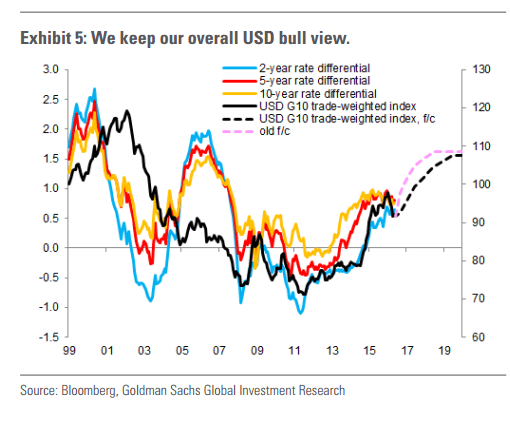

With the recent NFP inspired fall of the USD, it is hard to remain USD bullish, but at least against the euro, the team at Goldman Sachs certainly has its reasons:

Here is their view, courtesy of eFXnews:

We are doubtful that the ECB will be able to ease in an effective manner near term and pare back our expectation for EUR/$ downside one year out. Our 3-, 6- and 12-month forecasts are now 1.12, 1.10 and 1.05 (from 1.04, 1.00 and 0.95 previously).

However, we maintain our view that the Euro needs to fall a lot further in the medium term if the ECB wants to meet its inflation target.

Our 24-month forecast is 0.95 (from 0.90 previously) and our 36-month target is unchanged at 0.90.

This forecast may look extreme, but it is important to recall two things.

First, a root cause of the low inflation problem in Europe is the fact EUR/$ spent a long time above fair value, in part because the creation of the OMT inadvertently pushed the Euro up, giving a deflationary shock to an already struggling region. President Draghi implicitly said as much in his 2014 speech in Sintra, when he stated that two-thirds of the low inflation problem in Europe stems from the currency. We therefore continue to see the case for EUR/$ to undershoot fair value in a meaningful way.

Second, while it is clear that President Draghi is constrained from easing the way he would like to at the moment, these constraints can change over time. When we first switched to forecast Euro downside in early 2014, it seemed unthinkable that EUR/$ would fall meaningfully below 1.40, let alone that the ECB would embrace QE. But the low inflation picture changed all that and – as we note above (downside risk to the ECB forecast) – the low inflation picture has yet to change in a material way.

On a trade-weighted basis, our forecast for the Dollar remains for a strengthening of around 13%, although that is more back-loaded and in the near term tilted against the Yen. These revisions only see the Euro falling 6% in trade-weighted terms in the next 12 months, versus 11% previously.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.