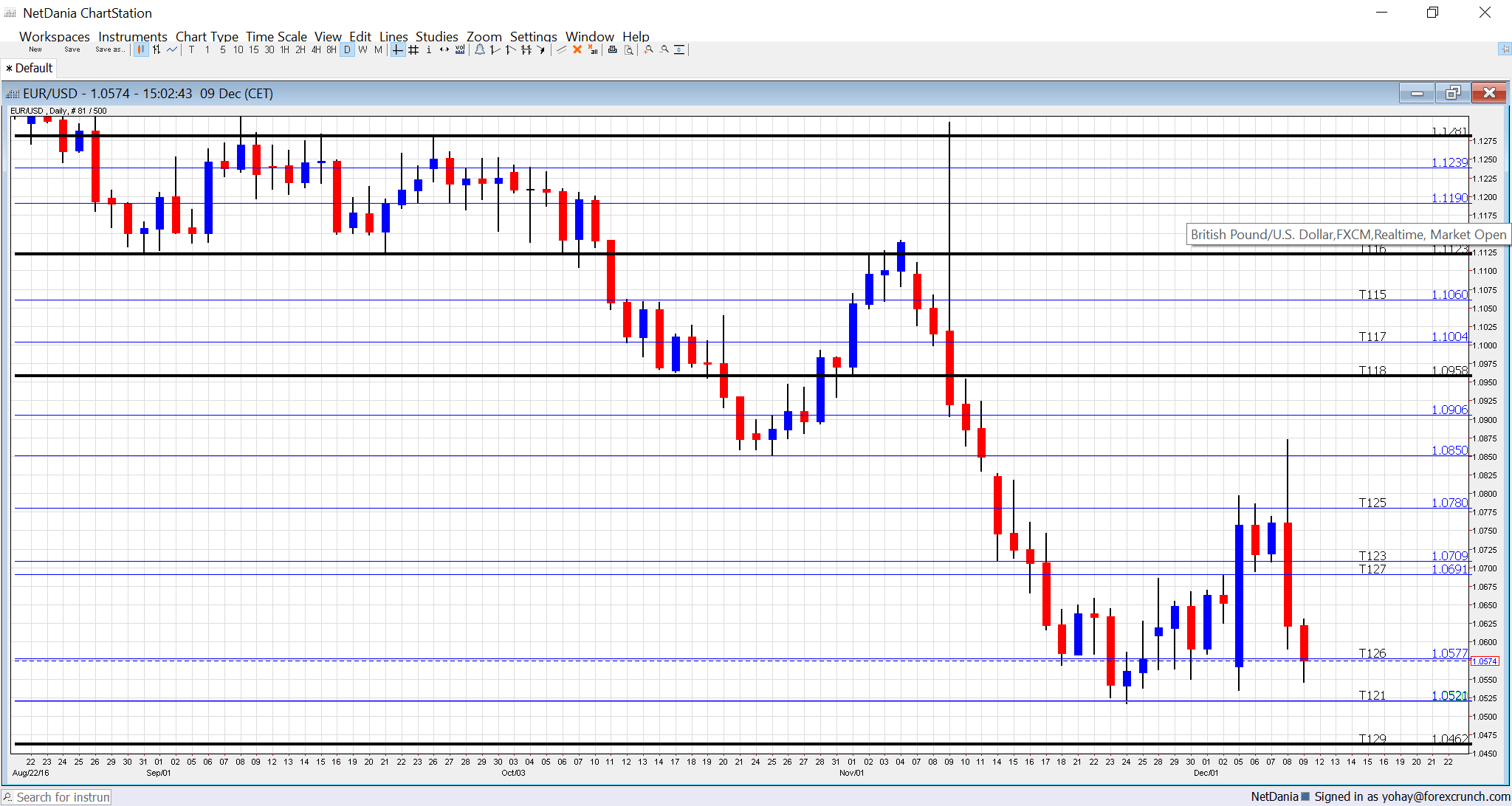

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- German inflation data: Tuesday, 7:00. According to the initial read, prices rose by 0.1% in November. The final read will likely confirm this. Also,, the Wholesale Price Index (WPI) is another measure of price pressure in the pipeline. WPI rose by 0.4% last time, and are now predicted to rise by 0.3%.

- German ZEW Economic Sentiment: Tuesday, 10:00. The ZEW survey is released very early in the month. In November, the score continued advancing and reached 13.8 points, reflecting growing optimism. A tick up to 14.2 is on the cards. The all-European number stood at 15.8 points and 16.5 is projected for December.

- Employment Change: Tuesday, 10:00. This quarterly figure is lagging but still carries some weight. A rise of 0.4% was seen in Q2 2016, and now we’ll get the number for Q3, which is forecast to stand at 0.3%.

- French CPI (final): Wednesday, 7:45. The second-largest economy in the euro-zone saw prices stalling in November according to the initial read. The final number will probably confirm it.

- Industrial Production: Wednesday, 10:00. Industrial output dropped by 0.8% in September. October could see a bounce of 0.2%. Note that the larger countries have already released their figures.

- Flash PMIs: Thursday morning: 8:00 for France, 8:30 for Germany and 9:00 for the euro-zone. According to Markit, the purchasing managers’ index for the French manufacturing sector stood at 51.7 points back in November, above the 50 point threshold separating expansion and contraction. A score of 51.9 is expected now. The services sector’s number was 51.6 points and 51.8 points is predicted now. In Germany, the largest economy, the manufacturing sector was growing faster, at 54.3 points and a rise to 54.6 is on the cards. Germany’s services sector had 55.1 points and a small dip to 55 is forecast. In the euro-zone as a whole, the manufacturing sector PMI had 53.7 points and the services sector had 53.8 points. Both are expected to stand at 53.9.

- LTRO: Thursday, 12:00. The European Central Bank runs the Long Term Refinancing Operation (LTRO), a program of cheap loans to banks. In theory, less lending implies more QE, but the QE question has been answered at the last rate decision. Nevertheless, more loans mean more money in circulation. Back in September, the total lending stood at 45.3 billion dollars.

- CPI (final): Friday, 10:00. According to the initial numbers, headline CPI was 0.6% y/y, a small rise from previous months, thanks to stable oil prices. Core inflation remained at 0.8%. The final numbers for November are expected to confirm the flash figures.

- Trade Balance: Friday, 10:00. Thanks to German exports, the euro-zone enjoys a wide trade balance. Back in September, the surplus was 24.9 billion euros, better than expected. A similar outcome is on the cards for October: 25.2 billion euros.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar had an exciting week, starting with an attempt to move under the 1.0520 level (mentioned last week). It then made a big move to 1.0870 before returning to the lows.

Technical lines from top to bottom:

1.10 is a round number and significant resistance. 1.0960, which supported the pair in early 2016 worked as resistance in October. 1.0850, which worked as support during the same month, serves as support.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

1.0690 is the post-Trump high. 1.0570 is the bottom of the range seen afterwards.

Further below, the 2016 low of 1.0520 and the 2015 low of 1.0460 provide further support – it is the last line in the sand.

I remain bearish on EUR/USD

After the ECB took the dovish route, including the abolishment of the yield limit, the FED is likely to emphasize the monetary policy divergence with a rate hike. Even if the FED is cautious about the future, the ECB remains much more dovish and like the QE program, also the fall of EUR/USD could be extended.

Our latest podcast is titled From the Crude Cut to Draghi’s Drag

Follow us on Sticher or iTunes

Safe trading!