EUR/USD extended its range to the downside in a choppy week. PMIs, another German survey and inflation data will be watched. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Euro-zone inflation edged up, but the euro didn’t really react. Draghi took advantage of his public appearance to weigh on the euro and also the meeting minutes of the ECB continue paving the way for more monetary stimulus. On the other side of the Atlantic, the minutes from the Fed, did not tell us anything we didn’t know: they indeed wanted to tell us that a hike is on the table for December, as we correctly understood. Data in the US was OK, with core inflation remaining at 1.9%.

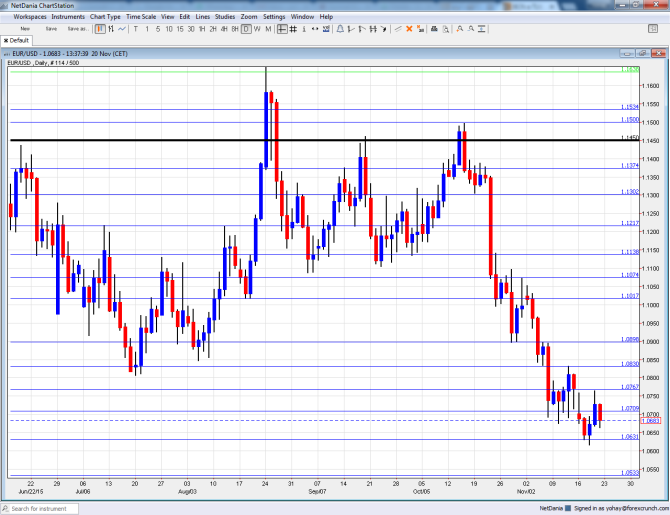

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Flash PMIs: Monday: 8:00 for France, 8:30 for Germany and 9:00 for the whole euro-zone. These are preliminary figures for November. The final figures for October showed that the French manufacturing sector was expanding very moderately: a score of 50.6 points, just above the 50 point level separating growth and contraction. The services sector did better with 52.7 points. Manufacturing is expected to remain at 50.6 while services is predicted to slide to 52.1 points. Germany, the zone’s largest economy saw the manufacturing PMI at 52.1 and services at 54.5 points. The manufacturing number, which is the most important figure out of all 6, carries expectations for 52.2 and services are expected to slide to 54.3 points. For the whole euro-zone, the numbers stood on 52.3 and 54.1 points for manufacturing and services respectively. No material changes are predicted.

- German GDP: Tuesday, 7:00. The initial read for the German economy showed a growth rate of 0.3%, slower than Q2. The final number will likely confirm that.

- German Ifo Business Climate: Tuesday, 9:00. The No. 1 Think Tank carries a lot of weight as it has a very wide survey. In October, it showed a small slide to 108.2 points. Will we see the impact of the Paris Attacks as well as the VW? According to forecasts, not so fast, with 108.3 being the consensus.

- Belgian NBB Business Climate: Tuesday, 14:00. Belgium is a small country, but in the heart of the euro-zone. In October, it came out better than expected at -4 points, yet still at negative ground. An advance to -3.2 is on the cards.

- ECB Monetary Data: Thursday, 9:00. The ECB’s monetary easing has been bearing fruit with more money in circulation and a revival of growth in private loans. However, after topping 5%, it slipped. In September, M3 Money Supply it stood on 4.9% and is not expected to change. Private loans rose by 1.1% and a tick up to 1.2% is on the cards.

- German GfK Consumer Climate: Thursday, 12:00. Consumer confidence has been sliding from the highs in the past few months. In October, it stood on 9.4 points. A drop to 9.2 is likely.

- German Import Prices: Friday, 7:00. Mostly due to oil prices, import prices have been falling in the past 4 months. In September it fell by 0.7%. A slide of -0.1% is predicted.

- French Consumer Spending: Friday, 7:45. The second largest economy in the euro-zone saw no change in spending in September. An advance of 0.2% is on the cards.

- Spanish Flash CPI: Friday, 8:00. The fourth largest economy in the euro-zone saw prices falling 0.7% y/y in October. We will now see the preliminary figure for November which carries expectations of -0.5%.

- ECB Financial Stability Review: Friday, 11:00. This twice yearly report focuses on the financial system, but can certainly slide towards risks to that stability coming from deflation, growth and other economic factors that are related to monetary policy.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started the week with a gap lower but certainly remained within lines seen last week. It found support at 1.0630 and only temporarily dipped below the level. 1.0760 served nicely as resistance.

Live chart of EUR/USD: [do action=”tradingviews” pair=”EURUSD” interval=”60″/]

Technical lines from top to bottom:

We start from lower ground this time. 1.1070 is a double top in October and is the next line. 1.10 is a pivotal line in the range but not so much as support or resistance.

1.09, which was a support line in October, is the next support line. 1.0830 was a post slide high seen in November and also a range separator..

The next line is 1.0790, a minor line in the range. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

1.0630 worked as nice support in November 2015 and is the last line before plunging to 1.0530, that supported the pair in April.

Below, the 12 year low of 1.0460 seen in March is the last line in the sand before parity.

I remain bearish on EUR/USD

With the Fed and the ECB reaffirming the monetary policy divergence, and just a small drop in the past week, there is room for more drops. The data this week, especially from Germany, could add fuel to the fire.

Our latest podcast is titled Between Terror and Thanksgiving:

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast

- For the kiwi, see the NZDUSD forecast.