EUR/USD was looking good during the last full week of August and remained range-bound before breaking to new highs. What’s next? The inflation figures stand out as we turn the page into September. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Germany’s ZEW economic sentiment fell short of expectations, weighing on the euro, but IFO beat predictions and PMIs are looking good. All in all, the euro is looking good. This was enough to tick up against the dollar and send EUR/GBP to the highest levels since 2009. In the US, data was alright, but Trump’s controversies dampened the mood. EUR/USD enjoyed the “perfect storm” in Jackson Hole: Yellen was not hawkish and Draghi did not talk down the euro.

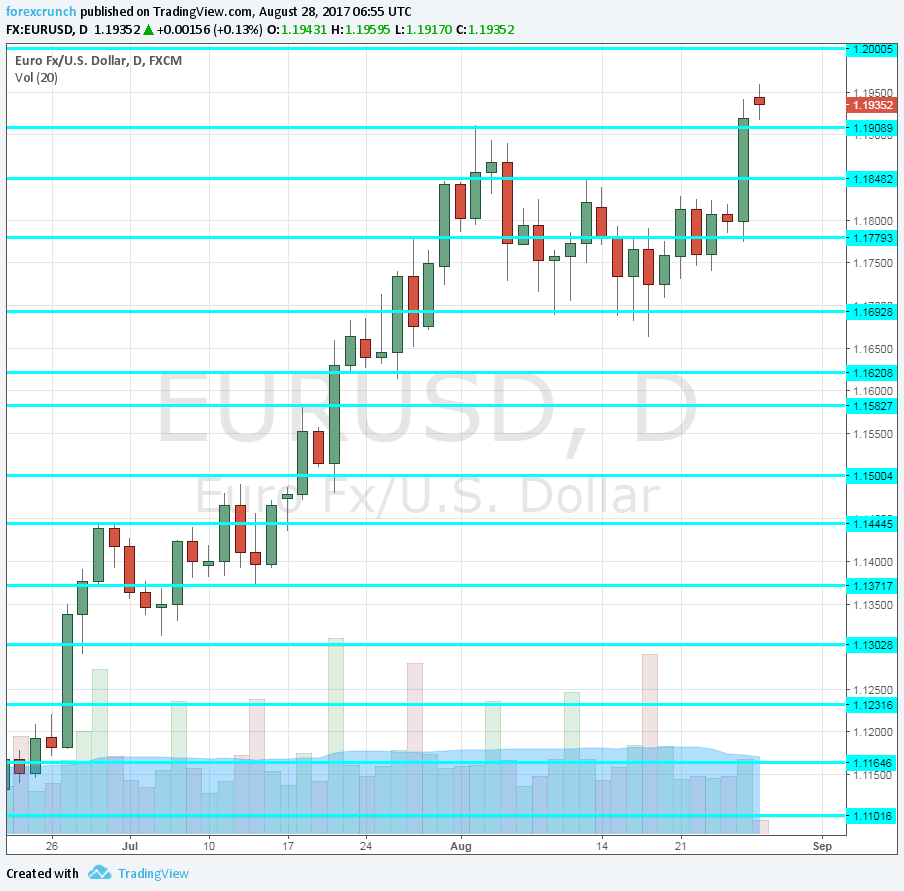

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Monetary data: Monday, 8:00. The European Central Bank measures the amount of money in circulation (M3 Money Supply) and private loans. The former rose by 5% in June, maintaining the levels seen beforehand. The latter, private loans, slipped to 2.6%. The ECB’s expansionary policies pushed the volume of loans back to growth after a period of declines. 4.9% and 2.7% are expected for Money Supply and Private Loans respectively.

- German GfK Consumer Climate: Tuesday, 8:00. Consumers in Germany are becoming more and more confident according to this survey of 2000 consumers: The score of 10.8 seen in July is the highest in many years. A repeat of the same number is on the cards.

