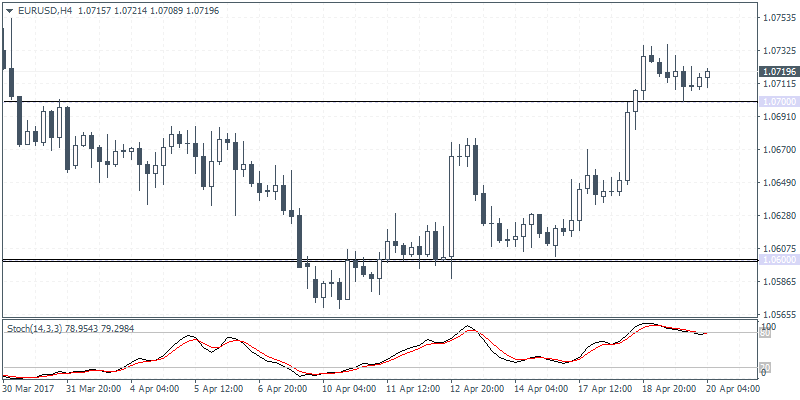

EURUSD intra-day analysis

EURUSD (1.0719): After EURUSD rose to a one-month higher yesterday; prices retreated pulling back from the highs of 1.0736 to close on a bearish note. With prices above 1.0700, there is strong indication that EURUSD could remain consolidated above 1.0700 in the near term. The bias remains to the upside above 1.0700, targeting 1.0800 resistance level. However, this could change in the event of a breakdown below the support at 1.0700. We could expect to see a decline towards the lower support at 1.0600.

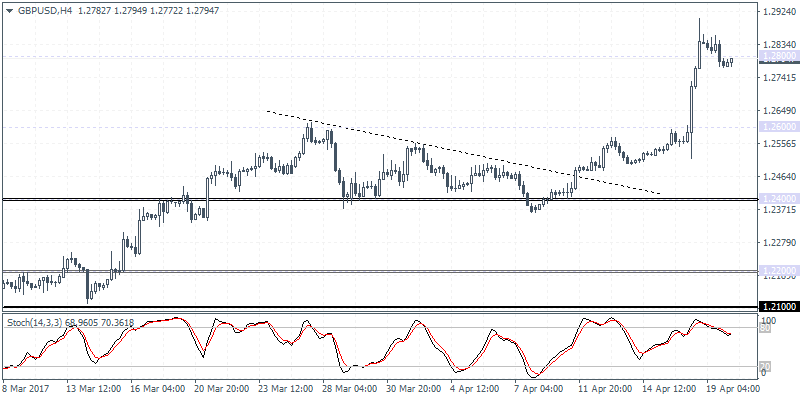

GBPUSD intra-day analysis

GBPUSD (1.2794): GBPUSD maintained some of the gains from the day before, but prices were seen consolidating after rallying to 1.2800 level. As mentioned in yesterday’s daily report, we can expect to see GBPUSD slide back towards 1.2600 in the short term where support is most likely to be established. This level also marks the top of the descending triangle pattern from which we saw an upside breakout in prices. Establishing support at 1.2600 will signal a continuation to the upside in GBPUSD as a result.

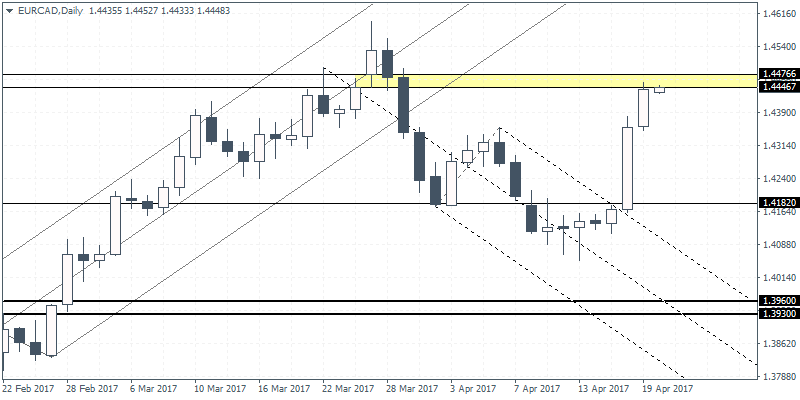

EURCAD daily analysis

EURCAD (1.4448): EURCAD posted strong gains in the past two days which saw prices rallying back to test the resistance level at 1.4450. If a lower high is formed here, relative to the previous highs formed near 1.4547, we can expect to see some downside in prices. The support at 1.3960 remains the downside target in EURCAD which is most likely to be tested if we get to see a reversal candlestick pattern in EURCAD and a breakdown below the minor support at 1.4182. Tomorrow’s inflation data from Canada is likely to be the catalyst for the downside bias in EURCAD.