EUR/USD had an exciting week, dropping to new lows only to rally to high ground. Is it set to continue gaining or is it still looking for a direction? German business data, Eurogroup meetings, German inflation and employment data as well as the Eurozone’s unemployment rate. Here is an outlook on the major events and an updated technical analysis for EUR/USD.

Talk about deflation is still prevalent in the old continent, with the IMF warning about it again. Nevertheless, the euro seemed to focus on positive news. The euro zone’s manufacturing and services sectors surprised to the upside. Germany continued to advance, remaining well above the 50 mark. While France remained below these levels, it still beat expectations. This helped the euro advance. In the US, a disappointing housing figure was enough to give the pair another push higher. However, it closed well below the highs. Let’s start:

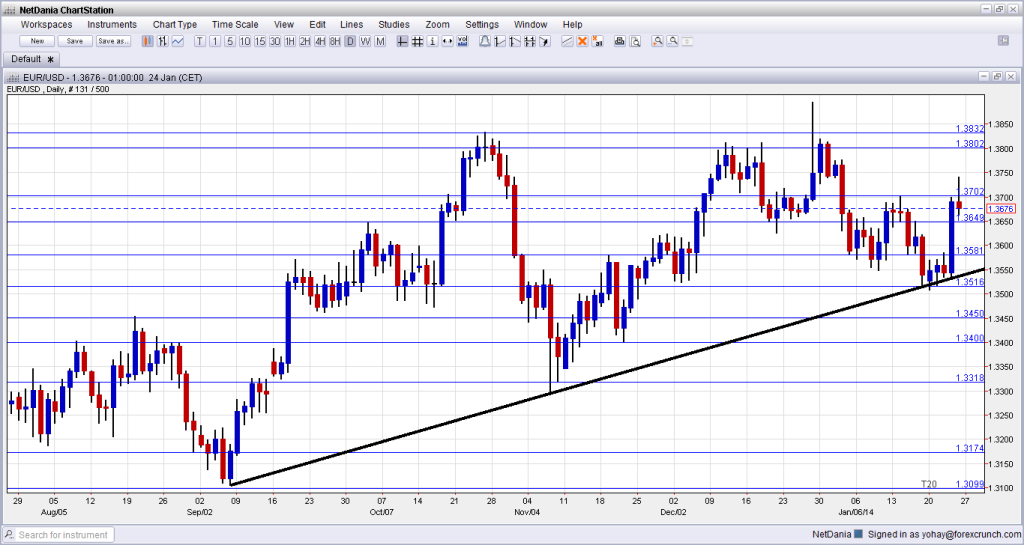

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Ifo Business Climate: Monday, 9:00. German business confidence improved mildly in December, rising to 109.5 from 109.3 in November, slightly below the 109.7 forecast. Rising optimism regarding future growth might have spurred this festive mood. A further rise to 110.2 is expected this time.

- Eurogroup meeting: Monday. The Eurogroup meeting is comprised of Finance Ministers from the Eurozone countries. It has political control over the euro and the Euro-area monetary issues. One of the issues is the next funding for Greece, which has a funding hole. The meetings take place in Brussels. The meetings will be followed by the wider full EU meetings.

- German Buba Monthly Report: Monday, 11:00. In the last Deutsche Bundesbank report the bank projected that German economy will grow in coming months due to a boost in industrial activity and in residential construction. The fourth quarter GDP is expected to expand considerably. The central bank also increased its predictions to a 1.7% growth rate in 2014 from a 1.5%rise in its earlier estimate in June. The bank also addressed the proposed financial transaction tax in parts of the European Union, saying it will harm the repo market.

- GfK German Consumer Climate: Wednesday, 7:00. Consumer sentiment in Germany climbed in December reaching 7.6 after posting 7.4 points in November. Optimism regarding future outlook, increased while producer prices continued to drop. Economists expected the index to remain at 7.4. The combination of prosperous job market as well as low inflation, spur growth in German domestic economy. Consumer sentiment is expected to climb to 7.8.

- Jens Weidmann speaks: Monday, 18:00. Deutsche Bundesbank President Jens Weidmann will speak in Germany. His institution denied the dangers of deflation, but the topic refuses to fall from the agenda.

- M3 Money Supply: Wednesday, 9:00. Eurozone’s money supply advanced in November to an annual growth rate of 1.5%, compared with 1.4% in October. Loans extended to the private sector dropped 2.3% on a yearly base in November, following a 2.2% fall in October. However, loans to households increased 0.1% annually following 0.2% rise in the previous month. A rise of 1.7% is expected now.

- German Prelim CPI: Thursday. Annual inflation in Germany increased 0.4% in December pushing annual inflation up to 1.4%, after posting 1.3% in November, The reading was in line with analysts’ expectations. The main cause for this rise was higher food prices. Inflation in Germany remains contained below the European Central Bank’s target of close to but below 2%, leaving room for accommodative monetary policy steps if required. A decline of 0.4% is forecasted this time.

- Spanish Flash GDP: Thursday, 8:00. Spain has returned to growth in the third quarter, with GDP rising 0.1% ending nine quarters of economic downturn on a quarter-to-quarter basis and the second recession since 2008. A rise in private consumption and in exports caused this rise. GDP in the second quarter contracted 0.1% reaching an annual contraction of 1.7% compared to a 2.0% decline in the previous quarter. 2013 is expected to remain in recession, due to massive unemployment, low economic output, and service sector contraction. Spain GDP is expected to gain 0.3% in the final quarter of 2013.

- German Unemployment Change: Thursday, 8:55. German unemployment declined in December by 15,000, but jobless rate remained unchanged at 6.9%, close to a record low level. In 2013 there were 2.95 million registered as unemployed, 45,000 less than in 2012 maintaining the lowest unemployment rate in the Eurozone. Germany’s strong economy and stable job market maintains robust domestic consumption and growth. Private consumption is expected to grow by 1.7% in 2014. Another decline of 5,000 in the number of unemployed is expected.

- German Retail Sales: Friday, 7:00. German retail sales, edged up by 1.5% following a 0.8% decline in the previous month. The reading was higher than the 0.5% rise anticipated by analysts, indicating strong consumer confidence. Despite the climb in November, average sales in October and November were unchanged from the third quarter. However the holiday season shopping spree is expected to contribute to retail sales growth in December. A small gain of 0.2% is expected now.

- French Consumer Spending: Friday, 7:45. French consumer spending edged up 1.4% in November due to the cold weather boosting energy consumption, however spending on other goods remained subdued. High unemployment of 10.9%, leaves no room for domestic expansion. In a separate report on third-quarter economic output, INSEE said households’ real gross disposable income fell 0.1% in the third quarter. The government expects the public debt to reach 93.4% of GDP in 2013 before peaking at 95.1% this year. A decline -0.2% is expected.

- CPI Flash Estimate: Friday, 10:00. The inflation rate In the Eurozone reached 0.8% in December following 0.9% in November. Economists expected a higher rate of 0.9%. All in all, Eurozone inflation remained below the ECB’s target of near 0.2% for the eleventh consecutive month. Core inflation ,excluding energy, food, alcohol and tobacco, weakened to 0.7% from 0.9% in November. Inflation rate is expected to reach 0.9%.

- Unemployment Rate: Friday, 10:00 Europe’s job market did not improve in November, with no change in the unemployment rate. The reading was in line with market consensus. The stubbornly high unemployment rate of 12.1% was maintained since April. The Eurozone’s recovery remains fragile in 2013 but recent data showed stronger growth in the last part of 2013 as the 1.4% rise in retail sales as well as growth in German manufacturing sector suggesting modest recovery. Furthermore, economists believe growth rate will rise 0.3% in the first quarter of 2014 which will also have an effect on the Job market condition. No change is expected this time.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started the week with a downwards move, and reached a low of 1.3508. From there it managed to recover, eventually making it up all the way to 1.3739 before closing at 1.3676..

Technical lines from top to bottom:

1.3940 was a peak in September 2011, over two years ago, and is just before the round number of 1.40. 1.3832 was the 2013 peak (excluding the post-Christmas break). The failure of the pair to get close to this line for a second time might make it a top for a long time, despite the false break.

1.38 is a round number and also worked as a temporary cap during that period of time and also in October 2013. Another round number, 1.37, is another resistance line after capping the pair in December.

1.3650 provided support in December and worked as resistance in September 2013, and is also a significant line. Below, 1.3580 worked in both direction in the winter of 2013-14.

The January 2014 low of 1.3515 provides minor support on the way down. 1.3450 worked as resistance in August 2013 and as support in September and October. The round number of 1.34 worked as resistance several times in 2013, and is strengthening now.

1.3320 worked as a double top in early September and it was crossed only with a Sunday gap. It remains a clear separator of ranges. It is followed by 1.3240, which capped the pair in April and also had a role in August. It worked as support in September.

1.3175 capped the pair during July 2013. 1.3100 is worked as temporary resistance in December 2012 and is becoming more important once again, after capping a recovery attempt in June and then in July and providing support in September.

Long term uptrend support works well

A line beginning in the lows of early September that was connected to a line in November gave support to EUR/USD. After testing the line, the pair bounced nicely higher.

I am bearish on EUR/USD

The danger of deflation still hasn’t made it to center stage, despite increased talk. The initial inflation numbers for Germany and the euro-zone could weigh on the pair and even trigger a negative deposit rate as early as March.

In the US, the FOMC is expected to announce a second taper of $10 billion. Even if this is mostly priced in, the actual announcement, coupled by solid GDP, could give the dollar a boost after the recent slide.

More:

- Forex Analysis: EUR/USD Rebounds from Key Support after Pullback

- Eurozone Turning Japanese and What it Means for the EUR

If you are interested a different way of trading currencies, check out the weekly binary options setups, including EUR/USD and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast

- For the kiwi, see the NZDUSD forecast.