The holiday season is characterized by thin liquidity and thin trading volume as many traders are taking some time off. During most of the time, the outcome is boring markets that move in tight ranges.

However, thin liquidity means that any surprising order can trigger big moves. When months, quarters and years draw to an end, we occasionally see last-minute portfolio adjustments. Is that what happened to EUR/USD?

Here are some lessons we can draw for trading, relevant not only in the holiday season:

Flash surge

In the last Asian session of the year, it may have been some algorithms going rogue. Nearly three months after the pound flash crash, we got a euro flash surge.

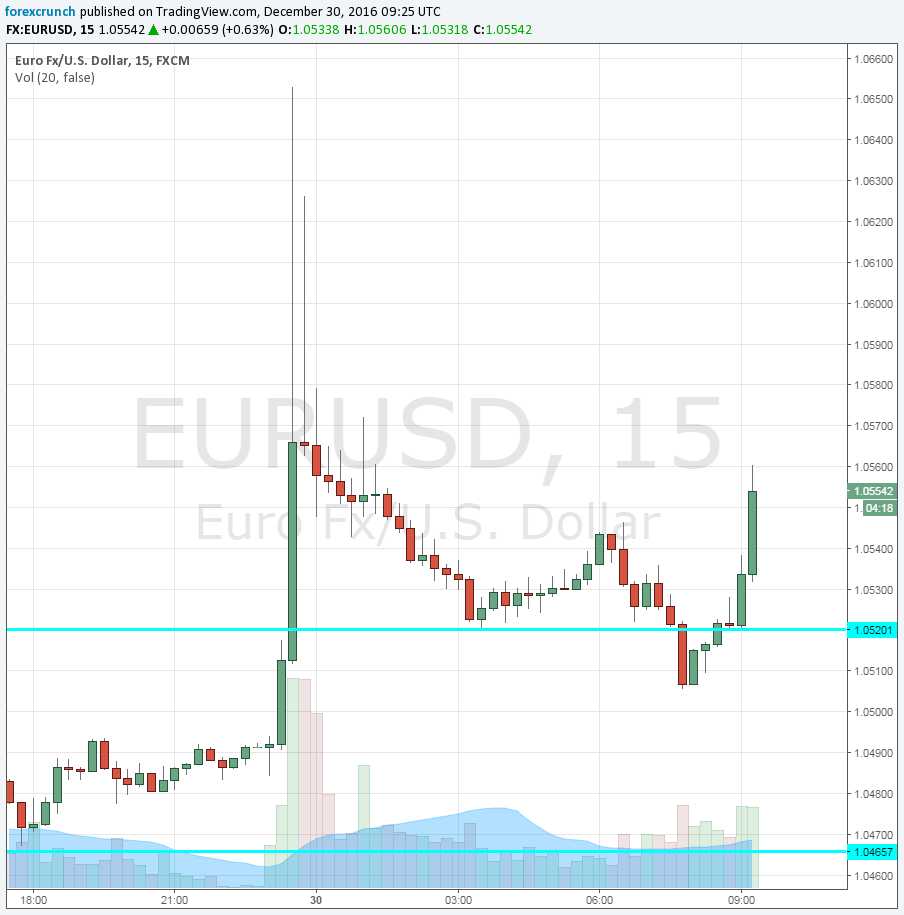

EUR/USD was moving higher, pushing above the 1.0460 resistance line in the US session of December 29th. But what happened next was not really calm. EUR/USD surged all the way to 1.0653, a leap of around 150 pips, only to settle lower afterward. The pair fell back to 1.0483. At the time of writing, euro/dollar is once again on higher ground, around 1.055, still some 100 pips of the flash highs.

Beware of tight range trading

The lesson for forex traders is that no period is really quiet. While many retail traders are waiting for breakouts, some try to take advantage of the tight and usually expected range trade, scalping a few pips within the range.

Normally, if your broker provides low spreads, a range of merely 20 pips can provide opportunities to grab 10 pips in the middle of the range. All these moves can be wiped out unless the trade is carefully planned with stop-loss orders.

Taking profit may not be feasible

For those placing orders for a breakout, this could also prove perilous. If you went long EUR/USD upon a break of 1.05, a round number, you could have enjoyed a and quick profit. However, this assumes you had your take-profit point below the high of 1.0653 seen at the peak.

But, this would have also required your broker to acknowledge that trades were really made at those high levels: if the flash move was flashy indeed, executing the TP could not have been realized.

A winning trade can be stopped out

And if you had your take-profit above that peak, the winning trade would have turned into a losing one quite quickly. Had you entered at 1.0530 with a stop-loss at 1.0495, the trade would have turned from a gain of 120 pips to a trade that was stopped out.

All in all, traders should beware the “twilight zone”: the time between the close in New York to the Asian open. And during the holiday season, perhaps enjoying the holidays and refraining from trading altogether is the best advice.

Here is how the euro flash surge of December 30 2016 looked on the 15-minute chart: