EUR/USD enjoyed the calm in Europe to push higher. German Trade Balance, Industrial production, as well as the ECOFIN and Eurogroup Meetings are the main highlights of this week. Here is an outlook on the major market-movers awaiting us ahead.

Last week, the ECB left policy unchanged in line with market forecast. The ECB has maintained ultra-low rates ECB President Mario Draghi announced in the press conference that cheap money will continue to flow, and key rates will remain low for an extended period of time. The ECB even marginally upgraded its growth forecast for 2014. Will the Eurozone succeed in enjoying a real recovery? In the US, Non-Farm Payrolls exceeded expectations and seemingly enable QE tapering. However, the jury is still out.

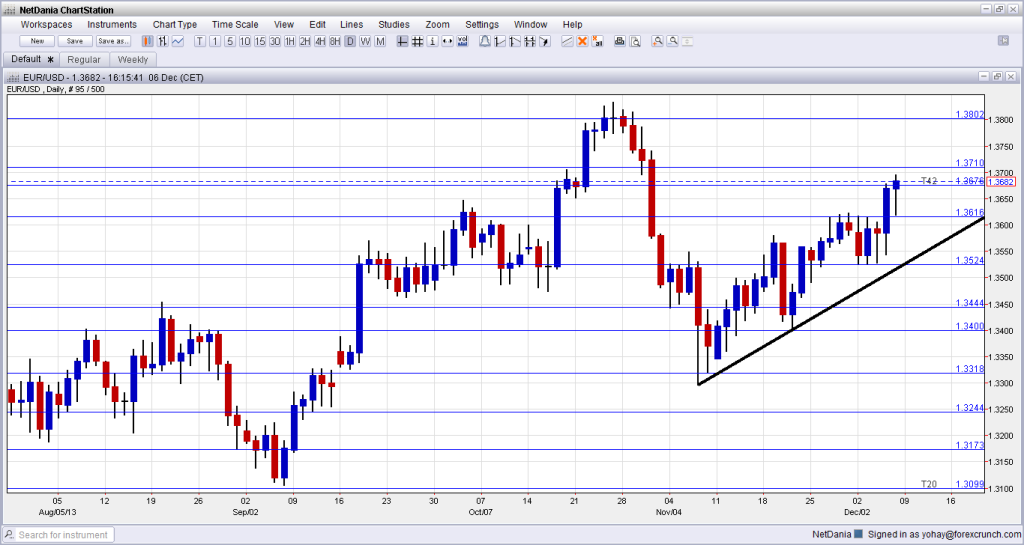

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Trade Balance: Monday, 7:00. Germany’s trade surplus expanded more than expected in September, reaching 20.4 billion euros ($27.4 billion) from a revised 13.3 billion euros in August. Economists anticipated a smaller rise to 17.2 billion euros. Germany’s strong exports overshadow other euro-area countries raising criticism that its surpluses hinder European and global growth. The IMF reprimanded Germany, urging Chancellor Angela Merkel’s government to limit its export surplus to an “appropriate rate” to help euro partners cut deficits.

- Eurogroup Meetings: Monday. Eurogroup meetings held in Brussels and attended by the Eurogroup President, Finance Ministers from euro area member states, the Commissioner for economic and monetary affairs, and the President of the European Central Bank. The current meeting will not include the Greek issue since Greece has made progress in the financial sector and economic reforms but need to resolve pending issues.

- German Industrial Production: Monday, 11:00. German industrial production plunged in September, signaling that German growth may have lost momentum in the third quarter. Production fell 0.9% following a revised 1.6% gain in August. Economists expected a small rise of 0.2%. Production advanced 1 percent from a year earlier when adjusted for working days. However, despite the fragile recovery, economists believe German economy is stable and will expand in the coming months.

- French Industrial Production: Tuesday, 7:45. French industrial production declined in September by 0.5%, amid a sharp drop in the automobile and refineries industries. The disappointing reading followed a 0.7% gain in August and came as a surprise to analysts expecting a 0.4% increase. Production of cars and other transport materials plunged by 3.4%, while the output of the country’s refineries fell 2.1%.

- Italian Industrial Production: Tuesday, 9:00. Italian industrial output increased by 0.2% in September following two consecutive monthly drops but the overall reading for the third quarter was 1.0% lower than the previous quarter, marking the tenth consecutive decline. The euro zone’s third largest economy has been in recession since mid-2011. In the first nine months of the year output fell 3.9% compared with the same period in 2012.

