EUR/USD tumbled down, mostly on the German elections. Has the pair changed its course or is it only a correction? The first week of Q4 features the ECB meeting minutes and PMIs among other events. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Germany’s elections resulted in a significant fall for the mainstream parties and a prolonged period of coalition talks. Merkel is expected to preside over the next government, but her new government may refrain from embracing significant reforms for the euro-zone. This certainly hurt the euro, which gapped lower and extended its falls. Weaker inflation in the euro-zone could result in a slower pace of QE tapering and also weigh on the euro. In the US, hopes for a massive tax reform gave a boost to the dollar, but the devil may be in the details. US economic data has been mostly positive, with a small upgrade to Q2 GDP.

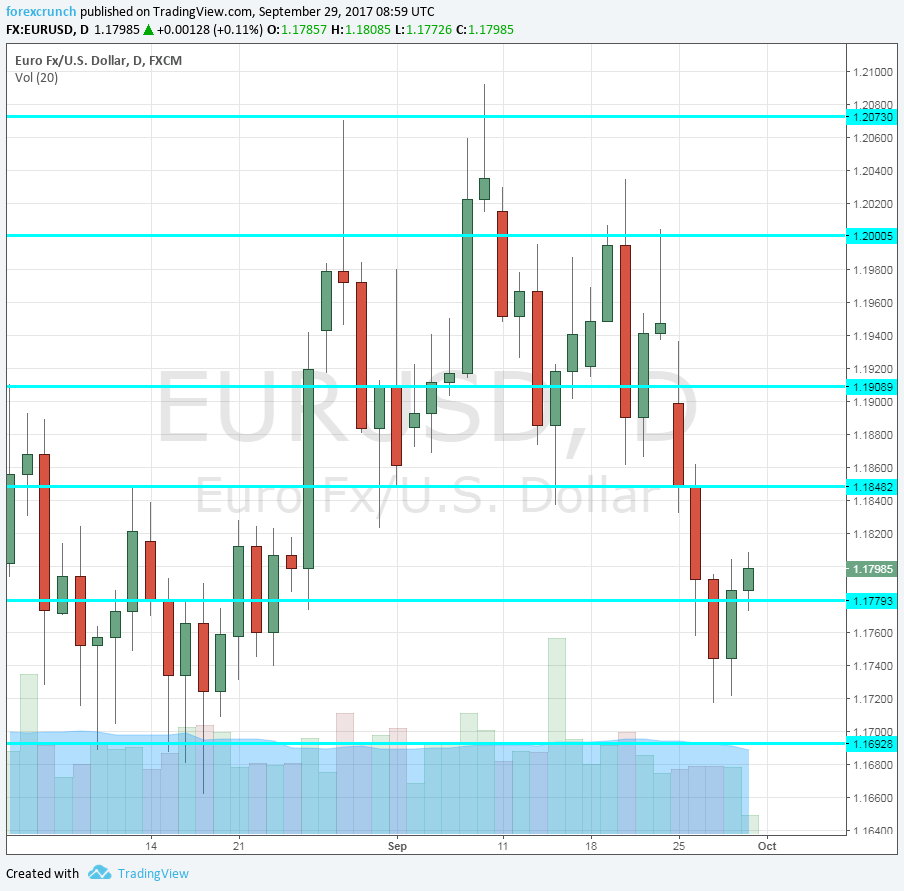

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Manufacturing PMIs: Monday morning: 7:15 for Spain, 7:45 for Italy, final French figure at 7:50, final German number at 7:55 and the final all-European number at 8:00. Spain’s manufacturing PMI dropped to 52.4 in August, well below expectations but above the 50 point mark separating expansion from contraction. We now get the figure for September. Italy, the third-largest economy, saw a much better score of 56.3. The preliminary read for France for September showed a score of 56 points. Germany had an excellent 60.6 and the whole euro-zone had 58.2 points. All the flash figures are expected to be confirmed now.

- Unemployment Rate: Monday, 9:00. The unemployment rate in the euro-zone is falling and this is encouraging. The rate stood at 9.1% in July.

- Spanish Unemployment Change: Tuesday, 7:00. The fourth-largest economy still suffers from high unemployment and the improvement is closely watched. In addition, Spain releases its data quite early, just after the month ends. In August, the number of the unemployed rose by 46.4K, falling short of expectations.

- PPI: Tuesday, 9:00. Producer prices are often seen as “consumer prices in the pipeline”. In any case, they serve as another measure of inflation. Prices remained flat in July. We now get the figure for August.

- Services PMIs: Wednesday morning: 7:15 for Spain, 7:45 for Italy, final French figure at 7:50, final German number at 7:55 and the final all-European number at 8:00. Spain had a healthy score of 56 for its services sector in August. Italy had 55.1 points. Markit’s flash services PMI for September showed France at 57.1, Germany at 55.6 and the euro-zone as a whole with 55.6. The preliminary numbers will likely be confirmed now.

- Retail Sales: Wednesday, 9:00. The figure for the euro-zone is released after all the main countries have released their figures. Nevertheless, surprises are common and the overall number still has an impact. A drop of 0.3% was seen in July.

- Retail PMI: Thursday, 8:10. Markit’s measure for the retail sector ticked down to 50.8 points, barely in growth territory. We now get the figure for August.

- ECB Meeting minutes: Thursday, 11:30. In its recent decision, the European Central Bank told us that it will probably make a decision in October. The minutes from that September meeting are released now, as we near the October meeting. Any details about the anticipated decision about QE tapering will move markets. A slower tapering will hurt the euro while a quicker end will boost it.

- German Factory Orders: Friday, 6:00. Orders dropped by 0.7% in July, falling short of expectations. However, it is important to note that this is a volatile figure. We now get the data for August.

- French Trade Balance: Friday, 6:45. France suffers from a trade deficit that widened to 6 billion in July. This stands in contrast to Germany’s surplus. Another deficit is on the cards now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started off the week with a weekend gap, only temporarily holding onto support at 1.1870 (mentioned last week).

Technical lines from top to bottom:

1.2240 is a high line from 2014. The cycle high of 1.2090 looms above.

1.2040 was the low point in 2012 and close to the round number of 1.20. It is followed by 1.1870, the trough in 2010, also seen in early August 2017.

1.1780 served as a cushion for the pair during the month of August. It replaces the 2015 high of 1.1712. 1.1620 was a swing high in May 2016.

1.1580 was a stepping stone for the pair on the way up in July 2017. It is followed by the round number of 1.15.

1.1445 is the June 2017 peak and immediate resistance. 1.1390 is the post-breakout low and works as support.

1.13 is the top line seen in November before the collapse. 1.1230 capped the pair in June.

I am neutral on EUR/USD

The German elections were supposed to be a non-event, but the fractured parliament could weigh on the common currency for quite some time. The dollar is not really posed to take advantage due to the hesitation of the Fed.

Our latest podcast is titled Euro troubles and golden opportunities

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!