EUR/USD enjoyed the weakness of the dollar and some good European data to rise. Can this continue? Industrial output data stands out in the first full week of February. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Top-tier European data was strong: the economy grew by 0.5% in Q4 2016, the unemployment rate surprisingly dropped and the inflation rate beat expectations. Will this change Draghi’s skepticism? In the US, the new President’s priorities do not seem to include fiscal stimulus and this is not helping the greenback to put it mildly. The NFP came out better than expected on the headline but with a big miss on wages, triggering choppy, but range-bound trading on EUR/USD.

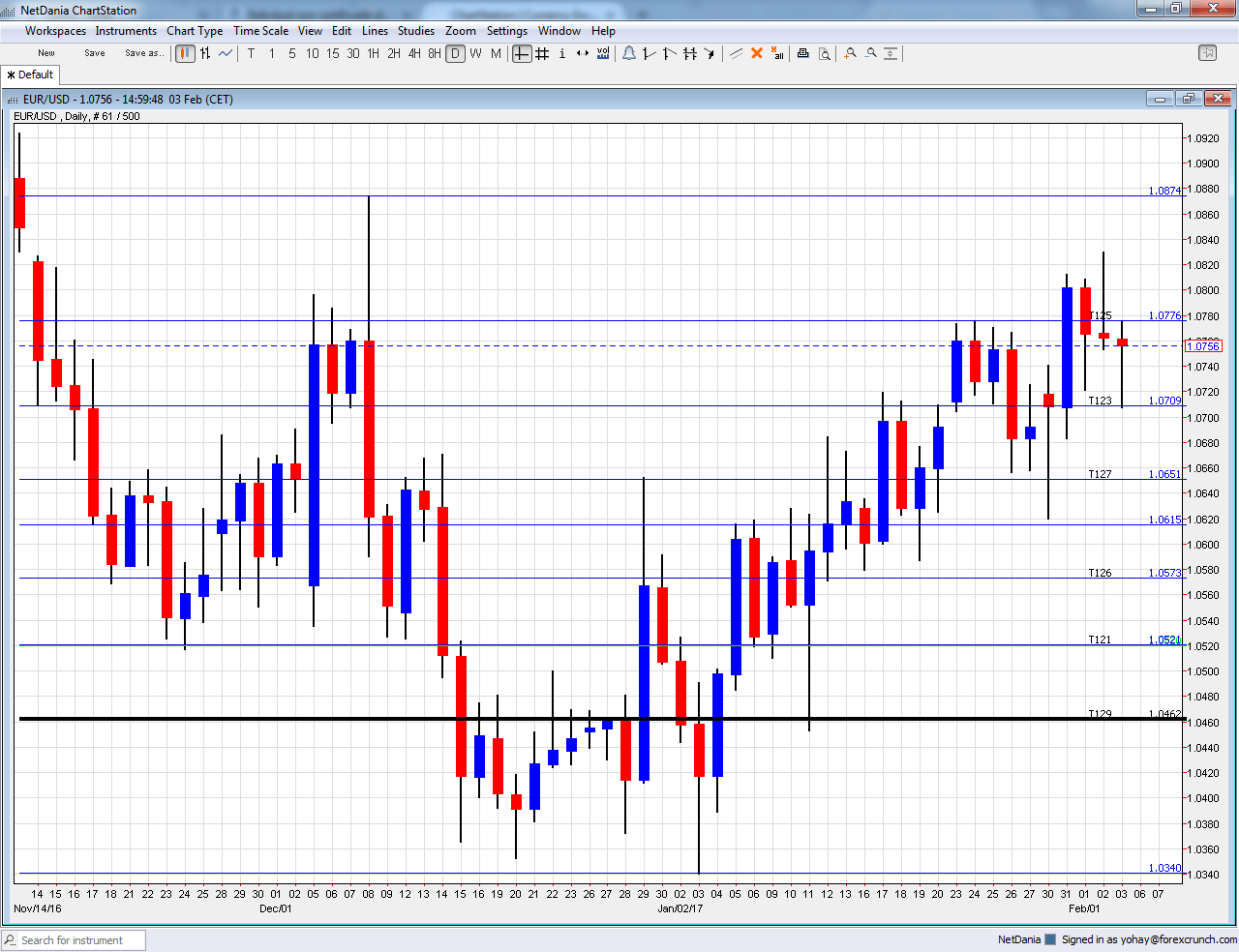

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- German Factory Orders: Monday, 7:00. Germany is often seen as Europe’s factory and the manufacturing locomotive. Factory orders disappointed with a drop of 2.5% back in November. We now get the data for December. A rise of 0.6% is on the cards.

- Retail PMI: Monday, 9:10. Markit’s purchasing managers’ index for the retail sector is flirting with the 50 point measure that separates growth and contraction. It hit 50.4 points in December.

- Sentix Investor Confidence: Monday, 9:30. The 2800 strong survey beat expectations in January by jumping to 18.2 points, reflecting an upbeat mood about the euro-zone economies. A small slide to 16.7 is predicted.

- German Industrial Production: Tuesday, 7:00. Contrary to factory orders, the overall output from German industry was OK, rising by 0.4% in November. A more moderate advance of 0.2% is projected.

- French Trade Balance: Tuesday, 7:45. While Germany enjoys a trade surplus, France has a deficit. A shortfall of 4.4 billion euros was seen in November. A narrower deficit of 4.2 billion is predicted.

- EU Economic Forecasts: Wednesday, delayed from the previous week. The European Commission releases these updated forecasts every six months or so. Given recent data, they may upgrade their projections for 2017 and 2018.

- German Trade Balance: Thursday, 7:00. A surplus of 21.7 billion euros was seen in November, in line with previous months. A similar number is on the cards now: 23.2 billion.

- French Industrial Production: Friday, 7:45. The second-largest economy in the euro-zone saw a bump up in output, 2.2% in November.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar continued rising once again, topping the 1.0775 level mentioned last week.

Technical lines from top to bottom:

1.10 is the ultimate high level in current trading ranges. It is followed by 1.0950. More importantly, the swing high of 1.0870 is fierce resistance.

1.0775 is the high line seen in late January. 1.0710 is the upper resistance line on the chart after temporarily capping the pair in April 2015.

1.0650 was the bottom end of the range seen in late January. The early high of January, at 1.0615 is the next line.

1.0570 was a stepping stone on the way down. Further below, the early 2016 low of 1.0520 and the 2015 low of 1.0460 are seen.

1.0460 seems to carry more weight. Even lower, there are two significant barriers on the way to parity. The 1.0340 level was the low of 2003 before the pair advanced to higher ground.

The 101.50 level was a peak seen in 2002, on the first attempt of the pair to break above parity. And then, there is EUR/USD parity.

I remain bullish on EUR/USD

While monetary policy divergence weighs on the pair, current growth rates and political issues favor the euro.

Our latest podcast is titled Worrying wages and shining gold

Follow us on Sticher or iTunes

Safe trading!