EUR/USD continued falling from the highs but it wasn’t a one-way street. The PMIs and inflation data stand out this week. Will the slide continue the downside? Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The improved market mood weighed on EUR/USD and Draghi’s words added to pressure. He repeated his clear commitment to act in March amid worsening conditions. He also called on governments to do more to help but this may fall on deaf ears. Sentiment in Germany worsens but doesn’t collapse. In the US, we are seeing quite a few significant surprises, a change from the losing streak we’ve seen beforehand.

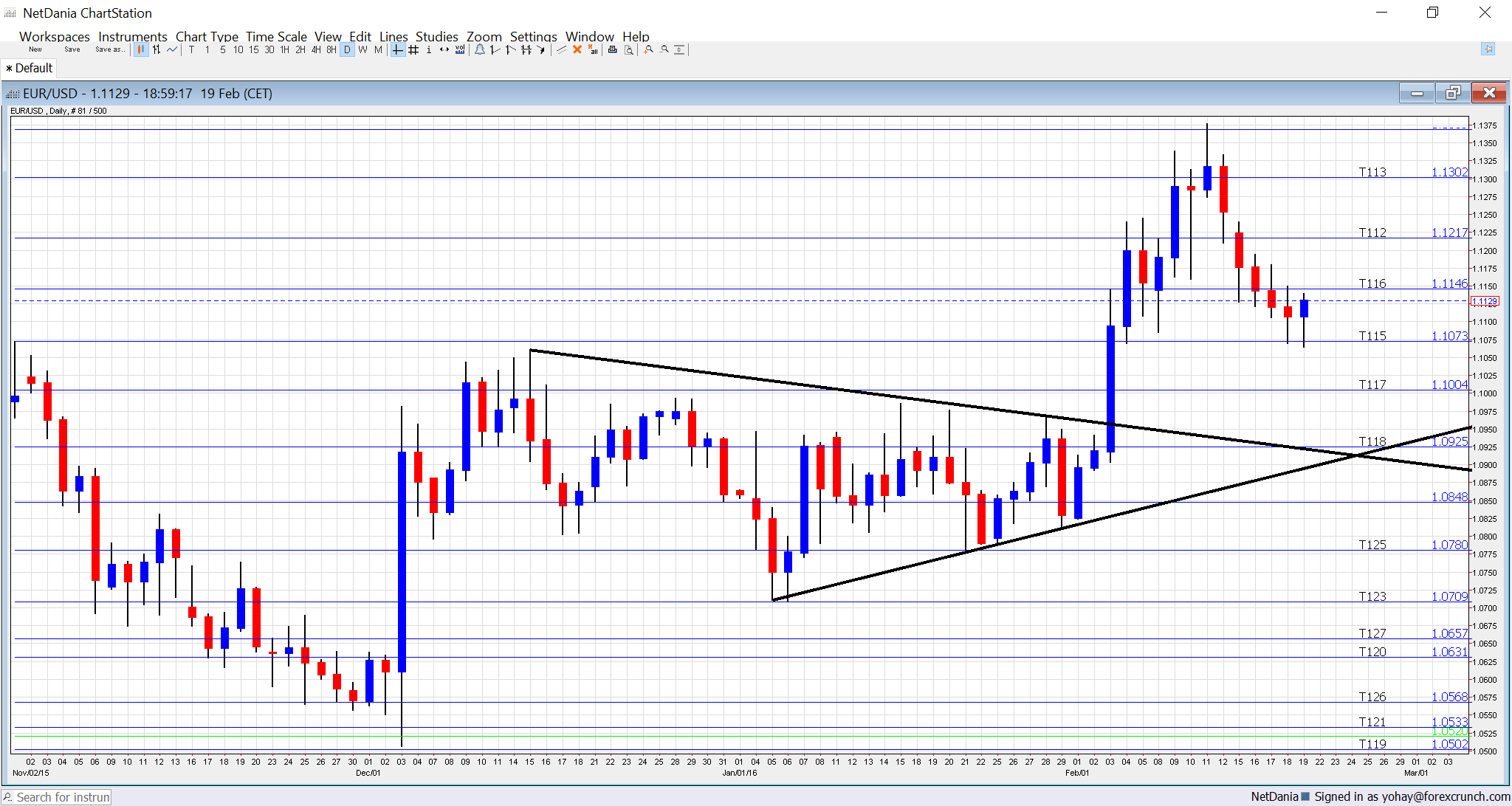

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Flash PMIs: Monday: France at 8:00, Germany at 8:30 and the whole euro-zone at 9:00. January’s figures showed ongoing sluggish growth in manufacturing and slightly better numbers for the services sectors, according to Markit. The French manufacturing sector was perfectly balanced at 50 points – the threshold between growth and contraction and now 49.9 is expected. Services stood on 50.3 points and a small rise to 50.4 is on the cards. In Germany, manufacturing stood on 52.3 and is predicted to drop to 52.1 points. Services on 55 points and a slide to 54.8 is on the cards. For the whole euro-zone, the numbers were 52.3 and 53.6. Slides to 52.1 and 54.8 are expected respectively.

- German GDP (final): Tuesday, 7:00. According to the preliminary release, the German economy rose by 0.3%, as expected and like in Q3. The final figure for Q4 is expected to confirm this. Note that the y/y figure missed by a bit and in general, a rise of 0.3% is quite mediocre, especially for the locomotive of the currency area.

- German Ifo Business Climate: Tuesday, 9:00. IFO is Germany’s No. 1 Think Tank and carries a lot of weight with their wide survey. In January, they showed a fall of sentiment to 107.3 points. A tick down to 107 points is predicted.

- Belgian NBB Business Climate: Wednesday, 14:00. Despite coming from a small country, this publication has an impact. In January it disappointed with a drop to -3 points from -1.4 beforehand. The negative sentiment is set to prevail. -3.5 points is on the cards.

- German GfK Consumer Climate:Thursday, 7:00. Germany brings us also a consumer survey. The mood has been eroding in recent months, with the score settling at 9.4 points. A slide to 9.2 is forecast.

- Monetary data: Thursday, 9:00. The ECB’s loose monetary policy has pushed more money into circulation and raised lending, but the figures are stuck of late. M3 Money Supply rose by 4.7% in December, slower than in previous months. A repeat of 4.7% is expected.. Private loans advanced by 1.4%, the same as in November. Here, an acceleration to 1.5% is due.

