EUR/USD dropped to lower ground with the greenback doing most of the work. PMIs and two German surveys stand out. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The Fed meeting minutes put a June rate hike firmly on the table and this was clearly felt in EUR/USD. Data was also OK, with inflation looking relatively solid, especially when compared to the euro-zone. As expected, core euro area inflation was downgraded to 0.7% for April. Is there more to this downtrend or just a mean reversion?

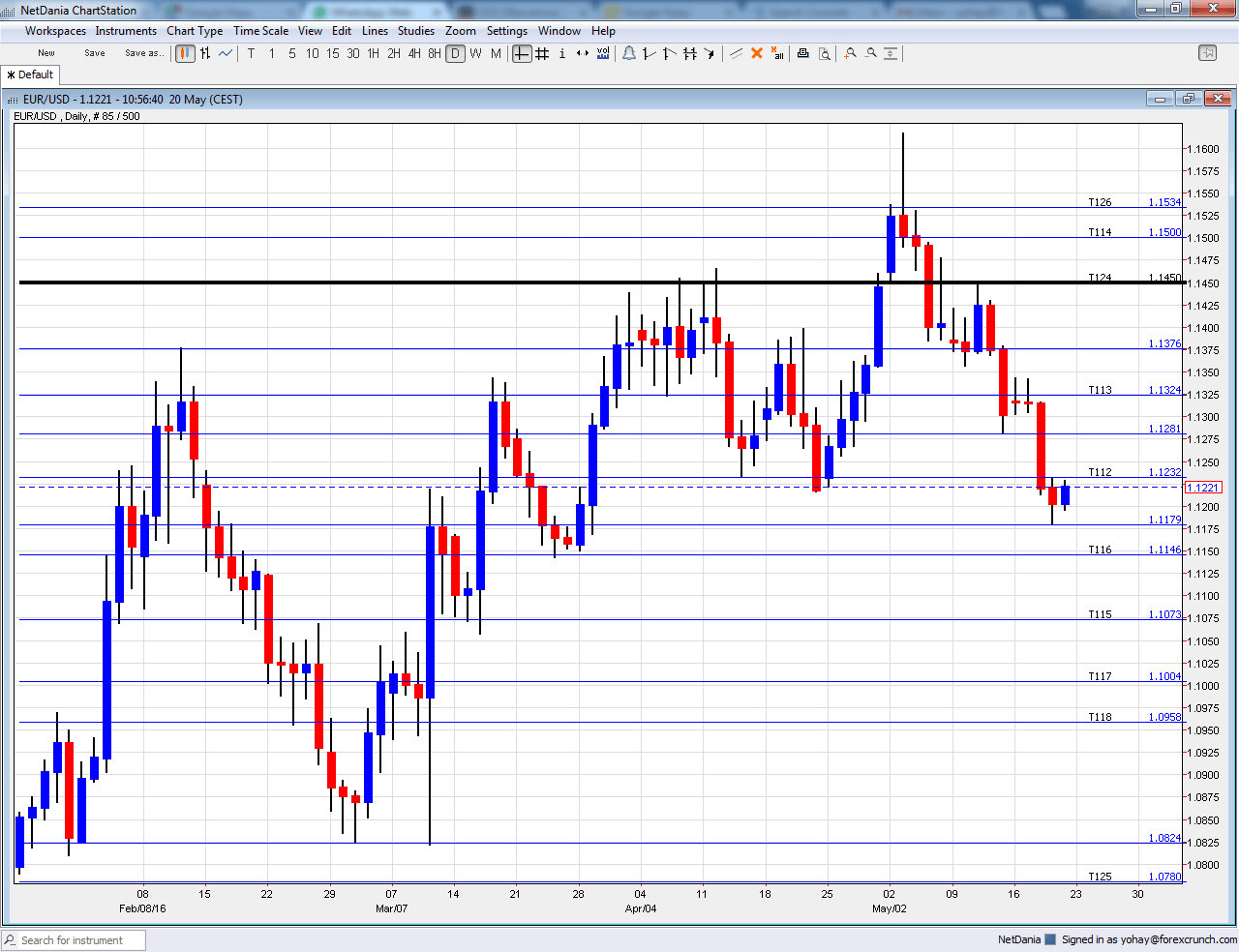

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Flash PMIs: Monday: 7:00 for France, 7:30 for Germany and 8:00 for the whole euro-zone. Markit releases the preliminary purchasing managers’ indices for May. In France, the final manufacturing PMI for April stood on 48 points, under the 50 point threshold separating growth and contraction. A rise to 49 points is on the cards. The services sector did better with 50.6 points and is now predicted to tick up to 50.8. In Germany, the continent’s powerhouse, manufacturing was in growth territory in April with 51.8 points. A small rise to 52.1 is on the cards. The services sector looked better with 54.5 points and a move to 54.6 is expected.. For the whole euro-zone, manufacturing stood on 51.7 and services were at 53.1 points. Advances to 51.9 and 53.3 for manufacturing and services are expected respectively.

- Consumer Confidence: Monday, 14:00. In April, confidence improved with a rise to -9 points. This is still in negative territory and may remain around these levels also in May.

- Eurogroup meetings: Tuesday. Two weeks after the Eurogroup decided to begin talking about Greece’s debt, the sides meet again. The IMF, one of Greece’s creditors, has published an offer for debt relief, basically postponing payments to 2040 and spreading them out until 2080. The suggestion also includes measures for the shorter term. Will Germany agree to some debt relief? That was a big sticking point in negotiations so far. There is also a good chance that they will decide to decide only after the EU Referendum in Britain, kick the can further down the road.

- German GDP (final): Tuesday, 6:00. According to the preliminary release, the German economy grew by 0.7% in Q1 2016, much better than in previous quarters. This will likely be confirmed now.

