EUR/USD made a move to the upside in thin end-of-year trading, closing 2016 above 1.05. The first week of 2017 is already packed with events, with inflation and PMIs standing out. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The euro enjoyed a “flash surge” during the holiday week. Thin trading conditions and perhaps some algo activity sent it soaring before it came back down to earth. Spanish CPI for December jumped more than expected, giving us an early indication of rising inflation in 2017. In the US, consumer confidence jumped while other measures weren’t that impressive.

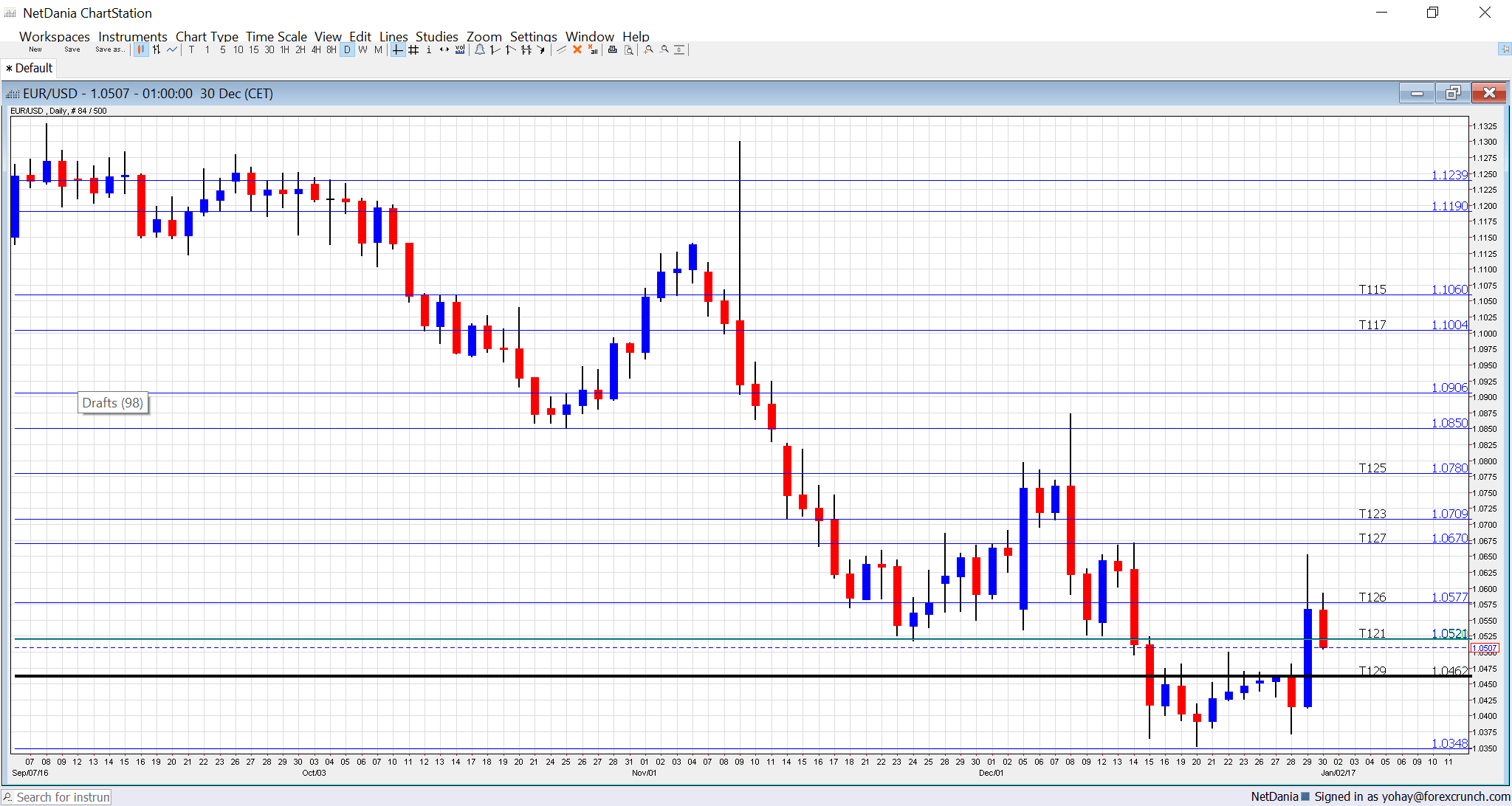

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Manufacturing PMIs: Monday morning: 8:15 for Spain, 8:45 for Italy, final figure for France at 8:50, final German number at 8:55 and the final euro-zone measure at 9:00. According to Markit, Spain saw OK growth in November, with a score of 54.5 points, above the 50 point threshold that separates growth from contraction. A score of 54.6 is now expected. Italy, the third-largest economy, saw a slower rate with 52.2 points. 52.3 is now on the cards. The initial assessment for France showed a score of 53.5 points in December. Germany enjoyed 55.5 points, and the whole euro-zone saw 54.9 points. The last three numbers will probably be confirmed.

