EUR/USD was under pressure as the dollar enjoyed some gains. However, the pair managed to recapture the losses. What’s next? The last week of June features an important German survey and key inflation data. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

According to some reports, Draghi will wait for longer before revealing plans about QE tapering. If correct, we will be kept in the dark until after the German elections in September. This hurt the euro. Euro-zone PMIs continued showing an ongoing growth but did not beat expectations. In the US, some Fed officials echoed the hawkish sentiment of the recent rate decision, keeping the dollar bid, but others expressed worries about inflation.

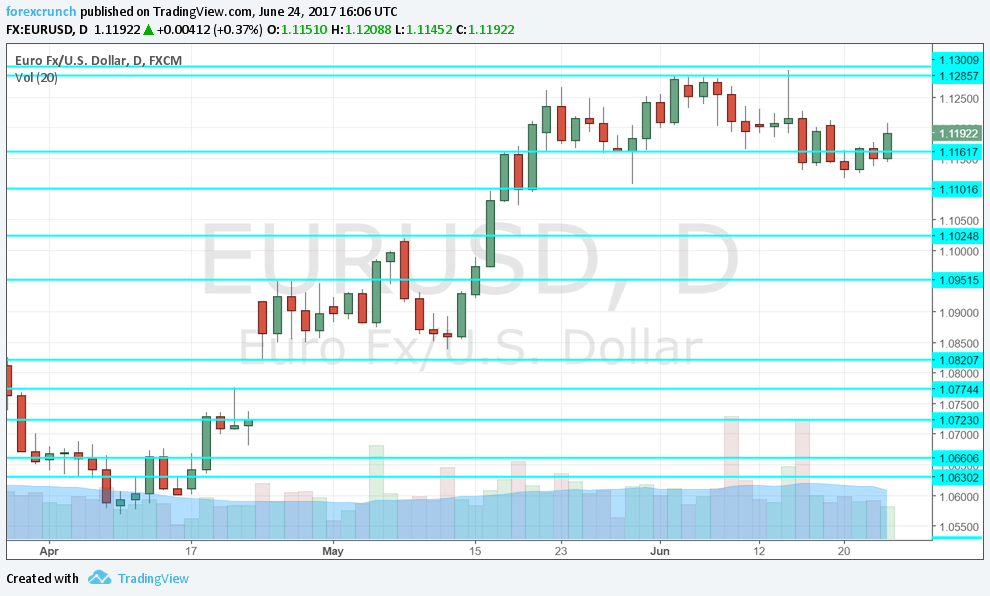

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Ifo Business Climate: Monday, 8:00. Germany’s No. 1 Think-tank has a significant influence. In the past four months, IFO’s readings beat expectations, reaching 114.6 points in May. While the parallel figure from ZEW fell short, we can expect an upbeat result from IFO. A small increase to 114.7 is on the cards.

- Mario Draghi talks: Monday, 17:30 and Tuesday at 8:00. The president of the ECB participates in an event in Sintra, Portugal. Amid reports that the announcement about QE tapering will have to wait for a long time, Draghi could provide clarifications. If he expressed worries about inflation, it will help keep the euro in check as well. If he focuses on strong growth, the euro could rise.

- German Import Prices: Wednesday, 6:00. Prices of imported goods, such as oil, feed into consumer prices. After a drop of 0.1% in April, a slide of 0.5% is predicted for May.

- Monetary data: Wednesday, 8:00. The M3 Money Supply advanced by 4.9% on a yearly basis in April, around the previous levels. A small acceleration to 5% is estimated. Private loans remained at a growth rate of 2.4% with 2.5% forecast now. The ECB’s monetary stimulus helps in accelerating growth in these figures.

- Italian CPI: Wednesday, 9:00. The third-largest economy in the eurozone saw prices slipping by 0.2% in the month of May, as expected. A bounce is on the cards now: 0.1%.

- Central bankers panel: Wednesday, 13:30. Four governors will participate in a panel at Sintra: the ECB’s Mario Draghi, the BOE’s Mark Carney, the BOJ’s Haruhiko Kuroda and the BOC’s Stephen Poloz all talk at one event. While some of them will have had separate events to talk at, this will be an opportunity to tackle worries about inflation all at once.

- German GfK Consumer Climate: Thursday, 6:00. Consumer confidence reached a post-crisis high of 10.4 points in May, reflecting the strength of the German economy as well as optimism for the future. Can it continue rising? A repeat of the same score of 10.4 is projected.

- Spanish CPI: Thursday, 7:00. The fourth-largest economy had already seen inflation at 3% y/y but this has cooled down. CPI dropped to 1.9% y/y in May. Yet another slide to 1.6% is now projected.

- German CPI: Thursday: German States release the data throughout the morning, and the all-German number is at 12:00. As the largest economy in the euro-zone, changes in German prices have the strongest weight in the all-European data. Month over month, CPI dropped by 0.2% in May. A flat 0% is predicted now.

- French CPI: Friday, 6:45. The second-largest economy begins the series of preliminary inflation reads before the all-European number on Friday. Back in May, the final read of French CPI eventually came out flat on a monthly basis, falling short of expectations. Prices are expected to remain unchanged also in June.

- German retail sales: Friday, 6:00. Consumers in Europe’s largest economy disappointed economists’ expectations in April by spending less: a drop of 0.2% in the volume of sales. A rise 0.3% is expected now.

- French Consumer Spending: Friday, 6:45. French consumers increased their spending by 0.5% in April. The rise was lower than expected. We now get the data for May which is projected to show another 0.5% rise.

- German Unemployment Change: Friday, 7:55. Germany enjoys a growing economy and falling unemployment. The number of the unemployed fell by 9K in April. The data for May is expected to show a similar drop, this time of 10K.

- CPI: Friday, 9:00. The culmination of all the euro-zone figures come on Friday when we will also get core inflation, which disappointed in May by falling to 0.9%. An uptick to 1% is predicted. Headline inflation stood at 1.4% and here, a slide to 1.3% is projected.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar was on the back foot, slipping towards the 1.11 level mentioned last week.

Technical lines from top to bottom:

1.1420 was a high back in the summer of 2016. 1.1360 capped the pair in September.

1.13 is the top line seen in November before the collapse. 1.1230 capped the pair in June.

1.1160 was a low point in May, where the pair retreated to after hitting new highs. The round number of 1.11 was a siwng low in late May.

1.1025 was the intial top after the pair breached 1.10 and now works as support. 1.0950 is close by, and the most recent 2017 high.

The swing high of 1.0870 is the swing high in December and remains fierce resistance. 1.0820 was the post-French elections low.

1.0775 capped the pair in January and remains of importance. 1.0720 was also high in January.

I turn from neutral to bullish on EUR/USD

The period of consolidation may have reached an end. The hawkishness of the Fed is already priced in and reality could bite. In the euro-zone, the economy looks good, politics look good and Draghi will eventually have to taper. He cannot delay things forever.

Our latest podcast is titled Fed faking it until they make it? + a Brexit brawl

Follow us on Sticher or iTunes

Safe trading!