EUR/USD had limited movement, but eventually closer on lower ground. Will it continue lower? A very busy calendar has GDP and inflation standing out as well as the Bank Stress Tests. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The ECB left policy unchanged and left the door open for adjustments in its policy. However, there was no clear pre-announcement of any move in September. Brexit does not seem to be huge catastrophe in the eyes of Draghi, but risks still remain to the downside. All in all, EUR/USD remained stable. The German ZEW economic sentiment went negative and reflected elevated uncertainty due to Brexit. In the US, housing figures came out OK and continued the positive trend.

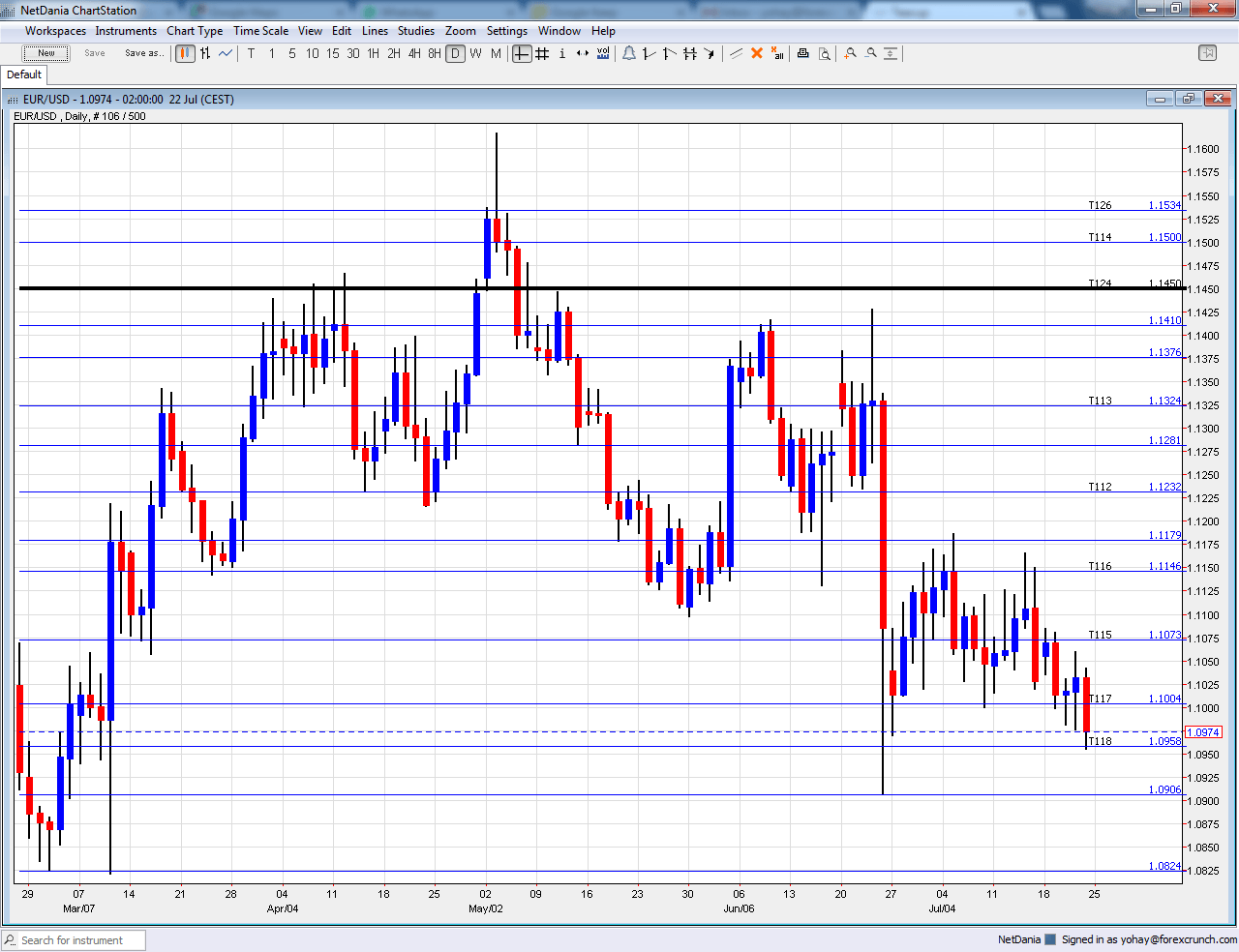

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Ifo Business Climate: Monday, 8:00. IFO is Germany’s No. 1 Think-tank and this specific report will be closely watched for the Brexit fallout. Does Brexit have a big negative impact on German business confidence like ZEW suggests? Or is it just a small slowdown? Last month, the figure stood on a healthy 108.7 points. It could slide now. 107.7 is expected.

