EUR/USD was under pressure once again, dropping for the second week in a row. The upcoming week’s highlight is a speech by Mario Draghi. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The euro suffered from the Catalan crisis. The Spanish government cracked down on a referendum it deemed illegal. The stand-off continues. In addition, dovish comments from the ECB weighed on the common currency. In the US, data has been mostly positive. The NFP was distorted due to the hurricanes but still consisted of higher wages. The odds for a rate hike in December remain very high.

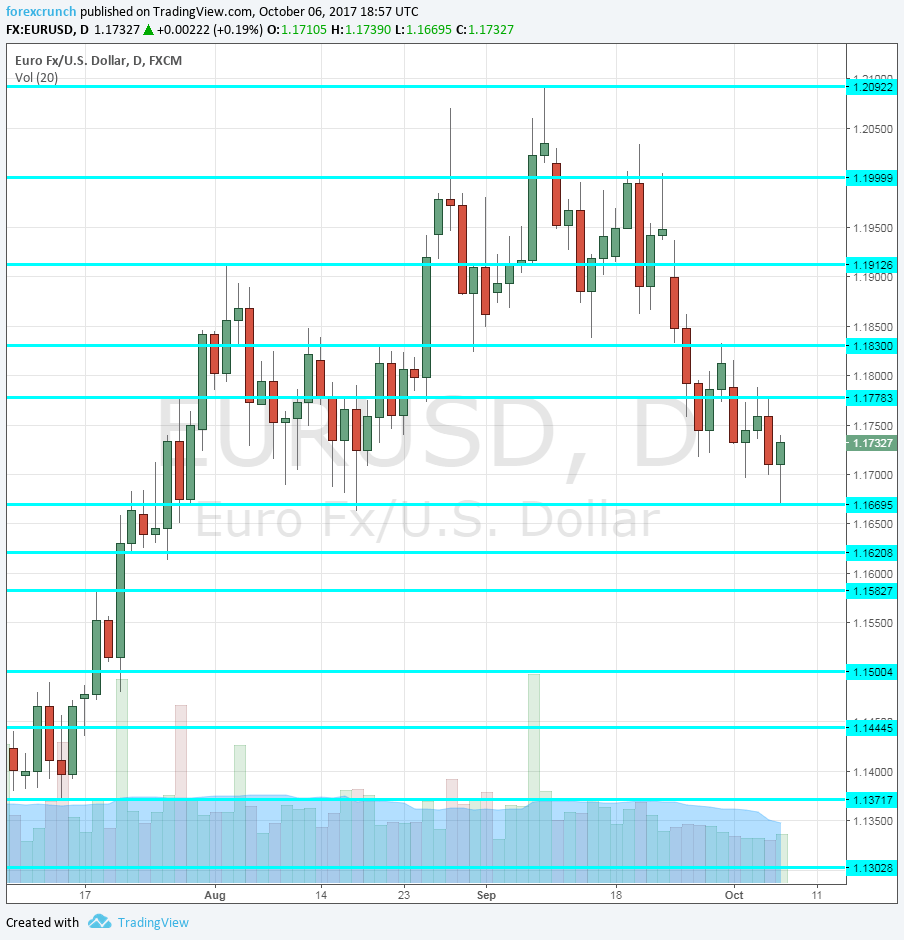

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- German Industrial Production: Monday, 6:00. Germany saw its industrial output stall in July, falling short of expectations. The euro-zone’s locomotive is now expected to enjoy an increase of 0.9%.

- Sentix Investor Confidence: Monday, 8:30. This 2800 strong survey has stabilized on high ground in recent months. Back in September, it reached 28.2 points. Another small rise to 28.6 is on the cards for October.

- German Trade Balance: Tuesday, 6:00. German exports keep its trade balance positive. In July, the country recorded a surplus of 19.5 billion, slightly below expectations. A surplus of 20.1 billion is expected now.

- French Industrial Production: Tuesday, 6:45. The second-largest economy in the euro-zone saw its industrial output rise by 0.5% in July. The same rate is expected now.

- French CPI (final): Thursday, 6:45. This is the final read for September. The drop of 0.1% that was originally reported will likely be confirmed in the final read.

- Industrial Production: Thursday, 9:00. The euro-zone saw a modest growth in in its industrial production in July: 0.1%. A higher growth rate of 0.6% is on the cards now, but it is important to note that expectations may change after both Germany and France release their own numbers.

- Mario Draghi talks: Thursday, 14:15. The President of the European Central Bank will participate in a panel in Washington. Draghi has an opportunity to hint about the upcoming ECB meeting, where a decision on reducing QE is expected. In early September, Draghi complained about the exchange rate, over and over again. While the markets ignored him at the time, EUR/USD is some 300 pips lower since then. Will he lower his tone about the euro? He may also be asked about the latest political developments, but will probably dodge these questions.

- German CPI (final): Friday, 6:00.Germany reported a small rise in price in September, 0.1%. The final read will likely confirm the initial one.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar dropped with a weekend gap once again, but it was quickly closed this time. However, the pair dropped, later on, losing the 1.1780 level mentioned last week.

Technical lines from top to bottom:

1.2240 is a high line from 2014. The cycle high of 1.2090 looms above.

1.20 is the obvious round level and also worked as resistance in September. 1.1830 capped the pair in August and in October while working as support in September.

1.1780 served as a cushion for the pair during the month of August. 1.1670 was a swing low in October.

1.1580 was a stepping stone for the pair on the way up in July 2017. It is followed by the round number of 1.15.

1.1445 is the June 2017 peak and immediate resistance. 1.1390 is the post-breakout low and works as support.

1.13 is the top line seen in November before the collapse. 1.1230 capped the pair in June.

I am bearish on EUR/USD

The Catalan crisis could get worse before it gets better and if things get worse, the euro will feel it in a stronger manner. Draghi could keep the pressure on the common currency as well. In the US, the Fed seems to see the glass half full and ignores lower inflation.

Our latest podcast is titled Good, bad and ugly NFP, Catalan crisis update

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!