- French CPI: Tuesday, 7:45. In November, prices stalled in Europe’s second-largest economy. A small rise could be seen in December. A rise of 0.5% is projected now.

- German Unemployment Change: Tuesday, 8:55. The strength of the German economy is reflected in the job market. A drop of 5K was seen in October. Another drop of the same scale is forecast now..

- German CPI: Tuesday, the German states release the data throughout the morning, with the final German release at 13:00. A small rise of 0.1% was seen in November. Germany’s figure has a wide impact on the euro-zone CPI.

- Spanish Unemployment Change: Wednesday, 8:00. Spain still suffers from a high, albeit improving, unemployment rate. A rise of 24.8K unemployed people was recorded in November. Employment is seasonal in Spain due to the economy’s reliance on tourism. A fall of 44.2K is estimated now.

- Service PMIs: Wednesday, morning: 8:15 for Spain, 8:45 for Italy, final figure for France at 8:50, final German number at 8:55 and the final euro-zone measure at 9:00. Markit showed that Spain enjoyed a solid growth rate in its services sector in November with a score of 55.1 points. A slide to 54.8 is expected. Italy had a lower score of 53.3 points. A score of 52.7 is predicted. According to the preliminary figures for December, France had a score of 52.6. Germany saw 53.8 points and the euro-zone had 53.1 points.

- CPI (preliminary): Wednesday, 10:00. In November, the consumer price index rose by 0.6% year over year. This has accelerated due to the diminishing effect of falling oil prices. The stable oil prices are likely to push headline inflation higher, to 1% this time. However, core inflation stood at 0.8%, for five consecutive months and no change is predicted.

- Retail PMI: Thursday, 9:10. This measure of the retail sector has shown a score of 48.6 points, under the 50 point mark separating growth and contraction. Markit will probably show a similar number now.

- PPI: Thursday, 10:00. Producer prices have risen by 0.8% in October. Yet another advance is on the cards now: 0.2%.

- ECB Meeting Minutes: Thursday, 12:30. These are minutes from the momentous meeting in which the ECB announced an extension of the QE program through 2017. The Governing Council also decided to remove a few limits, including buying of bonds with a yield under the deposit rate. On the other hand, the ECB will reduce the volume of its bond-buying scheme to 60 billion euros per month from April. The meeting minutes could reveal the need for more stimulus, hence the extension, or fewer worries about low inflation, hence the reduction of the scheme. The emphasis could have a significant impact on the common currency.

- German Factory Orders: Friday, 7:00. Germany, the continent’s locomotive, saw orders jump by 4.9% back in October. This volatile measure could slide in the read for November: a drop of 2.5%.

- German Retail Sales: Friday, 7:00. The volume of retail sales advanced by 2.4% in October. A slide of 0.8% is expected now.

- French Trade Balance: Friday, 7:45. France suffers from chronic trade deficits. In October, this deficit widened to 5.2 billion euros, the highest since 2014. A narrower deficit of 4.8 billion is projected.

- Retail Sales: Friday, 10:00. Despite being released after the German and French publications, the number is watched. A rise of 1.1% in October will probably be followed with a small drop: -0.3%.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar dipped towards the 1.0340 level (mentioned last week) before bouncing back and trading under the 1.0460 level.

Technical lines from top to bottom:

1.0710 is the upper resistance line on the chart after temporarily capping the pair in April 2015. 1.0690 is the post-Trump high. 1.0570 is the bottom of the range seen afterward.

Further below, the early 2016 low of 1.0520 and the 2015 low of 1.0460 are seen. 1.0460 seems to carry more weight.

Even lower, there are two significant barriers on the way to parity. The 1.0340 level was the low of 2003 before the pair advanced to higher ground. The 1.0150 level was a peak seen in 2002, on the first attempt of the pair to break above parity.

And then, there is EUR/USD parity.

I turn from neutral to bearish on EUR/USD

The holidays are over and 2017 is here. The monetary and fiscal divergence seen in 2016 is likely to spill over into early 2017. The ECB continues printing money while the FED is set to hike also in the new year. Also on the fiscal side, high expectations for fiscal stimulus from Trump amid a sluggish growth rate in Europe also make a difference.

Our latest podcast is titled What will move markets in 2017

Follow us on Sticher or iTunes

“‹

Safe trading!