EUR/USD looked for a new direction after the big blows eventually closing around the same levels. Final PMIs dominate the first week of November. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Germany’s IFO data came out a bit mixed when looking at the different components, but inflation is on the rise. The debate in the ECB is raging on. In the US, a hint about a December hike from the Fed sent the pair falling and dipping under 1.09, but also in the US, things aren’t that clear, especially as growth is weak. It’s going to get even busier.

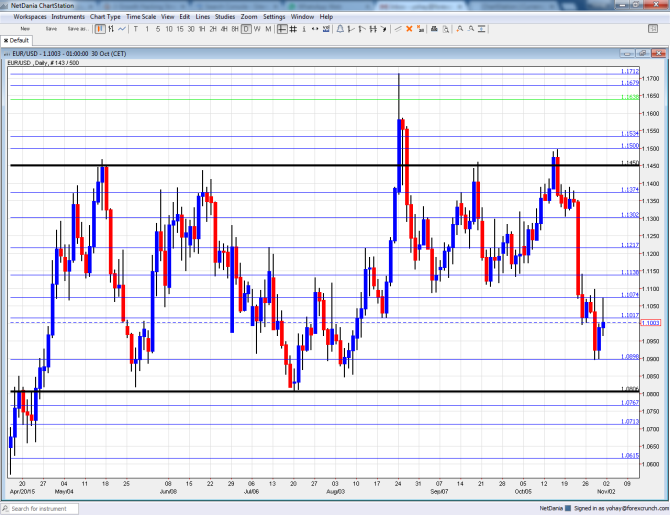

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Manufacturing PMIs: Monday: Spain at 8:15, Italy at 8:45, the final French number at 8:50, the final German number at 8:55 and the final euro-zone figure at 9:00. In September, Markit reported a drop in Spain’s manufacturing purchasing managers’ index to only 51.7 points. A small rise to 51.9 is expected. Italy, the third largest economy, saw 52.7 points and also here, an advance to 52.9 is on the cards. Both figures reflect growth – above 50 points. The preliminary figure for France in October stood on 50.7 points. Germany, the largest economy in the continent, saw 51.6 points and the whole euro-zone’s first estimate stood on 52. The final numbers are expected to confirm the initial reads.

- Spanish Unemployment Change: Tuesday, 8:00. The zone’s fourth largest economy has seen significant advance in its labor market. The monthly changes in unemployment are volatile and depend on seasonality in tourism, but still have an impact. In September, a rise of 26.2K unemployed was recorded. A bigger rise to 70.3K is on the cards.

- Mario Draghi talks: Tuesday at 19:00, Wednesday at 9:00 and Thursday at 11:45. The president of the ECB hit the euro hard in the recent rate decision and then repeated this stance in a weekend interview. In his three public appearances, the most important one on Wednesday, he may relate to the upbeat inflation figures and perhaps to the exchange rate. Will he provide more details about the tools he wants to use in December? He almost always moves markets.

- Services PMIs: Wednesday: Spain at 8:15, Italy at 8:45, the final French number at 8:50, the final German number at 8:55 and the final euro-zone figure at 9:00. In September, Spain’s services sector saw robust growth according to Markit: 55.1 points. 55.5 is expected now. Italy was behind with 53.3. In October and 53.7 is now predicted, France was somewhat behind with 52.3 points but Germany surprised according to the initial figure with 55.2 points. The whole euro-zone saw 54.2 points in the first read for October. The last three figures are expected to be confirmed.

- PPI: Wednesday, 10:00. Producer prices eventually reach the consumer and they continue falling. In August, a drop of 0.8% was seen. A smaller drop of 0.4% is expected.

- German Factory Orders: Thursday, 7:00. The level of orders dropped in the summer months of July and August, with a slide of 1.8% in August, below expectations. Did September see a rise? +1.1% is predicted.

- ECB Economic Bulletin: Thursday, 9:00. Two weeks after Draghi’s drama, we will get to see the data that ECB members had before their eyes, and how worrying it really was.

- Retail PMI: Thursday, 9:10. In the past 5 months, the retail sector has seen growth according to Markit. A similar figure is on the cards.

- EU Economic Forecasts: Thursday, 10:00. Once a quarter, the European Commission updates its estimates about growth. Will they continue seeing steady growth or are downgrades expected following the Chinese slowdown? This is an open question.

- Retail Sales: Thursday, 10:00. While the data is released after similar figures have already been published by Germany and France, the data is of importance. Sales were flat in August. A rise of 0.2% is predicted.

- German Industrial Production: Friday, 7:00. Industrial output, like factory orders, dropped in August. We may see a rise in September after Augsut’s fall of 1.2%. A rise of 0.6% is on the cards.

- French Trade Balance: Friday, 7:45. The zone’s second largest economy is experiencing somewhat narrower trade deficits in recent months. The number stood on -3 billion in August. A similar deficit of 3.1 billion is forecast.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started the trading week with a bounce from the round 1.10 level (mentioned last week). After dropping to 1.09 and rising to 1.1070 before closing bang on 1.10.

Live chart of EUR/USD: [do action=”tradingviews” pair=”EURUSD” interval=”60″/]

Technical lines from top to bottom:

We start from lower ground this time. 1.1680 capped the pair in January on its way down. The next line is a clear separator of ranges: 1.1535. It was last seen in January as well.

The very round 1.15 level is of importance thanks to its psychological role. It is closely followed by 1.1460 that served as resistance earlier in the year, twice.

The historic line of 1.1373 (from November 2003) still has a role as resistance, but it is certainly weakening. 1.13, the round number, showed its strength in capping a recovery attempt in early September.

1.1215, which capped the pair both in June and in August is clear resistance. The post Draghi rise to 1.1130 is also a line to watch.

1.1070 is a double top in October and is the next line. 1.10 is a pivotal line in the range but not so much as support or resistance.

1.09, which was a support line in October, is the next support line. 1.0810, which was the bottom in July also nicely coincides with the low seen in May is strong support..

The next line is 1.0760, which was the low point in both July and August 2003. 1.0715 joins the chart after temporarily capping the pair in April 2015.

Below, the 12 year low of 1.0460 is the last line in the sand before parity.

I remain bearish on EUR/USD

Monetary policy divergence just became clearer with the Fed’s intention to raise rates in December. In the euro-zone, we will probably hear more from Draghi and that will likely be euro negative. The small rise in inflation is not a game changer and the weakness in the German industry could certainly hurt.

In our latest podcast we explain why the Fed doves cry, the Chinese economy and upcoming events:

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast

- For the kiwi, see the NZDUSD forecast.