Business confidence tumbles down in Germany with the ZEW indicator crashing to negative ground, reflecting pessimism. This is Brexit driven. Current conditions also missed with a slide to 49.8 points. The all European figure has also gone negative with -14.7, way worse than +12.3 points expected. At the same time, At the same time, the euro-zone construction output for May also looks weak with a drop of 0.5%.

EUR/USD is not really reacting, not yet. The IFO figure will be eyed for confirmation.

Germany ´s ZEW Economic Sentiment was expected to be slashed to 9 points in July after 19.2 in June, a drop related to Brexit. The Current Conditions component carried expectations for a drop from 54.5 to 51.8 points.

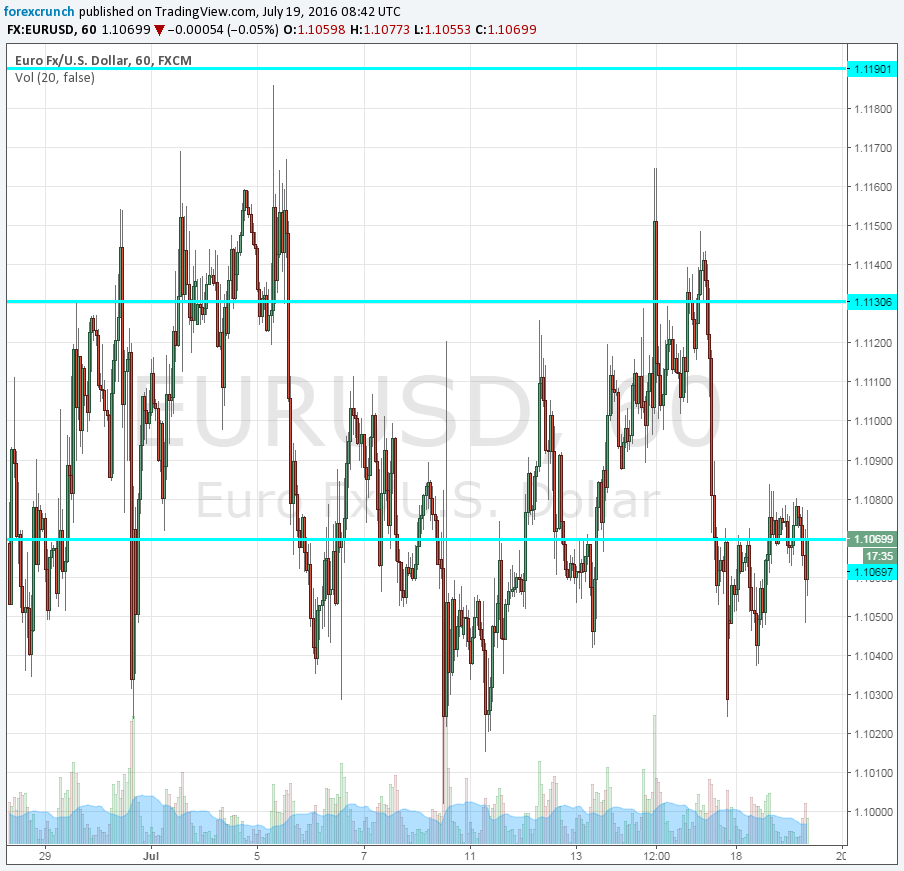

EUR/USD was frustratingly stable at 1.1070, hardly moving for long days.

The big event of the week is the rate decision of the European Central Bank on Thursday. Mario Draghi and his colleagues are not expected to change policy, but they have a long list of issues on the agenda: Brexit, Italy’s banks and low inflation.

More: Dollar strengthening should weaken the EUR over short to medium term