EUR/USD was not convinced by Draghi’s complaints about the exchange rate and reached new highs. Can it continue even higher? A mix of inflation, industrial output, and trade balance numbers awaits us. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The ECB did not reach a decision about tapering QE, but had a preliminary discussion and will probably make an announcement in October. ECB president Mario Draghi mentioned the exchange rate many times in his press conference. He blamed the strong euro for lower growth and inflation prospects, downside risks and everything that could go wrong. Markets were not convinced by this, and the euro advanced. EUR/USD also advanced on the weakness of the US dollar. Worries about the hurricanes, the retirement of Vice Chair Fischer and lower US bond yields all contributed.

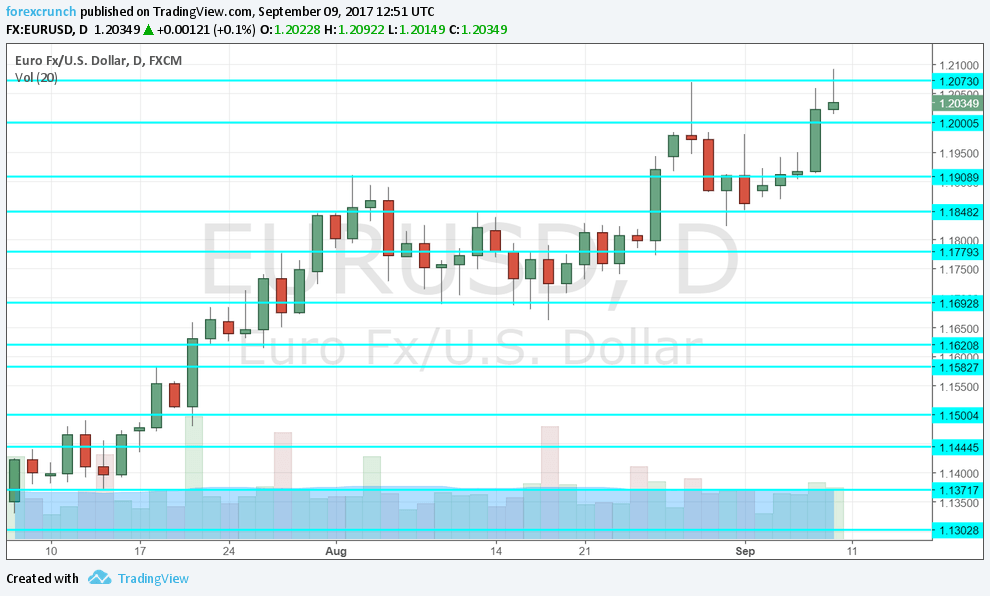

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German inflation data: Wednesday, 6:00. The initial read of German inflation came out stronger than expected and pushed the all-European figures higher. This will likely be confirmed in the final read for August. The wholesale price index (WPI) is expected to rise by 0.1% after sliding by the same scale last time.

- Employment Change: Wednesday, 9:00. We get a monthly measure of the unemployment rate from the euro-zone, but this quarterly indicator of the overall growth of employment provides a broader view. In Q1 2017, employment rose by 0.4%, better than expected and on top of an upwards revision for Q1 2016, that also saw 0.4% growth. A more modest growth rate of 0.3% is projected now.

- Industrial Production: Wednesday, 9:00. Despite its late publication, after the major countries had already published their own figures, the publication is of interest. A drop of 0.6% was seen in June. We now get the data for July, that could see a bounce back. However, expectations stand at 0%.

- French Final CPI: Thursday, 6:45. Also France, like Germany, has seen a robust rise in its consumer price index in August in the first estimate. A confirmation is on the cards now.

- German WPI: Friday, 6:00. Germany’s Wholesale Price Index serves as a gauge of inflation in the pipeline. A drop of 0.1% was recorded in July. We now get the figures for August and a rise is likely.

- Jens Weidmann speaks: Thursday, 15:30. The president of the German central bank, the Bundesbank, speaks in Frankfurst about monetary policy. Will he provide a direction about the next moves of the ECB?

- Trade Balance: Friday, 9:00. The euro-zone enjoys a significant trade balance surplus, driven largely by Germany’s exports. In June, the euro zone had a better than expected surplus of 22.3 billion. A marginally narrower surplus is predicted now: 22.1 billion.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar had a turbulent week and topped above the 1.2070 level mentioned last week. Nevertheless, that move was short lived and looks like a false break for now.

Technical lines from top to bottom:

1.2565 capped the pair back in late 2014. It is followed by 1.2240, another line from that time and 1.2170, quite close by.

1.2040 was the low point in 2012 and close to the round number of 1.20. It is followed by 1.1876, the trough in 2010, also seen in early August 2017.

1.17 is a round number that served as a cushion for the pair during the month of August. It replaces the 2015 high of 1.1712. 1.1620 was a swing high in May 2016.

1.1580 was a stepping stone for the pair on the way up in July 2017. It is followed by the round number of 1.15.

1.1445 is the June 2017 peak and immediate resistance. 1.1390 is the post-breakout low and works as support.

1.13 is the top line seen in November before the collapse. 1.1230 capped the pair in June.

I remain bullish on EUR/USD

Draghi can try to hurt the euro or not, but the economies of the currency bloc are doing well, and so is the euro. The US has a more hesitant central bank and an unfortunate sequence of hurricanes.

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!