Terrible jobs report: 38K jobs gained with additional bad news: -59K in revisions, participation rate falls to 62.6% and the weekly hours are down to 34.4K. Lowest since September 2010. Wages are OK with 0.2% m/m, 2.5% y/y but this doesn’t help.

USD crashing across the board with chances for a rate hike in June basically erased and chances for a hike in July going for 60% to 42% – a rate hike only after the elections?

The US was expected to report a gain of 160K and average hourly earnings to rise by 0.2%. The Verizon strike was said to skew data to the downside, but the magnitude of the impact was unclear.

More:

The US dollar and market in general were very calm ahead of the publication.

NFP Live Blog

May NFP Data (updated)

- Non-Farm Payrolls: 38K (exp. +164K, last 160K before revisions)

- Average Hourly Earnings:0.2%, 2.5% (exp. +0.2% m/m, last month +0.3% m/m, 2.5% y/y)

- Revisions: -59K (-19K last time)

- Participation Rate: 62.6% (62.8% last month )

- Unemployment Rate: 4.7% (exp.4.9%, last month 5% before revisions)

- Private Sector: TBA (ADP showed only +173K).

- Real Unemployment Rate (U-6): 9.7% (previous: 9.7%).

- Employment to population ratio: 59.7% (previous: 59.7%)

- Average workweek: 34.4 (exp. 34.5K, last month: 34.4).

NFP Currency Reaction

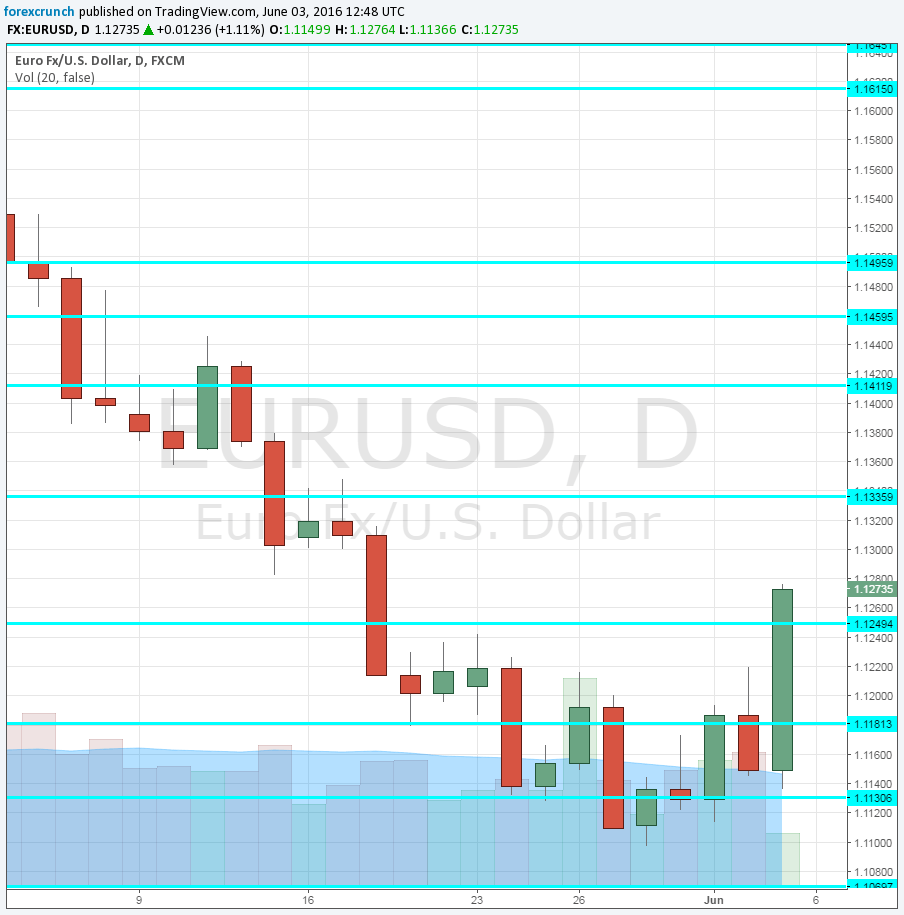

- EUR/USD traded around 1.1150 after Draghi’s drag – a quiet ECB meeting which was slightly dovish. The pair shoots above resistance at 1.1250 and hits 1.1270.

- GBP/USD was around 1.4430 with all eyes on the Brexit referendum and recent polls weighing on cable.Cable challenges the 1.45 level, seems cautious ahead of fresh polls.

- USD/JPY was around 108.87 after the yen enjoyed a “buy the rumor sell the fact”.. The pair loses 108 with support at 107.65.

- USD/CAD traded around 1.3080. Trade balance was published in Canada at the same time. The pair is dipping under 1.30

- AUD/USD was around 0.7250 after the blockbuster GDP report earlier in the week. Aussie is challenging resistance at 0.73.

- NZD/USD traded above the 0.6840 support after a rise in milk prices. Kiwi tops 0.69

A free fall of the greenback – here is the daily chart of EUR/USD: