EUR/USD traded in well known ranges throughout most of the week, leaning lower towards the end. Inflation figures and the ECB’s meeting minutes stand out. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The Eurogroup reported progress but basically kicked the can down the road on the umpteenth round of the Greek crisis. Strong German GDP was not enough to help the euro against the greenback’s strength. In the US, retail sales beat expectations quite impressively and other figures did not stand in the way of general dollar strength that prevailed throughout the week. Are we at the beginning of a downtrend?

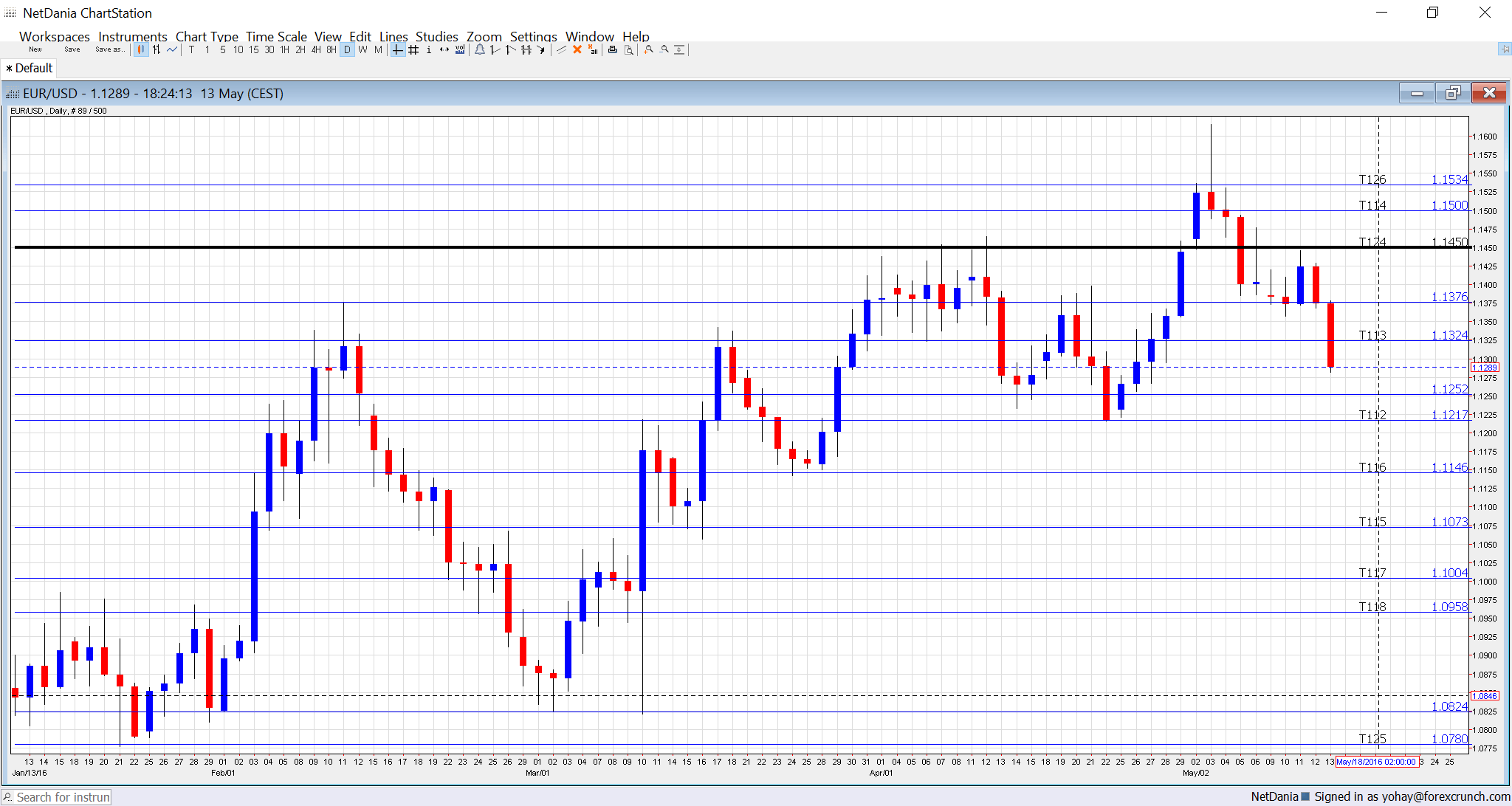

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Trade Balance: Tuesday, 9:00. The euro-zone enjoys a big surplus, mostly driven by German exports. As we already had a positive surprise in Germany, a rise from last month’s 20.2 billion is on the cards this time: 23.1 billion. Note that the surplus is a result of lower imports rather than elevated exports.

- Bundesbank monthly report: Tuesday, 10:00. The German central bank publishes its assessment about the economy. Despite strong growth in Q1, many see a slowdown in the continent’s locomotive in Q2. Will the team led by Weidmann paint a darker picture?

- Final CPI: Wednesday, 9:00. According to the preliminary publication for April, inflation remains quite depressed. a drop of 0.2% was recorded in prices. Core inflation is positive but also very far from the ECB’s “2% or a bit below” target, at 0.8%. Headline inflation is expected to be confirmed while core inflation could be downgraded to 0.7%.

- Current Account: Thursday, 8:00. Similar to the narrower trade balance figure, also the current account is positive, standing at 19 billion last in February. A wider surplus is likely in March: 19.6 billion.

- ECB Meeting Minutes: Thursday, 11:30. These are minutes from the April decision, one in which policy was left unchanged. While the door to further cuts remains open, the ECB seems to be in a “wait and see” mode and asks governments to do more. The minutes could reveal the divide within the Governing Council regarding future moves and if there was any kind of mention of so-called “helicopter money”. Draghi denied it in the press conference, but just denying it means mentioning it and keeping the idea afloat. It will also be interesting to see how the ECB sees the economic prospects after they said conditions have improved last time.

- German PPI: Friday, 6:00. Producer prices feed into the overall inflation picture, into consumer prices. Prices were unchanged last time, and could perhaps rise due to higher oil prices. +0.2% is expected.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar traded in a relatively narrow range throughout most of the week, with a failed attempt to rise above 1.1460 (mentioned last week).

Technical lines from top to bottom:

1.1712 was the high point in August 2015 and remains high in the sky. The May 2016 high of 1.616 is certainly worth watching.

1.1535 is a stepping stone as seen in May 2016 and also beforehand. It is followed by the very round level of 1.15.

1.1460 was a key resistance line in 2015 and 1000 above the multi-year lows. 1.1375 worked as resistance in February and as support in May 2016.

1.1325 served as support in late March and early April. It is followed by the swing low of 1.1220 in September which is minor resistance now.

1.1140 cushioned the pair in October. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0960, which worked in the past as resistance, provided a cushion for the pair in February. 1.0825 worked as support in early March 2015 and should also be watched. This is now a triple bottom.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

I remain bearish on EUR/USD

The dollar took the reins in markets, despite worrying signs from the US economy. On the other side of the Atlantic, the euro no longer enjoys a safe haven status and feels the weight of the greenback.

In our latest podcast we examine the upbeat US consumer and oil prices