EUR/USD made a move to higher ground but found it hard to continue rising. Will it make substantial falls? GDP and inflation figures stand out in a busy week. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Data was mixed in the euro-zone, with a miss in Germany’s IFO measure and PMIs going in different directions. In the US, Trump’s first week in office was certainly busy, with an initial slump in the US dollar followed by a recovery. Will the attention on Trump’s actions continue?

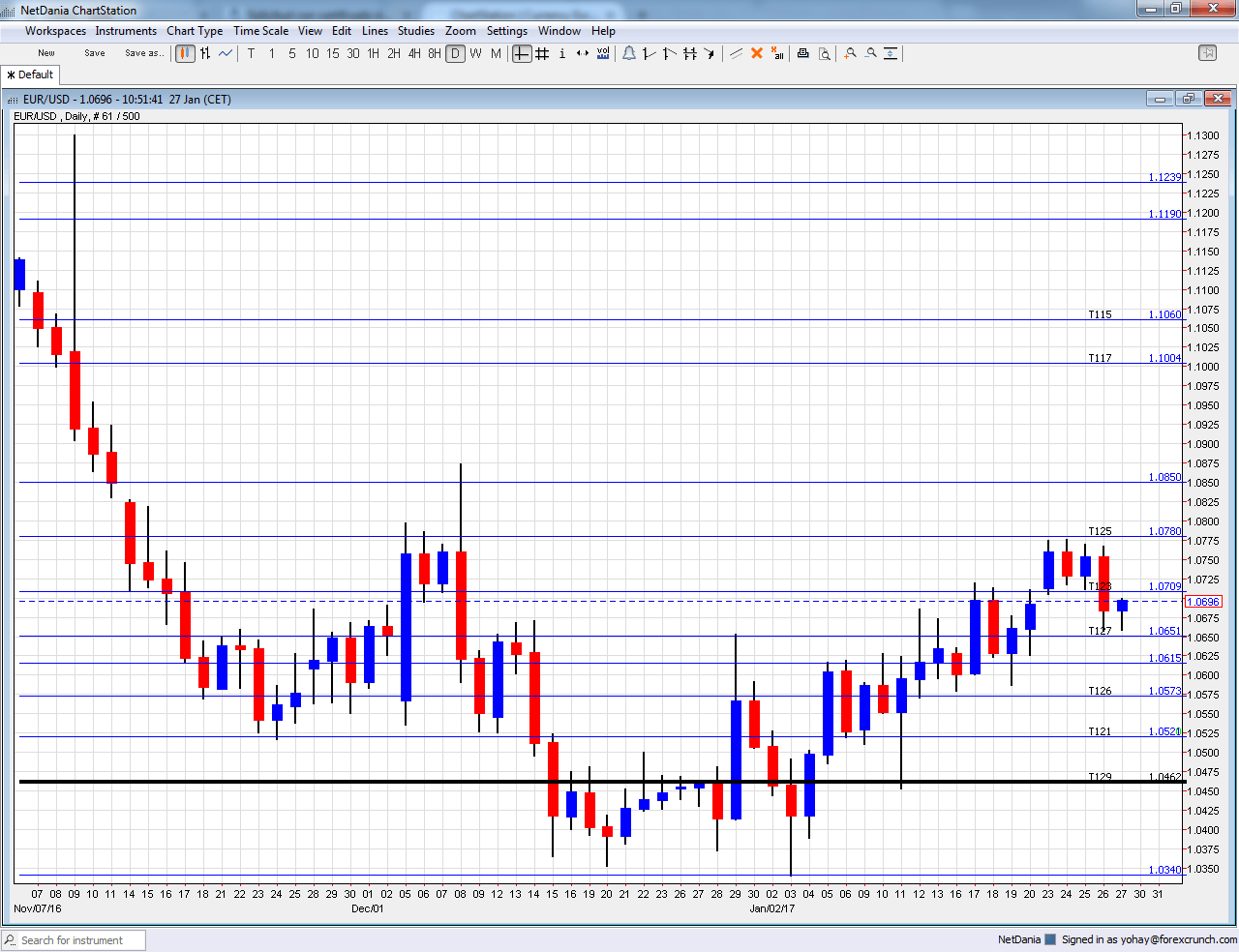

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Spanish Flash GDP: Monday, 7:00. The euro zone’s fourth largest economy begins the week with its initial GDP report for Q4 2016. The Spanish economy advanced at a solid pace of 0.7% in Q3, extending the previous trend. Another growth rate of 0.7% is expected for Q4.

- German CPI: Monday, data from the states during the morning and the final CPI measure is out at 13:00. German inflation jumped in December, causing worries in the inflation-phobic nation. While the ECB largely ignored this as a one-off, markets will be watching closely to see if holiday packages in December were to blame for the leap, or if a new trend has commenced. After 0.7% in December, a drop of 0.5% is on the cards.

- French GDP: Tuesday, 6:30. The second-largest economy in the euro area saw mediocre growth rates of late, such as 0.2% in Q3. A stronger growth rate of 0.4% is projected.

