EUR/USD had another week of struggle and slid to lower ground. More inflation numbers as well as PMIs stand out in the week that precedes the ECB meeting. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Yet another German business confidence survey showed a deterioration in sentiment. Also the preliminary PMIs weren’t too good, especially the German manufacturing ones. In the US, the winning streak of figures was cut short with a few rough ones, such as new home sales but some showed strength.

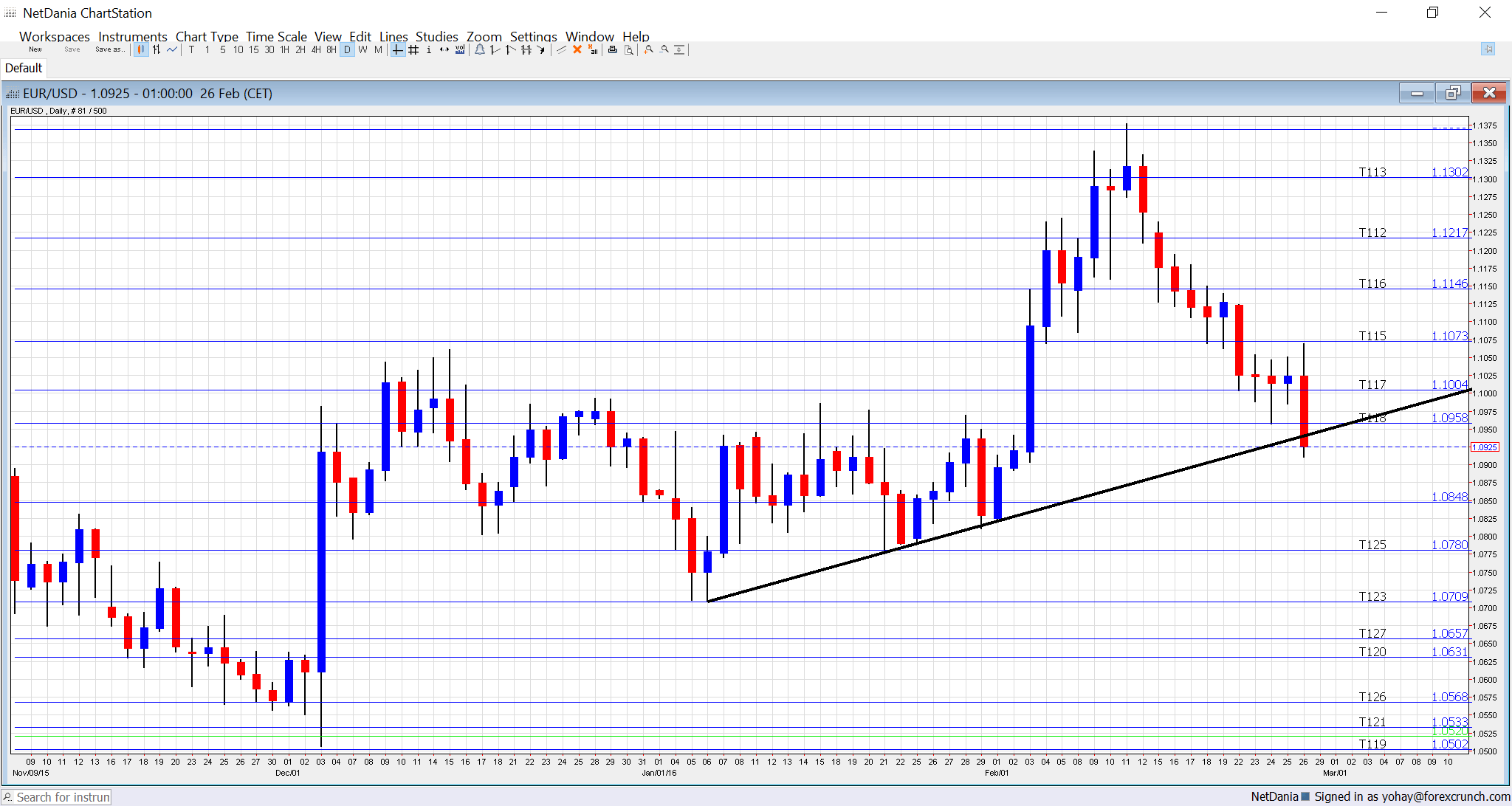

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- German Retail Sales: The volume of sales in the continent’s largest economy dropped by 0.2% in December and a bounce is on the cards for January: +0.3% is expected now. Import prices, released at the same time, are predicted to fall by 0.9% after a slide of 1.2% beforehand.