- CPI final): Thursday, 10:00. This is the final read for January. The preliminary read showed an acceleration of prices to 0.4% from 0.2% beforehand, mostly reflecting the partial removal of the base effects: the huge fall in oil prices seen in early 2015. Core inflation was reported at 1%. Both numbers will likely be confirmed now.

- German CPI (preliminary): Friday, during the morning from the various states with the final release at 13:00. These are fresh figures for February. In January, prices fell by 0.8% but year over year, things improved as base effects began fading away. For February, a fresh fall in oil prices as well as worries could keep prices depressed. A bounce up of 0.6% is predicted.

- French Consumer Spending: Friday, 7:45. The continent’s second largest economy saw spending rise by 0.7% in December and we could see a fall now. +0.6% is on the cards.

- Spanish CPI: Friday, 8:00. Also the fourth largest economy in the euro-zone is publishing its data and the focus here is on the y/y data. A drop of 0.3% was seen in January. A drop of -0.5% is predicted.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar continued sliding from the highs and found some support around 1.1140 (mentioned last week). It dropped lower but found support at 1.1070.

Technical lines from top to bottom:

We start from higher ground this time: 1.1460 was a key resistance line in 2015 and 1000 above the multi-year lows. 1.1373 is a veteran line from 2003 that continued playing a role also in 2015.

1.13 worked as support back in October and is the high line at the moment. It is followed by the swing low of 1.1220 in September which is minor resistance now.

1.1140 cushioned the pair in October. 1.1050 is the high seen in December and the next challenge on the upside.

1.10 is a round number and significant resistance. 1.0925, which was a support line in December, is the next support line. 1.0850 was the level the pair bounce off at the dying moments of 2015.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015. 1.0630 worked as nice support in November 2015 and then switched to resistance.

I remain bearish on EUR/USD

Euro-zone data doesn’t look good and Draghi is determined to act. In the US, it seems that the worst is behind us. Assuming some stability in oil and Chinese news, the absence of safe haven flows could allow the fundamentals to play a role.

Our latest podcast is titled Oil’n’gold merry go round