- Belgian NBB Business Climate: Tuesday, 13:00. Despite coming from a small country, this wide survey has some influence, especially as it turned positive last month. The figure surprised with a rise to +0.7 in June, after many years of negative figures. A slip back to worsening conditions is likely. -0.7 is on the cards.

- German GfK Consumer Climate: Wednesday, 6:00. German consumers are feeling more confident, with a surprising rise to 10.1 in June. We could see a slide in this 2000 strong survey. 9.9 is predicted.

- Monetary data: Wednesday, 8:00. The ECB managed to accelerate the movement of money, but figures have not been going anywhere fast of late. The M3 Money Supply stood on an annual rate of 4.9%. Private Loans are growing 1.6% y/y. Similar paces are on the cards now: 5% in money supply and 1.7% in private loans.

- German CPI: Thursday, during the morning from the various states with the all-European number at 12:00. Prices advanced by 0.1% in June, more or less as expected. We now get the preliminary data for July, which has a big impact on the all-European number. +0.2% is expected.

- Spanish Unemployment Rate: Thursday, 7:00. The fourth largest economy in the euro-zone is exceptionally high at 21% in Q1 2016. It had already reached higher levels at the peak of the crisis. A small drop is on the cards now: 20.5%.

- German Unemployment Change: Thursday, 7:55. The continent’s largest economy enjoys low unemployment. The number of unemployed dropped by 6K last month, similar to falls seen in previous months. -3K is predicted.

- French GDP: Friday, 5:30. The second largest economy in the euro-zone enjoyed strong growth in Q1 2016: 0.6% q/q according to the final figure. A slower growth rate is on the cards now: 0.2%.

- German Retail Sales: Friday, 6:00. Consumer have been spending more in Europe’s largest economy: 0.9% rise. A flat growth rate in the volume of sales is expected.

- French Consumer Spending: Friday, 6:45. Sales in France disappointed with a drop of 0.7% last month. A bounce back is likely now but only just: 0.1%.

- Spanish GDP: Friday, 7:00. Despite high unemployment, Spain enjoys strong growth. Well, this is built on falling prices. Q1 saw a very solid growth rate of 0.8%. Perhaps a somewhat slower growth rate could be seen now: 0.7% is expected. Spain is eyed for its strong growth and a slowdown could be worrying. Note that the country will also publish preliminary CPI for July. The y/y figure for June was -0.8% and -0.5% is expected now.

- CPI Flash Estimate: Friday, 9:00. Friday, 9:00. Inflation or more correctly the lack thereof remains a big headache for the ECB. After the main countries released their figures, it is time for the all European figures. The final figures for June stood on 0.1% in the headline number and 0.9% in core inflation. A repeat of both figures is expected.

- Flash GDP: Friday, 9:00. The euro-zone grew by a very nice 0.6% rate in Q1. A slower growth rate is predicted now: 0.3% q/q. Note that this number will be revised with the German release.

- Unemployment Rate: Friday, 9:00. The unemployment level is off the highs, but still elevated, at 10.1% according to the latest read. The same figure is on the cards now.

- Bank Stress Tests: Friday, 20:00. The European Banking Authority publishes its stress test results amid growing concerns about several banks in Europe. Non-Performing Loans at Monte dei Paschi in Italy as well as other critical institutions will come under scrutiny. Draghi suggested there should be state intervention in Italy, contrary to the European stance. We will now learn how bad the situation is.The EBA clarified that it learned its lessons from past failures, such as deeming the Irish banking system resilient only to see it crash soon after in 2010.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar had a slow start to the week, around the 1.1070 level mentioned last time but never went too far.

Technical lines from top to bottom:

1.1535 is a stepping stone as seen in May 2016 and also beforehand. It is followed by the very round level of 1.15.

1.1460 was a key resistance line in 2015 and 1000 above the multi-year lows. 1.1410 capped the pair in early June. 1.1375 worked as resistance in February and as support in May 2016.

1.1335 worked as the lower bound of a higher range and then capped recovery attempts in May. 1.1230 capped the pair after the fall in May and works as resistance.

1.1175 was the low point in the mid-May fall. 1.1140 cushioned the pair in October. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0905 is the swing low seen in June and serves as weak support. 1.0825 worked as support in early March 2015 and should also be watched. This is now a triple bottom.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

Further below, the 2016 low of 1.0520 and the 2015 low of 1.0460 provide further support.

I remain bearish on EUR/USD

Draghi continues putting pressure on the euro.

Our latest podcast is titled Oil down, gold up and the upcoming Fed-fest