- CPI (preliminary): Monday, 10:00. The preliminary figures for February serve as important input for the European Central Bank’s March Meeting. We already know that Germany slipped back to deflation, and the forecast for the greater euro-zone is for 0% from +0.4% beforehand in the headline figure and 0.9% in core inflation, down from 1%. Bigger drops would raise the pressure for more ECB action.

- Manufacturing PMIs: Tuesday: 8:15 for Spain, 8:45 for Italy, the final French figure at 8:50, final German at 8:55 and final euro-zone at 9:00. According to Markit, Spain enjoyed strong growth in the manufacturing sector: a score of 55.4 points in January, significantly above the 50 point mark separating growth and contraction. A score of 54.3 is on the cards now. Italy saw weaker growth with a score of 53.2 points in the wake of the new year and a slide to 52.2 is expected now. According to the preliminary release for February, France, the second largest economy, saw marginal growth with 50.3 points. Germany had a similar score of 50.2 and the whole euro-zone was at 51 points. The last 3 numbers are expected to be confirmed in the final read.

- German Unemployment Change: Tuesday, 8:55. The German labor market continues enjoying strong growth and the number of unemployed people is falling. A big drop of 20K unemployed was seen in December and a more modest fall of 10K is predicted now.

- Unemployment rate: Tuesday, 10:00. While the unemployment rate still remains elevated, it continues its gradual decline and stood on 10.4% in December. Will it fall once again? No change is expected.

- Spanish Unemployment Change: Wednesday, 8:00. The fourth largest economy is also seeing lower unemployment and also here, it is quite high. In January, 57.2K people left the ranks of the unemployed and it could fall again in February. The early release makes this release significant. +0.2K is the forecast for February.

- PPI: Wednesday, 10:00. Producer prices have been falling for quite some time in line with oil prices. In December they dropped by 0.8% and no relief is on the cards now: a fall of 0.9% is due.

- Services PMIs: Thursday, 8:15 for Spain, 8:45 for Italy, the final French figure at 8:50, final German at 8:55 and final euro-zone at 9:00. In January, Spain saw stable growth in the services sector, with 54.6 points according to Markit. For February, a score of 53.9 points is expected. Italy saw slightly weaker growth of 53.6 points, yet still above the 50 point threshold separating growth from contraction. A slide to 52.7 is expected. According to the initial publication for France, the services sector is contracting with 49.8 points. Germany still enjoys solid growth with 55.1 points and the whole euro-zone is at 53 points. The last three numbers will likely be confirmed.

- Retail Sales: Thursday, 10:00. Despite being published after the German and French publications, this release still should have a nice impact. A rise of 0.1% is expected for January after an advance of +0.3% was reported for December.

- Retail PMI: Friday, 9:10. Markit’s euro-zone retail purchasing managers’ index has been under 50 points, in contraction grounds in the past 3 months with 48.9 points last time. A similar number is on the cards now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar extended its falls and even dipped under 1.10 (mentioned last week) finding support at 1.0960.

Technical lines from top to bottom:

We start from higher ground this time: 1.1460 was a key resistance line in 2015 and 1000 above the multi-year lows. 1.1373 is a veteran line from 2003 that continued playing a role also in 2015.

1.13 worked as support back in October and is the high line at the moment. It is followed by the swing low of 1.1220 in September which is minor resistance now.

1.1140 cushioned the pair in October. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0960, which worked in the past as resistance, provided a cushion for the pair in February 1.0850 was the level the pair bounce off at the dying moments of 2015.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015. 1.0630 worked as nice support in November 2015 and then switched to resistance.

Uptrend support

As the thick black line shows, the pair is supported since early 2016 by uptrend support, originating from the low level of 1.0710. EUR/USD slipped under the line in the late hours of Friday and the breakout is still pending confirmation.

I remain bearish on EUR/USD

The deteriorating inflation situation keeps a high level of pressure on Mario Draghi and his colleagues. Further worries about the economic recovery fueled with speculation regarding the ECB’s moves could push the common currency lower. On the other side of the Atlantic, a rate hike in March was already written off a long time ago and recent figures have shown improvement, so a fall of the greenback is not likely.

Our latest podcast is titled Time for Regrets? Referendum and Rates version