- French Consumer Spending: Tuesday, 6:45. Consumer spending surprisingly dropped by 0.8% in June, rose than expected. Figures so far this year have been quite mixed. An increase of 0.7% is forecast.

- French GDP: Tuesday, 6:45. According to the initial release for Q2, the French economy grew by 0.5%, a robust rate of growth but slightly below the euro-zone average of 0.6%. This publication will likely confirm the first one.

- Spanish Flash CPI: Wednesday, 7:00. After rising to a peak of 3% y/y in late 2016, inflation moderated and stood at 1.5% in July, slightly above the euro-zone level of 1.3%. We now get the preliminary figure for August which is estimated to have reached 1.7%.

- German CPI: Wednesday, during the morning, with the all-German number at 12:00. In July, prices in Germany advanced by 0.4%, double the early expectations, eventually pushing the euro-zone numbers higher. A rise of 0.1% m/m is on the cards.

- German Retail Sales: Thursday, 6:00. The confidence of German consumers is not only evident in surveys, but also in real spending. The volume of sales leaped by 1.1% in June, the second surprise in a row. We now get the data for July. A drop of 0.6% is projected.

- French CPI: Thursday, 6:45. Similar to Germany, also France’s prices came out higher than expected, but they still slipped by 0.3%. A rise of 0.5% is predicted.

- German Unemployment Change: Thursday, 7:55. The number of the unemployed in Germany is dropping almost every month. In June, 9K people left the ranks of the unemployed. This report is also the last one before the German elections on September 24th. Another drop will support Chancellor Angela Merkel. A slide of 0.5% is expected.

- CPI (preliminary): Thursday, 9:00. After the all the major countries will have already released their figures, we get the all-European figures. Headline inflation stood at 1.3% y/y in line with expectations. Encouragingly for the ECB, the core inflation came out above expectations, at 1.2% in July. The preliminary numbers for August will shape expectations for the ECB meeting. Headline CPI carries expectations for 1.4%, a rise, while core CPI will likely remain unchanged at 1.2%.

- Unemployment Rate: Thursday, 9:00. The unemployment rate in the euro-zone remains high but is falling quite consistently. An unemployment rate of 9.1% was seen in June, the lowest in 8 years. A repeat of 9.1% is expected.

- Manufacturing PMIs: Friday, 7:15 for Spain, 7:45 for Italy, final figures for France at 7:50, final German numbers at 7:55 and the final euro-zone figure at 8:00. Back in July, Spain had a score of 54 points, above the 50 point threshold that separates expansion and contraction. A rise to 54.4 is expected. Italy, the third-largest economy, had a higher level of growth with 55.1 points. A small advanced to 55.4 is predicted. According to the preliminary publication for France, manufacturing PMI stood at 55.8. Germany had a robust level of 59.4 and the euro-zone saw 57.4 points. These three preliminary figures are expected to be confirmed in the final read.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar began the week with a rise above 1.18, looking to move to higher ground. The end of the week saw the pair jump to the highest levels since January 2015, well above 1.19.

Technical lines from top to bottom:

1.2565 capped the pair back in late 2014. It is followed by 1.2240, another line from that time and 1.2170, quite close by.

1.2040 was the low point in 2012 and close to the round number of 1.20. It is followed by 1.1876, the trough in 2010, also seen in early August 2017.

1.17 is a round number that served as a cushion for the pair during the month of August. It replaces the 2015 high of 1.1712. 1.1620 was a swing high in May 2016.

1.1580 was a stepping stone for the pair on the way up in July 2017. It is followed by the round number of 1.15.

1.1445 is the June 2017 peak and immediate resistance. 1.1390 is the post-breakout low and works as support.

1.13 is the top line seen in November before the collapse. 1.1230 capped the pair in June.

I remain bullish on EUR/USD

Politics, inflation and growth point to a small advantage for the euro. After the big rally, the consolidation phase may be ending.

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!