- ECOFIN Meetings: Tuesday. Eurozone: The ECOFIN meetings held in Brussels and attended by Finance Ministers from EU member states. The quorum discuss a range of financial issues, such as euro support mechanisms and government finances. The current Ecofin Meeting will include the backstop arrangements that have to be established no later than ahead of the completion (November 2014) of the comprehensive assessment of EU banking institutions.

- French Final Non-Farm Payrolls: Wednesday, 6:30. French Final Non-Farm Payrolls showed a 0.2% drop for Q2, in line with market forecasts. The first quarter Non-Farm Payrolls posted a 0.1% fall. This was the fifth consecutive quarter of declines indicating scarce job opportunities and continuing layoffs. On a yearly base, full-time employment is dropped 0.7%, but temporary work has plunged 5.0%.

- French CPI: Thursday, 7:45. Consumer prices dropped 0.1% in October, slightly better than the 0.2% decline registered in September. Analysts expected a flat reading. Services recorded the main increase offset be a sharp drop in energy prices. Annual inflation declined from 0.9% in September to 0.6% in October, posting the lowest reading since November 2009.

- ECB Monthly Bulletin: Thursday, 9:00. The ECB stated in its previous monthly bulletin that the Euro zone inflation may remain subdued for some time. Inflation expectations over the medium to long term remained in line with the central bank’s aim of maintaining inflation rates close to, 2%. The Bulletin was similar to the rate statement made by Draghi when he announced the rate cut of 0.25%.

- Industrial Production: Thursday, 10:00. Industrial production across the 17-country euro-area fell 0.5% in September, following a 1.0% gain in August, suggesting the Eurozone economic growth may have halted in the third quarter and future growth is expected to remain slow at best. The poor economic condition in the periphery heavily weighs on the Eurozone’ growth prospects

- Employment Change: Friday, 10:00. Workforce in the euro zone declined again in the second quarter of this year but at a slower pace, suggesting that the bloc’s modest recovery may be gaining momentum. Employment fell 0.1% in the second quarter, significantly better than in the two preceding quarters. However, the recovery remains fragile and reliant on exports. Improvements are modest and moral is slightly better, but the Eurozone is still a long way to recovery.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar began the week with a slide to 1.3525. After some range trading between this line and 1.3615, the pair broke higher and reached 1.3675. Note that quite a few levels have changed from the previous week.

Technical lines from top to bottom:

We start from higher ground this time: 1.4036 was a separator back in 2011, and awaits the pair if it breaks above 1.40. 1.3940 was a peak in September 2011, over two years ago, and is just before the round number of 1.40.

1.3870 capped the pair during the fall of 2011 and served as the “shoulders” in a H&S pattern. 1.38 is a round number and also worked as a temporary cap during that period of time and also in October 2013.

1.3710 was the previous 2013 peak, and served as a clear separator. The pair needed a big trigger to break above this line, and when it lost it again, the fall was painful. 1.3675 capped the pair in December and also provided some support back in October.

1.3615 worked as resistance in December, as an upper bound for the range. It is followed by 1.3525, which was the lower bound during this period and also had the opposite role in early 2013.

1.3440 worked as a clear separator in early November 2013 and is a key line to the upside. The round number of 1.34 worked as resistance several times in 2013, and is strengthening now.

1.3320 worked as a double top in early September and it was crossed only with a Sunday gap. It remains a clear separator of ranges. It is followed by 1.3240, which capped the pair in April and also had a role in August. It worked as support in September.

1.3175 capped the pair during July 2013. 1.3100 is worked as temporary resistance in December 2012 and is becoming more important once again, after capping a recovery attempt in June and then in July and providing support in September.

Uptrend resistance

From early November, the pair is trending higher, riding above an uptrend support line that currently coincides with the 1.3525 support line.

I am neutral on EUR/USD

For a change, this isn’t a pure ugly contest between the dollar and the euro. The better US data raised the odds of QE tapering, and this is dollar supportive. On the other hand and at least for now, things look calmer in Europe: Draghi said that there was only a “brief discussion” about a negative deposit rate. The problems in the euro-zone are wide and large, but the “Santa Rally” doesn’t seem to skip the common currency.

We could see both currencies gain against other currencies, but probably not against each other.

More:

If you are interested a different way of trading currencies, check out the weekly binary options setups, including EUR/USD and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast

- For the kiwi, see the NZDUSD forecast.