- German ZEW Economic Sentiment: Tuesday, 9:00. This survey has shown improving sentiment in Germany, with the main indicator surprising with 11.2 points in April. The fresh figure for May could be slightly better with 12.1 points. The all-European figure stood on 21.5 points and 23.4 is on the cards.

- German GfK Consumer Climate: Wednesday, 6:00. This survey has shown improvement also among consumers, with a rise to 9.6 points in April. The 2000 strong survey could show the same score also now.

- German Ifo Business Climate: Wednesday, 8:00. Contrary to ZEW, Germany’s No. 1 Think-Tank has shown a deterioration in sentiment, with business climate reaching 106.6 in April. A rise to 106.9 is predicted.

- ECB Financial Stability Review: Thursday, 8:00. This report, published only twice a year, offers the European Central Bank an opportunity not only to talk about financial stability within the European institutions but also a broader view on the economy.

- Belgian NBB Business Climate: Friday, 13:00. Despite coming from a small country, this survey of 6000 businesses is considered a barometer for the wider European economy. It dropped to -2.4 points in April, rising but still in negative territory. A move to -1.8 is on the cards.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar held its head under 1.1335 (mentioned last week) before dropping to much lower ground under 1.12.

Technical lines from top to bottom:

1.1712 was the high point in August 2015 and remains high in the sky. The May 2016 high of 1.616 is certainly worth watching.

1.1535 is a stepping stone as seen in May 2016 and also beforehand. It is followed by the very round level of 1.15.

1.1460 was a key resistance line in 2015 and 1000 above the multi-year lows. 1.1375 worked as resistance in February and as support in May 2016.

1.1335 worked as the lower bound of a higher range and then capped recovery attempts in May. 1.1230 capped the pair after the fall in May and works as resistance.

1.1175 was the low point in the mid-May fall. 1.1140 cushioned the pair in October. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0960, which worked in the past as resistance, provided a cushion for the pair in February. 1.0825 worked as support in early March 2015 and should also be watched. This is now a triple bottom.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

I remain bearish on EUR/USD

The Fed gave another boost to the dollar and this overshadows the weakness in the euro. This could be seen now and the pair could fall from the euro side of the equation.

In our latest podcast we examine the road to a June hike (or not)