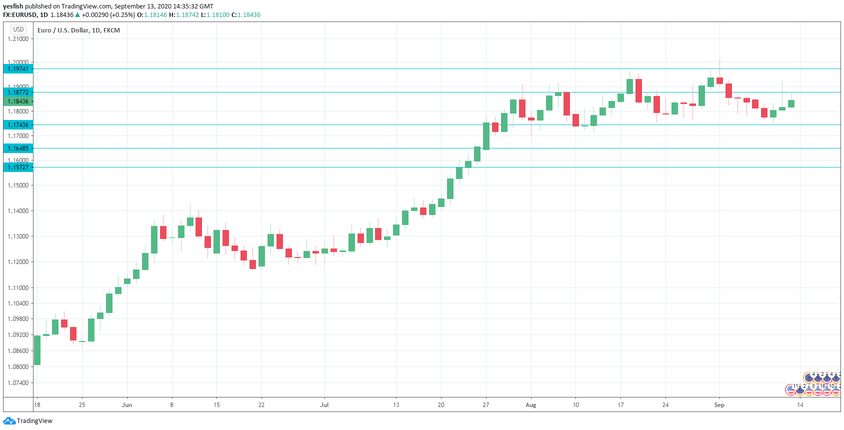

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

In the US, unemployment claims were worse than expected. The indicator was almost unchanged at 884 thousand, higher than the estimate of 838 thousand. Inflation remained weak, as consumer inflation slowed in August. Both the headline and core readings reading dropped from 0.6% to 0.4%. Still, both releases beat their estimates. The Producer Price Index, another important inflation gauge, also slowed in August.

- Industrial Production: Monday, 9:00. Industrial Production dipped slowed to 9.1% in June, down from 12.4% beforehand. The indicator is expected to slow to 2.8% in July.

- German ZEW Economic Sentiment: Monday, 8:30. Investor Confidence improved to 71.5 in September, up from 59.3. The forecast for September stands at 70.0.

- Trade Balance: Wednesday, 9:00. The eurozone’s trade surplus improved in June to EUR 17.1 billion, up sharply from EUR 8.0 billion. The projected surplus in July is EUR 17.3 billion.

- Final CPI: Thursday, 9:00. Inflation declined by 0.2% in August, as deflation remains a growing concern for ECB policymakers. Core CPI was stronger, with a reading of 0.4%. The final read will likely confirm the first one.

- Current Account: Friday, 8:00. The current account surplus jumped to EUR 20.7 billion in June, up sharply from EUR 8.0 billion. We now await the July release.

- All times are GMT

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2174.

This is followed by 1.2107.

1.1974 is protecting the symbolic 1.20 level.

1.1877 is a weak resistance line.

1.1744 is the first support level.

1.1648 has held in support since late July.

1.1573 (mentioned last week) is the final support line for now.

.

I am neutral on EUR/USD

The US dollar has shown some improvement recently, but the euro remains at high levels. The pair’s direction could depend on how investors respond to the Federal Reserve rate announcement on Wednesday.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!