EUR/USD had an exciting week, extending the gains, but closed well off the highs. The upcoming week features a speech by Mario Draghi and the ECB’s meeting minutes among other events. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Euro-zone figures were not so impressive, with misses on industrial output and mediocre GDP results. In the US, data was quite alright. However, the dominant force remained fear, and this helps the euro. Fresh lows in oil prices, worries about financial stability of various companies and perhaps the loss of faith in central banks all weighed on sentiment. While the euro is lagging behind the wild yen in its safe haven appeal, it still enjoyed nice gains.

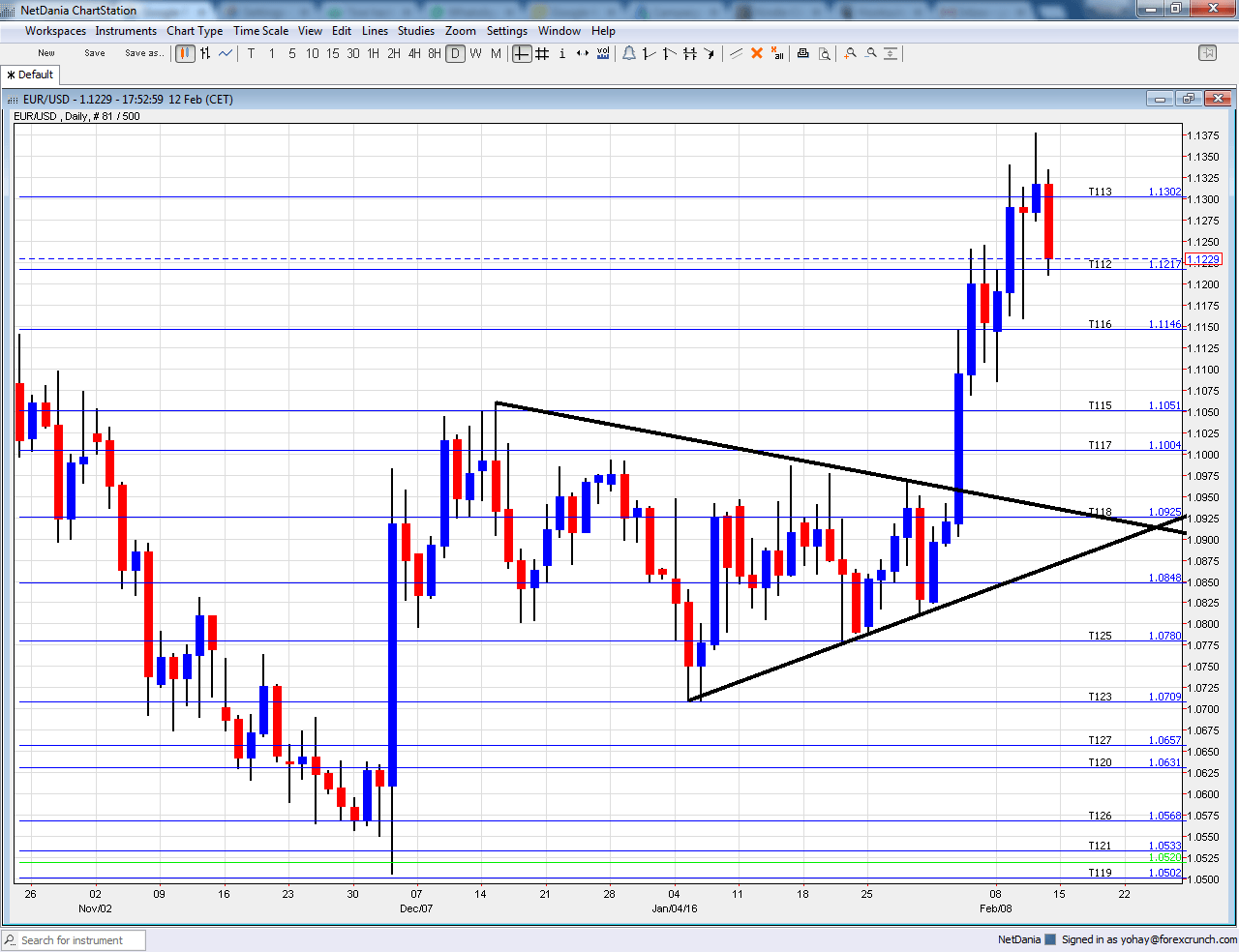

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Trade Balance:Monday, 10:00. The euro-zone enjoys a nice surplus in its trade balance, mostly thanks to German exports. The figure stood on +22.7 billion back in November and the figure for December could be slightly lower. Note that Germany already released its own data. A surplus of 22.4 billion is on the cards.

- Mario Draghi talks: Monday, 14:00. The president of the ECB testifies in the European Parliament amid the recent market storms and after he received some support from Jens Weidmann, who usually opposes him. The timing of the testimony coincides with low liquidity on a US bank holiday and this also promises action. Any details about the potential policy measures to be introduced in March will move markets.

- German Constitutional Court Ruling: Tuesday morning. The Karlsruhe court is called to on the legality of various ECB operations, namely QE. In the past, this body laid out its criticism about decisions by the ECB, that bordered monetary financing. However, it fell short of ruling them out. Without Germany, the ECB is meaningless and the high court did not want to enter the political arena. Also this time, it may refrain from action, but we need to keep our ears open in case of a surprise.

- German ZEW Economic Sentiment: Tuesday, 10:00. This business survey is released early, for the current month, and that’s where it gets its importance. After a long series of dips that nearly sent sentiment to negative ground, sentiment bounced off. However, after reaching the 10.2 points in January, the recent market turmoil could be reflected in a drop this time, with only 0.1 points expected. Also note the all European figure, which stood on 22.7 points last month and now 10.3 is expected.