- German Retail Sales: Tuesday, 7:00. While the data is volatile, the big drop of 1.8% in the volume of sales back in November was worrying. A bounce is on the cards now: 0.6%.

- French CPI: Tuesday, 7:45. Contrary to Germany, consumer prices fell short of expectations in France, advancing by a mere 0.3% in December. A drop of 0.5% is forecast. Note that France also releases its consumer spending measure at the same time, but inflation figures matter more.

- Spanish CPI: Tuesday, 8:00. Spain has seen one of the worst deflation rates but similar to Germany, December saw a jump in CPI, which rose to an annual level of 1.5%. Another leap to 2.4% is expected.

- German Unemployment Change: Tuesday, 8:55. Germany enjoys a robust labor market. The number of unemployed is on a downtrend for a very long time. In November, a better than expected fall of 17K was recorded. A slide of 5K is predicted.

- CPI: Tuesday, 10:00. This is the preliminary announcement for January. In December, headline inflation continued rising to 1.1% y/y, mostly due to oil prices. The bigger surprise came from core inflation, which advanced to 0.9% y/y after many months at 0.8%. Headline inflation is expected to continue rising, reaching 1.5%, while core inflation is expected to stand at 0.9% once again.

- GDP: Tuesday, 10:00. The initial GDP measure for Q4 will have to compete with the inflation report, but clearly, has an impact on its own. The euro-zone economies grew by 0.3% in Q3 2016, mimicking the growth rate seen in Q2. This time, output is predicted to increase by 0.4%.

- Manufacturing PMIs: Wednesday morning: 8:!5 for Spain, 8:45 for Italy, the final figure for France at 8:50, final measure for Germany at 8:55 and the final number for the whole euro-zone at 9:00. According to Markit, Spain’s manufacturing sector saw healthy expansion in December, hitting a score of 55.3 points, above the 50 point threshold separating growth from contraction. 55.1 is expected now. Italy, the third-largest economy, saw a score of 53.2 points and 53.3 is predicted. The initial read for France for January stood at 53.4 points. In Germany, the score surprised with 56.5 and the euro-zone saw a preliminary estimate at 55.1 points. The final read is expected to confirm the first estimates.

- EU Economic Forecasts: Wednesday, 10:00. The European Commission publishes updated economic forecasts twice a year. An upgrade of growth and employment forecasts could boost the euro, while a downgrade could weigh on it.

- Spanish Unemployment Change: Thursday, 8:00. Spain still suffers from a sky-high unemployment rate of 18.6% according to the data for Q4. We now get an estimate of the change in the number of the unemployed during January. December was surprisingly strong, with a big drop of 86.8K. A rise of 60.2K is estimated.

- ECB Economic Bulletin: Thursday, 9:00. Two weeks after the decision which saw Draghi downing the euro with his downside risks, we get a detailed report about what the Governing Council members had in front of their eyes. This sheds some light on the internal data, but usually, does not consist of new headlines.

- Services PMIs: Friday morning: 8:!5 for Spain, 8:45 for Italy, the final figure for France at 8:50, final measure for Germany at 8:55 and the final number for the whole euro-zone at 9:00. Spain’s services sector saw a good growth rate, similar to its manufacturing sector, at 55 points in December. A slide to 54.7 is projected. Italy was behind with 52.3 points and 52.6 is projected now. The preliminary number for France in January was 53.9, above expectations. Germany had a lower level of 53.2 and the euro-zone saw a number in the middle, at 53.6 points. The initial January data will likely be confirmed.

- Retail Sales: Friday, 10:00. Despite coming out after the German release, this wide measure of the 19-country bloc still matters. The volume of sales dropped by 0.4% in November. A rise of 0.3% is on the cards.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar made a move to the upside and reached 1.0775, a line that did not appear last week.

Technical lines from top to bottom:

1.10 is the ultimate high level in current trading ranges. It is followed by 1.0950. More importantly, the swing high of 1.0870 is fierce resistance.

1.0775 is the high line seen in late January. 1.0710 is the upper resistance line on the chart after temporarily capping the pair in April 2015.

1.0650 was the bottom end of the range seen in late January. The early high of January, at 1.0615 is the next line.

1.0570 was a stepping stone on the way down. Further below, the early 2016 low of 1.0520 and the 2015 low of 1.0460 are seen.

1.0460 seems to carry more weight. Even lower, there are two significant barriers on the way to parity. The 1.0340 level was the low of 2003 before the pair advanced to higher ground.

The 101.50 level was a peak seen in 2002, on the first attempt of the pair to break above parity. And then, there is EUR/USD parity.

I am bullish on EUR/USD

Donald Trump is beginning to disappoint earlier than expected. On this background, the greenback could fall and the euro, despite Draghi’s dovishness, could advance.

Our latest podcast is titled Trumping Trade and the Donald Dollar

Follow us on Sticher or iTunes

Safe trading!