- Current Account: Thursday, 9:00. Similar to the narrower trade balance figure, the wider account is in positive digits thanks to Germany’s exports. A beat with 26.4 billion was seen in November and a slightly lower number could be seen now: 22.3 billion.

- ECB Meeting Minutes: Thursday, 12:30. In the recent meeting in January, ECB president Mario Draghi said that further downside risks have materialized and that his institution will re-consider monetary policy in March, hinting of more action. We know that there is a variety of views within the central bank, namely a hawkish camp led by the president of the German Bundesbank Jens Weidmann. However, the same Weidmann already showed his support for more action in March. It will be interesting to not only see the level of support for more measures but also the views on inflation developments, fear of deflation and lots more.

- German PPI: Friday, 7:00. Producer prices eventually reach consumers and impact the ECB’s policy. Germany saw a big drop of 0.5% in prices back in December and it’s safe to assume another drop is coming: -0.3% is expected.

- Consumer Confidence: Friday, 15:00. According to Eurostat, consumers remain slightly pessimistic, with a stable score of -6 in January, for the third time in a row. A drop to -7 is on the cards.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar began the week under 1.1215 (mentioned last week) and after dipping, it shot higher, pausing at the historic 1.1373 level.

Technical lines from top to bottom:

We start from higher ground this time: 1.1460 was a key resistance line in 2015 and 1000 above the multi-year lows. 1.1373 is a veteran line from 2003 that continued playing a role also in 2015.

1.13 worked as support back in October and is the high line at the moment. It is followed by the swing low of 1.1220 in September which is minor resistance now.

1.1140 cushioned the pair in October. 1.1050 is the high seen in December and the next challenge on the upside.

1.10 is a round number and significant resistance. 1.0925, which was a support line in December, is the next support line. 1.0850 was the level the pair bounce off at the dying moments of 2015.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015. 1.0630 worked as nice support in November 2015 and then switched to resistance.

I am bearish on EUR/USD

EUR/USD may have peaked at resistance: this includes the bottoming out of poor US data and also growing support for big measures from the ECB. Draghi could regain his strength and move the markets, pushing the euro down.

Our latest podcast is titled What’s the Deal with the Death Cross? + Yellen and yen